Market Opening - An Overview

SGX Nifty futures were trading 1.18% lower at 17200.5, signalling Dalal Street was headed for a negative start.

Asian shares were trading lower, tracking the US markets, after hawkish comments from the Federal Reserve hinting that an interest rate hike was imminent. Nikkei 225 and Topix tanked 1.89% and 1.32%, respectively. China’s Hang Seng fell 1.1% and CSI 300 was flat.

Indian rupee inched up 6 paise to 76.14 against the US dollar on Thursday.

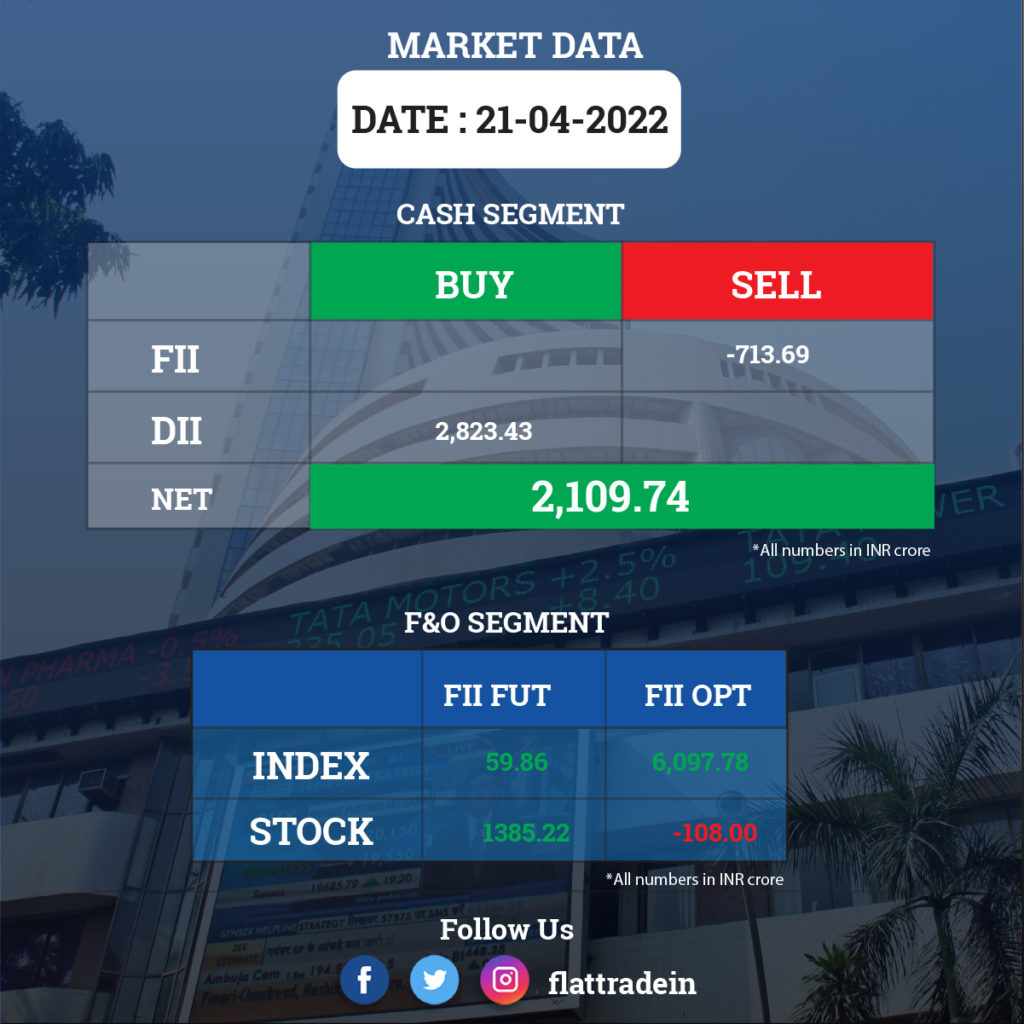

FII and DII Trading Data

Upcoming Results

Aditya Birla Money, Hindustan Zinc, Sundram Fasteners, Tata Metaliks, Tejas Networks, MMTC, Wendt (India), Bhakti Gems and Jewellery, Eiko Lifesciences, Jhandewalas Foods, Khaitan Chemicals & Fertilizers, Quest Capital Markets, RS Software India, and Sharad Fibres & Yarn Processors will release quarterly earnings today.

ICICI Bank, Bhansali Engineering Polymers, and Indag Rubber will release quarterly earnings on April 23.

Stocks in News Today

HCL Technologies: The IT services company saw its net profit zoom to Rs 3,593 crore for quarter ended March 2022. The net profit was Rs 1,102 crore in the year-ago period. The company’s revenue from operations for Q4 FY22 came in at Rs 22,597 crore, 15% higher than a year ago. HCL Tech expects revenue to grow between 12-14% in constant currency for the fiscal 2023.

The company’s board has declared an interim dividend of Rs 18 per share of Rs 2 each.For FY22, the net income increased to Rs 13,499 crore from Rs 11,145 crore in the previous fiscal. The revenue rose to Rs 85,651 crore from Rs 75,379 crore in FY21.

ICICI Lombard General Insurance: The company’s net profit dropped 9.5% to Rs 313 crore in the quarter ended March 2022 from Rs 346 crore a year ago due to higher expenses even as claims paid fell versus December 2021. Total expenses including claims paid increased 34% to Rs 3627 crore from Rs 2708 crore a year ago.

For the full year, the company earned a net profit of Rs 1,271 crore, down 13.7% from Rs 1,473 crore in FY21. The company has proposed a dividend of Rs 5 per equity share for the financial year. The board of directors of the company has proposed final dividend of ₹5 per share for FY22.

Tata Communications: The company posted a 22% growth in consolidated profit at Rs 365 crore for the quarter ended March 2022 compared with a profit of Rs 299.2 crore in the same period a year ago. Consolidated income from operations grew by 4.65% to Rs 4,263 crore from Rs 4,073.25 crore in the March 2021 quarter.

For the full financial year 2022, the consolidated profit jumped 18.48% to Rs 1,481.76 crore. Income from operations dipped 2.19% to Rs 16,724.73 crore.

L&T Technology Services (LTTS): The company an increase of 34.7% in consolidated net profit to Rs 262 crore for the quarter ended March 2022. It had posted a net profit of Rs 194.5 crore in the same period a year ago. The consolidated revenue from operations grew by about 22% to Rs 1,756.1 crore from Rs 1,440.5 crore in the March 2021 quarter.

For FY22, LTTS’ consolidated profit grew by 44.27% to Rs 957 crore, from Rs 663.3 crore in FY21. The annual revenue from operations increased by 20.55% to Rs 6,569.7 crore in 2021-22, from Rs 5,449.7 crore in the preceding fiscal.

RIL and Future Group: Lenders have rejected the slump sale proposal of Kishore Biyani’s Future Group to Reliance Retail Ventures (RRVL), Business Standard reported citing multiple sources after the e-voting was conducted on Thursday.

Reliance Industries Ltd (RIL): The retail arm of RIL, Reliance Retail, said it will launch a dedicated artisan-only store format ‘Swadesh’, which will showcase agriculture & food products, handlooms, clothing, textiles, handicraft and handmade natural products. The first Swadesh store is expected to open in the second half of 2022.

Rallis India: The company reported a consolidated net loss of Rs 14.19 crore in Q4FY22 as against net profit of Rs 8.12 crore in the year-ago period. It recorded consolidated revenues of Rs 507.5 crore, a rise of 7.7% from Rs 471.26 crore in the year-ago period. Separately, the board has recommended a dividend of Rs 3 per share

Cyient: The company reported a net profit of Rs 154 crore in Q4FY22, up 49.5% YoY as against Rs 103 crore in the same quarter previous year. The company’s total income rose 8% YoY to Rs 1,181 crore. The Board has recommended a final dividend of Rs 14 a share on face value of Rs 5 each, aggregating to Rs 154.4 crore.

GAIL and HPCL: GAIL, its JV company Bengal Gas Co and Hindustan Petroleum Corporation Ltd’s (HPCL) combined investment in various CNG projects in West Bengal will be Rs 17,000 crore over the next five years, senior officials said. The projects include piped gas distribution and setting up of Compressed Natural Gas (CNG) stations. Availability of the green fuel is expected to play a role in reducing air pollution.

TVS Motor Company: The company has announced an additional investment of 100 million pound in Norton Motorcycle, Britain’s iconic sporting motorcycle brand.

RailTel Corporation of India: The company has received work order worth Rs 29.75 cr from National Informatics Centre Services. National Informatics Centre Services was incorporated in relation to assignment of work of immigration visa and foreigner registration & tracking.

JSW Energy: The company’s subsidiary, JSW Neo Energy (JSWNEL), is going to set up 1,500 MW capacity of hydro pumped storage project (PSPs) – Komoram Bheem Pumped Storage Project, in Telangana. With the said project, the company has tied-up resources for 5 GW hydro PSPs with the governments of various states.