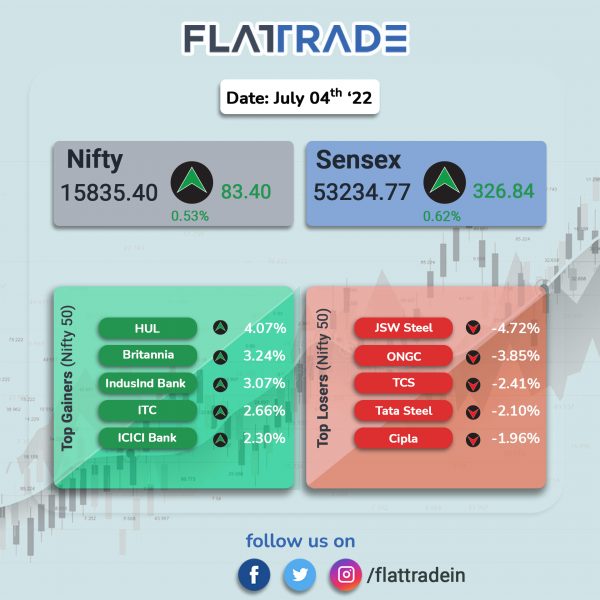

Benchmark equity indices snapped three-day losing streak, helped by gains in FMCG and banking stocks, while metal stocks declined. The Sensex rose 0.62% and the Nifty 50 gained 0.53%.

Top Nifty sectoral gainers were FMCG [2.66%], PSU Bank [1.66%], Private Bank [1.53%], Bank [1.2%] and Financial Services [0.93%]. Top losers were Metal [-0.99%] and IT [-0.62%], Pharma [-0.35%], Energy [-0.19%] and Auto [-0.17%].

Indian rupee rose 10 paise to 78.95 against the US dollar on Monday.

Stock in News Today

HDFC Bank: The lender reported a 21.5 % year-on-year (YoY) growth in advances to Rs 13.95 trillion in Q1 FY23. The advances were at Rs 11.48 trillion on June 30, 2021. As of June 30, HDFC Bank’s deposits registered a YoY rise of 19.3% to Rs 16.05 trillion from Rs 13.46 trillion a year ago.

Tata Power: The company has signed an MoU with Tamil Nadu government to set up a greenfield 4 Gigawatt solar cell and 4 Gigawatt solar module manufacturing plant, for an investment of Rs 3,000 crore. The investment in the plant will be made over 16 months, the company said in an exchange filing. The Tamil Nadu plant will produce high wattage modules and utilise smart manufacturing tools.

NTPC: The state-run power company said that it has registered a 21.7% growth in electricity generation at 104.4 billion units (BU) in the April-June quarter of this financial year. NTPC group of companies recorded a generation of 104.4 BU in the April to June quarter of 2022, registering an increase of 21.7% from 85.8 BU generated in the corresponding quarter last year, a company statement said.

Coal India Ltd (CIL) and Adani Enterprises: The company floated its first import tender on behalf of power companies, where Adani Enterprises Ltd came out to be the lowest bidder, a report in The Economic Times said. The company quoted Rs 4,033 crore for the supply of 2.416 million tonnes of coal on a freight-on-road (FOR) basis, the report added. Adani Group is also eyeing two tenders totalling six MT from Coal India, industry insiders told ET, adding that the bids for these have to be submitted by Tuesday.

AU Small Finance Bank (AU SFB): The lender posted a 42% year-on-year (YoY) growth in credit to Rs 49,366 crore in the first quarter ended June 2022. Its gross advances stood at nearly Rs 34,687 crore at end of June 2021.

Hindustan Aeronautics Ltd (HAL): The company shares rose 2.3% after Tejas Light Combat Aircraft emerged as the top choice for Malaysia as the country looks to replace its fighter jets’ fleet. The two countries are are holding negotiations to firm up procurement. The LCA Tejas is developed and made in India by HAL.

Deepak Nitrite: The company performed restoration and submitted stability certificates to government with respect to fire incident at Nandeswari plant. Gujarat Pollution Control Board has issued directions revoking the closure order and allowed the company to operate a part of the plant, 50% of consented capacity of Nitro section, the company said in an exchange filing.

Dilip Buildcon: Shares of the company rose 9.5% after the company emerged as L-1 bidder for a tender by Gujarat Metro Rail Corp. pertaining to the construction of 8,702 km elevated viaduct and seven stations under Surat Metro Rail Project Phase-1. The project cost is Rs 702.02 crore and is to be completed within 26 months.

Avenue Supermarts (D-Mart): The company reported a rise in its standalone revenue from operations to Rs 9,806.89 crore for the first quarter ended on June 30, 2022. The company had revenue from operations of Rs 5,031.75 crore in the April-June quarter a year ago.

VA Tech Wabag: Shares of the company closed 3.5% higher after the firm bagged an order worth Rs 430 crore from Reliance Industries. The scope of the order includes design, engineering, procurement, supply, construction, commissioning and performance guarantee test run of sea water reverse osmosis plant. The plant is to be completed in 21 months.

Mahindra & Mahindra Financial Services: The NBFC delivered 115% YoY and 27% growth in disbursements to Rs 3,750 crore in June. The company’s year-to-date disbursement stood at Rs 9,450 crore, up 145% YoY. The company’s gross business assets, as on June 30, rose 6% YoY to Rs 67,500 crore. Its collection efficiency in the month of June 2022 was at 96% compared to 90% in June 2021.