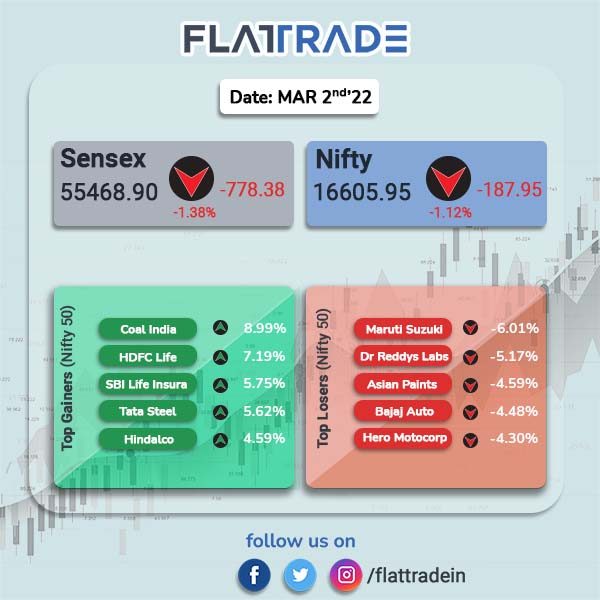

Benchmark indices slumped as auto and banking stocks shares declined due to consistent selling pressure and ongoing Russia-Ukraine crisis. Auto and Banking stocks dragged the indices. The Sensex closed 1.38% lower and the Nifty fell 1.12%.

Lower-than-expected GDP data at 5.4% in the October-December quarter also weighed on the markets. Many economists’ had estimated a growth of 6% in the said quarter. The Indian economy is likely to grow at 8.9% in 2021-22, according to the latest estimates released by the government’s statistical office.

IHS Markit India Manufacturing Purchasing Managers’ Index (PMI) stood at 54.9 in February, up from 54.0 in January and signalling a stronger improvement in manufacturing sector.

Top losers were Nifty Auto [-2.96%], Private Bank [-2.38%], Bank [-2.3%], Financial services [-2.27%] and Pharma [-1.84%]. Top gainers were Metal [4.07%] and Energy [1.27%].

Indian rupee fell 36 paise to 75.70 against the US dollar.

Stock in News Today

Hindustan Petroleum Corp Ltd (HPCL): The company has announced plans to raise Rs 1,500 crore on private placement basis on Monday. The fund would be utilised in refinancing existing borrowing and funding of capital expenditure.

Tata Consultancy Services (TCS): Global building materials firm CEMEX selected the IT major to accelerate its digital transformation and improve employee experience for over 4,00,000 people. TCS will work with CEMEX for next seven years. The information technology giant will utilise AI-driven human-machine collaboration suite to integrate systems. The digital transformation will enable CEMEX to reduce time to market, improve processing times, productivity among others.

Central Depository Services (India): The company shares rallied 3.28% after the company said that it has become the first depository to open six crore plus active demat accounts. CDSL in just three months added one crore accounts after it hit the five-crore mark in November 2021.

HCL Technologies: The IT company has opened a centre of excellence with IBM to modernise their network infrastructure and optimise operations. HCL will establish an IBM Telco Initiative practice team to develop network outsourcing and modernization solutions using IBM’s open hybrid cloud approach.

Escorts Ltd: Shares of the company rose nearly 0.88% after SEBI approved the Kubota open offer to acquire shares from retail investors. The open offer process should not take over five weeks for completion, according to a note by Edelweiss Securities. Edelweiss expects the stock to run up till Rs 1,950 in next few days and final acceptance to be around 80%.

Varun Beverages Ltd: Shares of the company closed 2.75% higher after the company approved the proposal to enter into an agreement to manufacture “Kurkure Puffcorn” snack brand for Pepsico India Holdings Pvt Ltd.

Chemplast Sanmar Ltd: Rating agency India Ratings and Research (Ind-Ra) has upgraded the company’s Long-Term Issuer Rating to ‘IND A+’ from ‘IND A-‘ with positive outlook. Its short-term non-fund based working capital facilities have been upgraded to ‘IND Al+’ by the rating agency, according to regulatory filing.

Religare Enterprises Ltd: Shares of the company rose 5.4% after the company announced that it has repaid the Rs 185.50 crore dues owed to its subsidiary, Religare Finvest. Religare Enterprises is now debt free and the company plans to enter new strategic sectors like asset reconstruction, AIF, insurance broking and digital wealth management for growth.

WardWizard Innovations & Mobility Ltd: Shares of the company rose nearly 5% to Rs 84.5 apiece after it registered sales of 4,450 units of electric two-wheelers in February 2022. The manufacturer of India’s leading electric two-wheeler brand Joy e-bike posted robust sales growth of 1,290% compared to Feb. 2021, when the company sold 320 units. The company has already crossed 25,000 sales mark for the current financial year.

TVS Motor Company: The two-wheeler maker has announced the launch of 125cc segment TVS Raider for the aspirational young customers across countries in Latin America (LATAM).It said the the company is targeting Gen Z customers in Colombia, Guatemala, Honduras and Nicaragua.

Dilip Buildcon: The company has received a letter of acceptance (LOA) from National Highways Authority of India (NHAI) for a new Hybrid Annuity Mode (HAM) project in Chhattisgarh. The 56.70 km-long project is worth Rs 1,255 crore and the project is expected to be completed within a period of 2 years.

Pennar Industries: The company shares jumped 5.71% to Rs 37.05 after the company said that a meeting of the board of directors is scheduled to be held on Wednesday, Mar. 9, 2022, to consider a proposal for buyback of the equity shares.

Dynacons Systems & Solutions: The company jumped 10.43% to Rs 235 apiece after the company said it won a Rs 101-crore order from Bank of Baroda to set-up of Software Defined Wide Area Network (SD-WAN) for 6000 branches.