Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.29% higher at 15,869, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares advanced amid speculation that the Biden administration could scrap some Trump-era tariffs on Chinese consumer goods. Japan’s Nikkei 225 was up 0.82% and Topix rose 0.4%. China’s Hang Seng gained 0.48%, while CSI 300 fell 0.33%.

Indian rupee rose 10 paise to 78.95 against the US dollar on Monday.

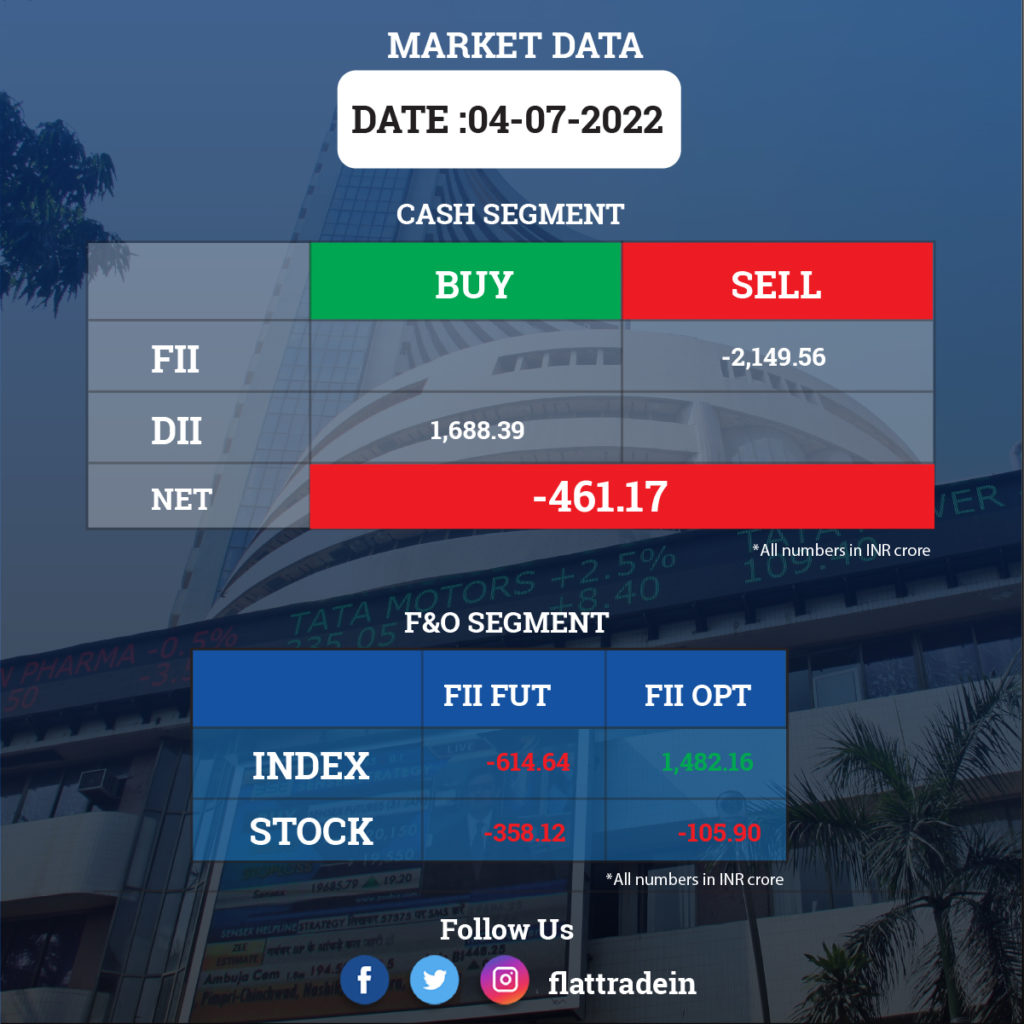

FII/DII Trading Data

Stocks in News Today

Tata Consultancy Services (TCS): A U.S. court has reduced the punitive damages to $ 140 million for the IT major in a trade secrets case with American software firm Epic Systems Corp. The company said that it has been advised that the order is appealable in the higher court.

HDFC Bank: The lender registered a 21.5% growth in advances in June quarter to reach Rs 13.95 lakh crore as against Rs 11.48 lakh crore (YoY), and a growth of around 1.9% over Rs 13.68 lakh crore as of March 31, 2022. The bank’s deposits aggregated to approximately Rs 16.05 lakh crore as of June 30, 2022, a growth of around 19.3% over Rs 13.45 lakh crore as of June 30, 2021 and a growth of around 2.9% over Rs 15.59 lakh crore as of March 31, 2022.

Punjab National Bank (PNB): The state-run bank has raised Rs 2,000 crore in capital through tier I bonds at a rate of 8.75%. Bond dealers said the paper from the public-sector lender was placed at a lower yield against an indicative rate of 9-9.25%.

Vedanta: The company reported 3% yoy increase in production of Aluminum in Q1 to 5.65 lakh tons. It also increased mining of domestic Zinc’s by 14% yoy to 2.52 lakh tons in the first quarter. Oil and Gas gross production reduced 10% yoy to 1.35 crore barrels of oil equivalent.

Tata Motors: The company is eyeing a 5x growth in sales of electric vehicles (EVs) from the current levels by the end of 2023-24, the automaker’s chairman N Chandrasekaran told the shareholders at the AGM.

Tata Steel: The steel major said that it completed the acquisition of 93.71% in Neelachal Ispat Nigam Limited through its listed step-down subsidiary, Tata Steel Long Products.

Tech Mahindra: The IT services company has opened new campus in Coimbatore and aims to hire 1,000 in FY23 to grow its India operations.

Cipla: The company informed BSE that the US FDA conducted a Pre Approval Inspection (PAI) at the company’s Indore plant from June 27 to July 01, and has received two observations on FDA Form 483 with respect to ANDA filed for the product to the manufactured at the plant.

Kotak Mahindra Bank: The Reserve Bank of India imposed a penalty of Rs 1.05 crore due to inability of bank to credit amount involved in unauthorised electronic transactions within 10 working days. The Bank did not maintain/apply required margin on advances to stockbrokers. It failed to credit required amount to depositor education fund.

Marico: The company has raised its stake in its subsidiary Apcos Natural from 52.38% to 56.52% on acquiring additional equity up to 4.14%, according to its exchange filing.

IndusInd Bank: The Reserve Bank of India imposed a penalty of Rs 1 crore for non-compliance with customer due diligence procedures in accounts opened via E-KYC.

Reliance Power: The shareholders of the company turned down the company’s asset monetisation plan during its AGM. The special resolution needed at least 75% votes in favour of the proposal, but the company could garner only 72% favourable votes. A report by Institutional Investor Advisory Services (IiAS) last month said the company defaulted on loans to the tune of Rs 3,561 crore as on March 31, 2022.