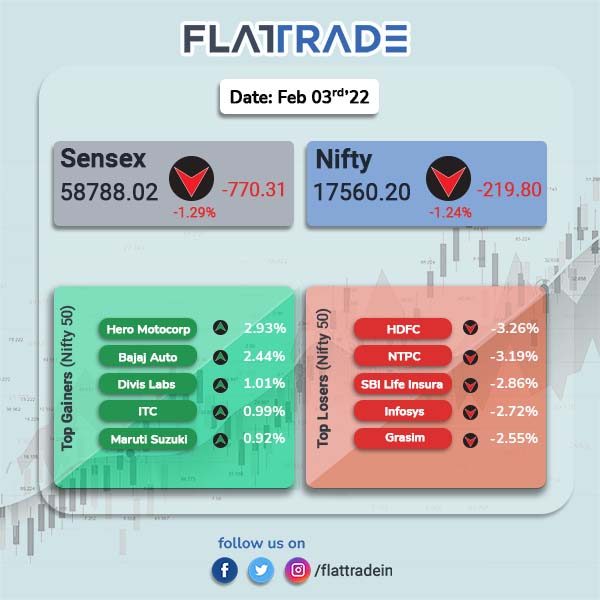

Dalal Street snapped its 3-day winning streak and ended lower on the day of weekly F&O expiry, as investors booked profit amid muted global cues. The Sensex closed 1.29% down to 58,788.02 and Nifty fell 1.24% to 17560.20.

Top losers among Nifty sector indices were IT [-2.05%], Realty [-1.74%], Financial Services [-1.51%], Infrastructure [-1.29%] and Energy [-1.08%]. Nifty Auto was the only sector that closed higher by 0.44%.

Indian rupee slipped 2 paise to 78.86 against the US dollar.

Services PMI declines to 51.5 in January 2022 from 55.5 in December 2021, according to the latest IHS Markit survey.

Stock in News Today

Titan: The company’s net profit jumped 91 per cent to Rs 1,004 crore in Q3FY22 compared to the year-ago period. Revenue from operations rose 37 per cent YoY to Rs 9,903 crore riding helped by strong consumer demand during the quarter. The total income for the quarter stood at Rs 9,570 crore in the reported quarter from Rs 7324 crore in Q3FY21.

Bharat Dynamics: Shares of the company rose after the company signed a contract worth Rs 3,131.82 crore with Indian Army. As part of the order, the company will manufacture and supply Konkurs – M Anti-Tank Guided Missiles to the Indian Army. After the new order, its order book position stood at Rs 11,400 crore.

GAIL: The company’s standalone net profit rose 121% YoY to Rs 3,287.99 crore. Revenues was up 66.75% to Rs 25769.75 crore in Q3FY22 from Rs 15454.29 crore in the year-ago period.

Adani Transmission: The company’s net profit declined 32.45% to Rs 267.03 crore in the quarter ended December 2021 as against Rs 395.31 crore during the same quarter last fiscal. Sales rose 14.02% to Rs 2613.35 crore in the reported quarter ended December 2021 as against Rs 2292.10 crore during the same quarter ended December 2020.

Vedanta Limited: The company denied media reports which said Vedanta Resources Limited will be combined with Vedanta Limited. The company added that the reports as speculative and misleading to the investors.

Dr. Reddy’s Laboratories: The company will buy German-based Nimbus Health GmbH. Nimbus Health is a privately owned, licensed pharmaceutical wholesaler focussing on medical cannabis in Germany.

Tata Power and Apollo Tyres: The companies will partner to deploy electric vehicle charging stations at the Apollo’s commercial and passenger vehicle zones across India. Based on location, this classification of chargers will support EV charging for two-wheelers and four-wheelers, respectively.

Infosys Ltd: The IT major has approved the grant of 2,307,300 stock incentive units to certain eligible employees of the company and its subsidiaries. The grant is effective February 1, 2022 and the exercise price will be equal to the par value of shares.

Emami: The company reported 5% increase in consolidated net profit to Rs 220 crore in Q3FY22 from Rs 209 crore in Q3FY21. Consolidated revenue rose by 4% YoY to Rs 972 crore. Domestic business grew by 3% on a yearly basis and international business grew by 7% year-on-year.

Meanwhile, the board of Emami has approved the buyback of the company’s fully paid equity shares for an aggregate amount of Rs 162 crore.

Cadila Healthcare Limited (Zydus Cadila): The drug manufacturer posted a five per cent fall in its consolidated net profit year-on-year (YoY) to Rs 500.4 crore in Q3FY22, compared with Rs 527.2 crore in Q3FY21. Revenue from operations rose marginally by one per cent to Rs 3,655 crore in Q3FY22 from Rs 3,591.5 crore in Q3FY21.

Godrej Properties: The company’s net profit stood at Rs 38.95 crore as against a net profit of Rs 14.35 crore for the corresponding period a year ago. Total income increased to Rs 466.91 crore in the quarter from Rs 311.12 crore in the corresponding period of the previous year,

DLF Ltd: The realty firm has increased its sales revenue forecast by 17 per cent to Rs 47,000 crore from 35 million square feet of planned new launches of housing and commercial projects in the medium term.

Radico Khaitan: The liquor maker’s net profit declined 5.9% to Rs 79.13 crore in the quarter ended December 2021 as against Rs 84.09 crore during the year-ago period. Sales rose 11.95% to Rs 765.99 crore in the reported quarter as against Rs 684.21 crore during the corresponding period of last financial year.

Varun Beverages: The company reported a consolidated net profit of Rs 16.49 crore in Oct-Dec quarter of 2021 as against a net loss of Rs 19.73 crore in the year-ago period. Net sales rose 30.31% to Rs 1,734.33 crore in the reported quarter over the corresponding quarter of last year. Total sales volumes were up by 28.5% YoY at 112.0 million cases in the reported quarter.

Triveni Engineering and Industries Ltd (TEIL): The company has reported a 37 per cent rise in its consolidated net profit to Rs 130.12 crore for the December 2021 quarter compared with Rs 94.66 crore in the year-ago period. The total income also increased to Rs 1,242.40 crore in the reported quarter from Rs 1,130.73 crore in the corresponding period of the previous year.

Welspun India: Net profit declined 26.76% to Rs 132.39 crore in the quarter ended December 2021 as against Rs 180.77 crore during the same quarter last fiscal. Sales rose 19.18% to Rs 2418.17 crore in the reported quarter from Rs 2029.01 crore during the corresponding quarter of FY21.

Barbeque-Nation Hospitality: The QSR chain operator will invest Rs 16.99 crore in the equity shares of Red Apple Kitchen Consultancy (Toscano), a subsidiary of the Company. The Company will acquire 1,261 equity shares, having face value of Rs.100 each, at an issue price of Rs.1,34,776 apiece.

Mahindra Holidays & Resorts India: The tourism focused company’s net profit rose to Rs 13.72 crore in the quarter ended December 2021 as against Rs 0.17 crore during the same quarter ended December 2020. Sales rose 13.14% to Rs 553.44 crore in third quarter of FY22 as against Rs 489.15 crore during the same quarter last fiscal.

Rolex Rings: the company’s net profit rose 30.92% to Rs 29.81 crore in the quarter ended December 2021 as against Rs 22.77 crore in the year-ago period. Sales rose 32.17% to Rs 242.08 crore in the quarter ended December 2021 as against Rs 183.16 crore during the same quarter of last financial year.

DJ Mediaprint & Logistics Ltd: The company’s board has approved 1:1 bonus share issue, according to its regulatory filing. Investors will get one fully paid up new equity share as bonus for every one fully paid up equity shares held. The record date will be fixed in the coming weeks.