Benchmark indices started the first day of 2022 on a strong note as there was continuous buying support during the day. Banking sector stocks outperformed all other sectors as it soared 2.65% in the day. Metal and Auto stocks also contributed to the rally. Nifty Metal and Nifty Auto surged 1.93% and 1.62%, respectively. Auto stock rose mainly because most of the companies reported encouraging sales numbers for December 2021.

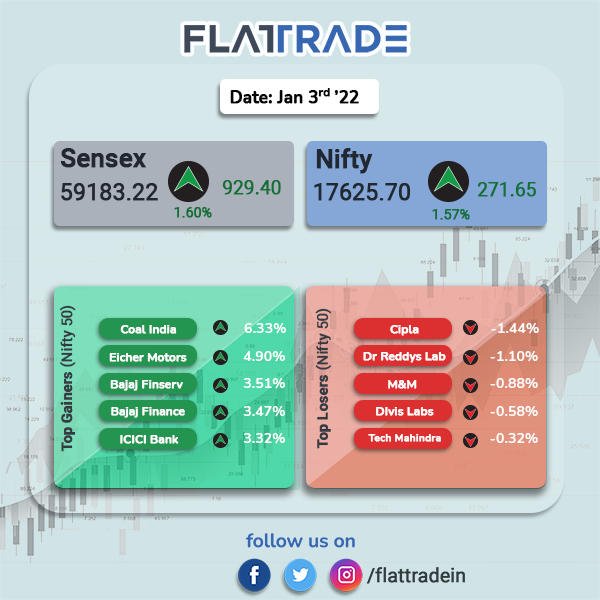

The Sensex closed 1.60% higher to 59183.22 and the Nifty jumped 1.57% to 17625.70. Broader markets also rose tracking benchmark indices. Nifty Midcap 100 advanced 1.13% and BSE Smallcap gained 1.19%.

Indian rupee rose 7 paise to 74.26 against the US dollar.

Stock in News Today

Avenue Supermarts Ltd (D-Mart): The company has reported a 22% increase in its standalone revenue from operations at Rs 9,065.02 crore for the third quarter ended on December 31, 2021, as against Rs 7,432.69 crore in the year-ago period. Its total number of stores as of December 31, 2021 grew to 263 stores, a rise of 17 stores from July-September quarter of this financial year.

Future Retail: The company has asked a New Delhi court to declare ongoing arbitration proceedings with Amazon.com illegal, saying the country’s antitrust agency had suspended a 2019 deal which Amazon used to assert its rights over Future, Reuters reported. In the latest Future Retail filing in New Delhi, the company argues that since the 2019 deal no longer has antitrust approval, it has “no legal existence” in India and Amazon can no longer assert any of its rights. The “continuation of the entire arbitration proceedings is a perpetuation of illegality,” Future said in its filing dated Dec. 31.

Coal India Ltd: The company reported a 15.7% year-on-year growth in coal offtake during December 2021. During April-December period, coal offtake stood at 481.8 MT, up 17.6% year-on-year. Coal production in December grew 3.3% YoY. The company also raised it sales volume guidance to 660-670 MT for FY22.

IndiGo and SpiceJet: Shares of the airlines fell after the price of jet fuel or Aviation Turbine Fuel was hiked by 2.75% on account of hardening global oil prices. According to a notification by state-owned fuel retailers, ATF prices have increased by Rs 2,039.63 per kilolitre to Rs 76,062.04 per kl in Delhi.

NCC Ltd: Shares of the company rose 2.5% after the company secured five new orders aggregating to Rs 1,898 crore in December 2021. Among the new five orders, three orders were worth Rs 988 crore pertain to building division and the other two orders worth Rs 910 crore were related to water segment. The orders were received from state government agencies, according to its exchange filing.

L&T Technology Services Ltd: Shares of the company rose after the company said it will consider approving a proposal for interim dividend, on Jan. 18 and also to approve standalone and consolidated financial statements for the third quarter of FY22. The IT firm has fixed Jan. 27,2022 as the record date.

KPI Global Infrastructure Ltd: The company has commissioned 12.50 Mega Watt (DC) solar power project for Anupam Rasayan under captive power producer business vertical of the company.

Mahindra & Mahindra Financial Services Ltd: The company in an exchange filing said that it disbursed loans approximately Rs.2,750 crore in December 2021, up 42% year-on-year compared with the year-ago period. The collection efficiency (CE) improved further to 100%, up from 96% in December 2020 and 94% in November 2021. For the third quarter, the total disbursement stood at approximately Rs. 18,100 crore, registering a YoY growth of 39%. For Q3, the collection efficiency improved to 95% from 88% in the year-ago period.

Edelweiss Financial Services Ltd (EFSL): The company said it has raised Rs 456.24 crore through the issuance of non-convertible debentures (NCDs). The company has allotted 45,62,472 NCDs of the face value of Rs 1,000 each, a press release said. The bond issue witnessed significant demand in the retail and high net-worth individuals (HNI) segment with a total collection of Rs 361.97 crore.