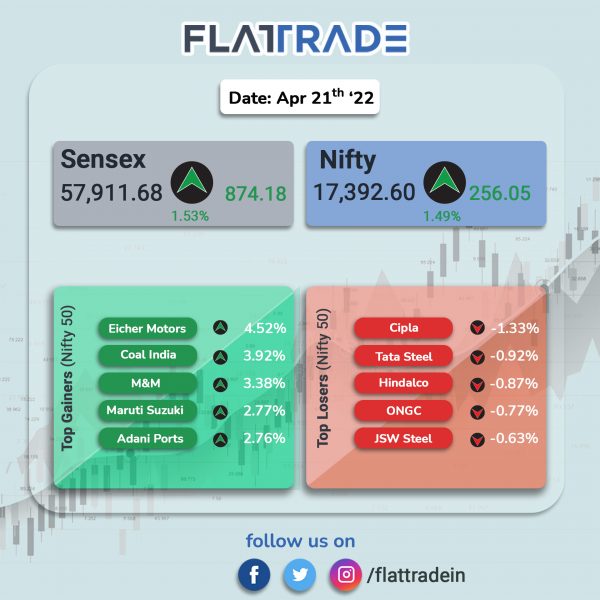

Dalal Street surged on Thursday aided by gains in RIL, financials and auto stocks. The Sensex surged 1.53% and the Nifty 50 jumped 1.5%.

The broader markets mirrored headline indices. The Nifty Midcap 100 rose 1.07% and BSE SmallCap climbed 1.33%.

Top gainers among Nifty sector indices were Auto [2.23%], Financial Services [1.54%], Private Bank [1.51%], Bank [1.38%] and IT [1.36%]. Top losers was Media [-0.12%].

Indian rupee inched up 6 paise to 76.14 against the US dollar on Thursday.

Stock in News Today

Reliance Industries Ltd (RIL): The conglomerate hit a new lifetime high as its shares advanced 2.34% after foreign brokerage firm Morgan Stanley upgraded its target price to Rs 3,253, signalling about a 20% upside in the counter. The foreign brokerage expects value creation potential from RIL’s global pivot on energy security. The market cap of RIL inched towards Rs 19 trillion-mark as the shares rose over 10% from its lows this week.

Bharat Petroleum Corporation Ltd (BPCL): The government is likely to take a fresh look at the oil refiner’s privatisation, including revising the terms of sale, an official said. “We need to go back to the drawing board on BPCL. There are issues in terms of consortium formation, geopolitical situation and energy transition aspects,” the official said. The official added that the transition towards green and renewable fuel has made privatisation difficult in existing terms.

Maruti Suzuki India Ltd (MSIL): The car manufacturer launched a new version of its multi-purpose vehicle XL6 and it will bring a slew of new products this fiscal along with taking the challenges of prevailing uncertainties head-on. The new XL6 is powered by a 1.5-litre petrol engine with a peak power of 75.8 kW. It is available in manual and automatic transmission options, priced between Rs 11.29 lakh and Rs 14.55 lakh (ex-showroom).

Jindal Steel & Power Ltd (JSPL): The Enforcement Directorate (ED) raided offices of the company in New Delhi over suspected violation of foreign exchange regulations, Reuters reported citing a source familiar with the matter. The company did not immediately respond to a Reuters request for comment on the searches. Shares of the company closed nearly 3% lower.

ITC: The conglomerate said that it will acquire 10.07% stake in Blupin Technologies, the company that owns direct-to-consumer(D2C) brand, Mylo, for up to Rs 39.34 crore. The investment will provide the company an early mover advantage in the evolving content-to-community-to-commerce space and will provide an expanded presence in the D2C space, ITC said in a regulatory filing.

Nestle India Ltd: The FMCG major Nestle reported a 1.25% decline in its net profit to Rs 594.71 crore for the first quarter ended March 2022. It had posted a profit of Rs 602.25 crore in the same period a year ago. Its net sales rose 9.74% to Rs 3,950.90 crore during the quarter against Rs 3,600.20 crore in the corresponding period last fiscal. The company follows January-December financial year.

PNC Infratech: Shares of the company closed over 11% higher after the company said it has received a Rs 37 crore ($4.9 million) bonus for early completion of a project. Part of the Purvanchal Expressway project was completed 97 days ahead of schedule, according to iits exchange filing.

Ramkrishna Forgings: Shares of Ramkrishna Forgings surged 4.93% higher after the company bagged export order with an estimated business value of Rs 33 crore over five years. The order pertains to the supply of front axle for Europe’s leading Tier-1 axle manufacturer.

Dhanlaxmi Bank: Shares of the lender closed 2.67% higher after the bank signed an MoU with Central Board of Direct Taxes and Central Board of Indirect Taxes and Customs. Bank has been authorised by RBI based on recommendation of CAG for collection of various taxes. With this MoU, the bank’s customers will be able to pay direct taxes, GST payments and other indirect taxes through the branch network and digital platforms of the bank.