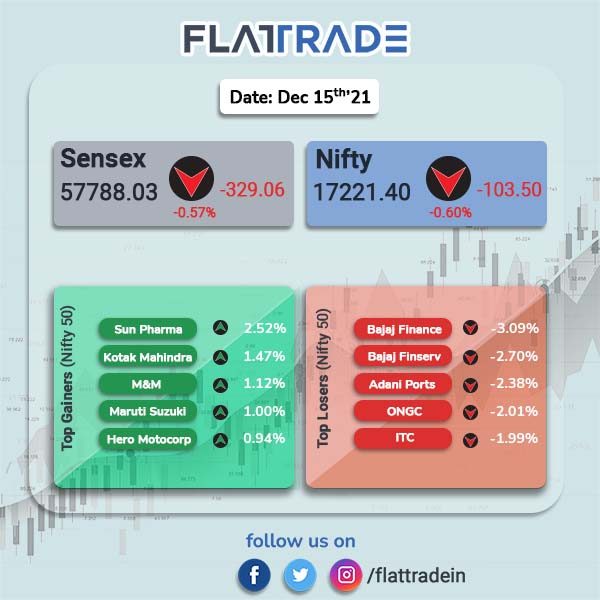

Domestic benchmark stock indices closed lower, weighed by losses in information technology, metal and reality stocks. The Sensex fell 0.57% to 57788.03 and the Nifty ended 0.60% lower 17221.40.

Top losers were Nifty Realty [-1.89%], Media [-1.35%], PSU Bank [-1.35%], Metal [-1.11%] and IT [-1.01%]. Nifty Auto closed higher 0.49% led by TVS Motor [2.07%] and M&M [1.12%].

Indian rupee plunged 37 paise to 76.23 against the US dollar on Wednesday.

Stock in News Today

State Bank of India: The public-sector lender said it is planning to offload 6% of its stake in its mutual fund venture through the initial public offering route. SBI currently holds 63 per cent stake in SBI Funds Management Private Ltd and the remaining 37 per cent stake is held by AMUNDI Asset Management through a wholly owned subsidiary, Amundi India Holding. The lender did not give any timeline for the listing.

Tata Motors and Bandhan Bank: The automaker has a MoU with the bank to offer financing facility to all its passenger vehicle customers. As part of the MoU, Tata Motors’ customers will be charged an interest rate starting from 7.50% and the scheme will offer a maximum of 90% financing on the total on-road cost of the vehicle.

Paytm: Shares of the company closed 7.76% lower as the mandatory one-month lock-in period for anchor investors expired on December 15, 2021. the company shares have been on a downward trend since the day of listing. The company has fallen 35.81% from its issue price of Rs 2150 per equity share.

TVS Motor Company: The two-wheeler maker and BMW Motorrad will expand their partnership for future mobilities & EVs, the company said in a regulatory filing. TVS said that the partnership will include design and development of future BMW Motorrad products. Both companies will develop exclusive products on a common platform and the companies will retail their products globally. TVS said that the first product with be launched in the next 24 months.

Jindal Steel and Power Ltd (JSPL): The company will aggressively bid for Odisha-based steel maker NINL, said V R Sharma, JSPL Managing Director. He added that the asset is more valuable in terms of their operations in Odisha. Furthermore, the bidding for Neelachal Ispat Nigam Ltd (NINL) will happen on December 23.

SpiceJet Ltd: The company has entered into a deal with Canadian aircraft manufacturer De Havilland to settle all disputes related to the Q400 turboprop aircraft purchase agreement. The company in a statement said, “All related proceedings before the UK court and execution proceedings before the Delhi High Court have been stayed and will be withdrawn upon compliance with the settlement terms.”

Larsen & Toubro (L&T): The construction and engineering company announced that its water & effluent treatment business received contracts ranging between Rs 2,500 and Rs 5,000 crore from the State Water & Sanitation Mission (SWSM), Uttar Pradesh. In addition, the Smart Water Infrastructure segment of the Water Et Effluent Treatment Business has been awarded a contract for an integrated infrastructure project at Silvassa in the Union Territory of Dadra and Nagar Haveli and Daman and Diu by the Silvassa Smart City Limited.

Burger King India: The Quick Service Restaurant chain has approved raising as much as 1,500 crore via sale of shares, the company said in a regulatory filing. The company has also approved a change in name from “Burger King India Ltd.” to “Restaurant Brands Asia Ltd.” The board has also approved an increase in its authorised share capital from Rs 505 crore to Rs 600 crore.

Ashoka Buildcon: Shares of the company rose in intraday trading after the company in an exchange filing said that it has received a Letter of Award from Ministry of Road Transport & Highways for the construction of six-lane link road in Goa on EPC mode. The accepted quoted offer of the project is Rs 769.41 crore, the company said.

Genus Power Infrastructure: Share price of the company closed 2.67% higher after the company bagged orders worth Rs 325 crore across exports geography and domestic geography. Orders have been received for Smart Meters across multiple state electricity boards and gas meters in the domestic market. These orders will be executed over next 12 months and the company has crossed Rs 1,000 crore order book which includes the new orders.