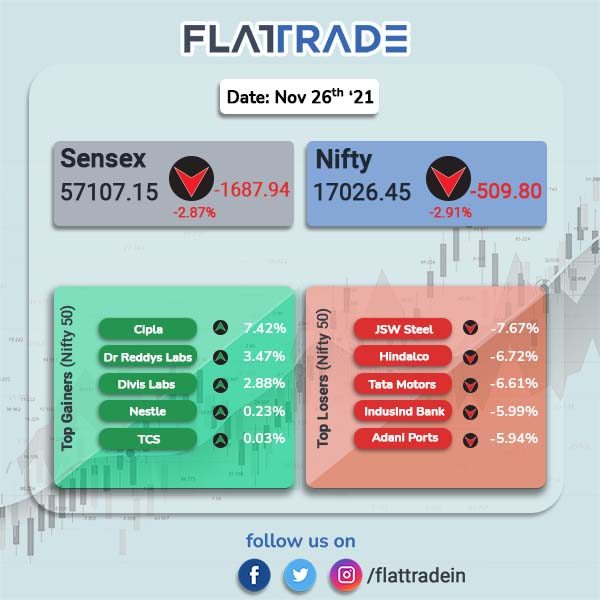

Benchmark equity indices plunged to three-month low, as the new variant of coronavirus spooked market participants. The Sensex closed 2.87% lower at 57107.15 and Nifty closed 2.91% lower at 17026.45. In August, Nifty closed at 17132.20.

All Nifty indices closed in the red except Nifty Pharma. Top losers were Nifty Realty (-6.26%), Metal (-5.34%), Auto (-4.34%), PSU Bank(-4.21%) and Private Bank(-3.85%). Nifty Pharma jumped 1.7%.

India rupee dropped 36 paise to close at 74.87 against the US dollar.

India VIX, a measure for volatility, rose 24.85% to 20.80 levels.

Stock in News Today

Bank of Baroda: The public-sector bank has raised Rs 1,997 crore by issuing Basel III-compliant bonds. In a regulatory filing, the bank said it has received a total bid amount of Rs 5,308 crore, out of which the issuance was finalised for Rs 1,997 crore at 7.95 per cent per annum. This will improve their capital planning processes and strengthen their compliance with respect to Basel-III Capital Regulations.

Escorts: Shares of the company closed 2.82% higher after the company announced open offer schedule for stake purchase by Kubota. According to its regulatory filing, the tendering period for the open offer will start from January 11, 2022 and end on January 24, 2022.

ITC: The conglomerate said in an exchange filing that it will acquire a 16% stake for Rs 20 crore in Mother Sparsh, a premium ayurvedic and natural personal care start-up in the direct-tocustomer space. The company added that it has recognised the significant potential of naturals and Ayurveda and ITC has taken this strategic step forward to invest in this segment.

Aurionpro Solutions Ltd: Shares of the company rose 5% and hit upper circuit after the company said in a regulatory filing that it will acquire a majority stake in Toshi Automatic Systems for around Rs 14 crore. It added that the buyout will allow Aurionpro to further consolidate its position as the only integrated player in Automatic Fare Collection (AFC) & transit solutions space in India.

Tarsons Products: The company had a good stock market debut even as the broader markets fell. Shares of the company closed higher at Rs 818.40 as against its issue price of Rs 662. It opened at a premium of Rs 682, 3% higher than its issue price.