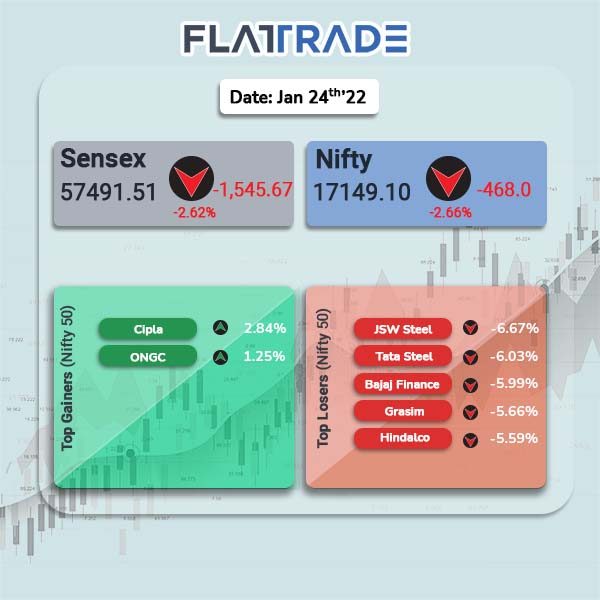

Domestic markets tanked as investors were spooked by a host of factors such as sooner-than-expected tapering by the US Fed, higher inflation, increase in interest rates, rising crude prices and geo-political tensions between Russia and Ukraine. The Sensex closed lower 2.62% and Nifty tanked 2.66%.

Broader markets also bore the brunt of panic selling by investors and overall negative sentiments. Nifty Midcap 100 fell 3.86% and BSE Smallcap crashed 4.43%.

All sectoral indices closed in the red. The biggest losers among Nifty sectoral indices were Realty [-5.9%], Metal [-5.23%], IT [-3.42%], Infrastructure [-2.91%] and Auto [-2.60%].

Indian rupee fell 17 paise to 74.58 against the US dollar.

Stock in News Today

Tube Investments of India: The company has acquired 70% stake in EV startup Cellestial for Rs 161 crore. The company will be forming a new subsidiary to pursue clean mobility business interests, including the electric three-wheeler business. Initial capital of Rs 350 crore will be infused into the new subsidiary.

Cera Sanitaryware: The company’s net profit rose 44.50% to Rs 43.25 crore in the quarter ended December 2021 as against Rs 29.93 crore during the year-ago period. Sales rose 28.08% to Rs 404.46 crore in the quarter ended December 2021 as against Rs 315.78 crore during the corresponding quarter last fiscal.

One97 Communications Ltd (Paytm): Fullerton India and Paytm have announced partnership to provide lending products to merchant partners and consumers. The two firms with leverage data-driven insights and offer products like BNPL, merchant loans, personal loans.

Zomato Ltd: Shares of online food aggregator extended its losses from last week and declined 19.62% due to low valuations. Over the past one-month period, Zomato’s shares have fallen nearly 30%.

Cyient Limited: The Indian engineering and technology solution provider plans to sell stakes in units that are underperforming, Bloomberg reported. “We are aggressively considering what makes sense in our portfolio,” Cyient Managing Director Krishna Bodanapu said in an interview to Bloomberg.

Rane (Madras) Ltd: The company’s net loss stood at Rs 4.31 crore in the quarter ended December 2021 as against a net profit of Rs 5.49 crore in the year-ago period. Sales rose 2.47% to Rs 437.79 crore in Q3FY22 as against Rs 427.23 crore during the same period last fiscal.