Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 2.08% higher at 17,311.5, signalling that Dalal Street was headed for a gap-up start on Friday.

Asian shares were trading higher, following gains in Wall Street overnight amid rising inflation. Nikkei 225 index soared 3.39% and Topix surged 2.53%. Hang Seng jumped 2.91% and CSI 300 index rose 1.72%.

The Indian rupee slipped 3 paise to 82.35 against the US dollar on Thursday.

In the US, the core consumer price index, which excludes food and energy, increased 6.6% from a year ago, the highest level since 1982, according to data released by the US Labor Department. The core CPI climbed 0.6% month-on-month. The overall CPI rose 0.4% in September compared to August, twice the 0.2% projected by analysts. The annual rate of inflation slowed slightly to 8.2% from 8.3%, according to the report. Higher prices for food, shelter and medical care weighed on consumers, according to data from the Bureau of Labor Statistics.

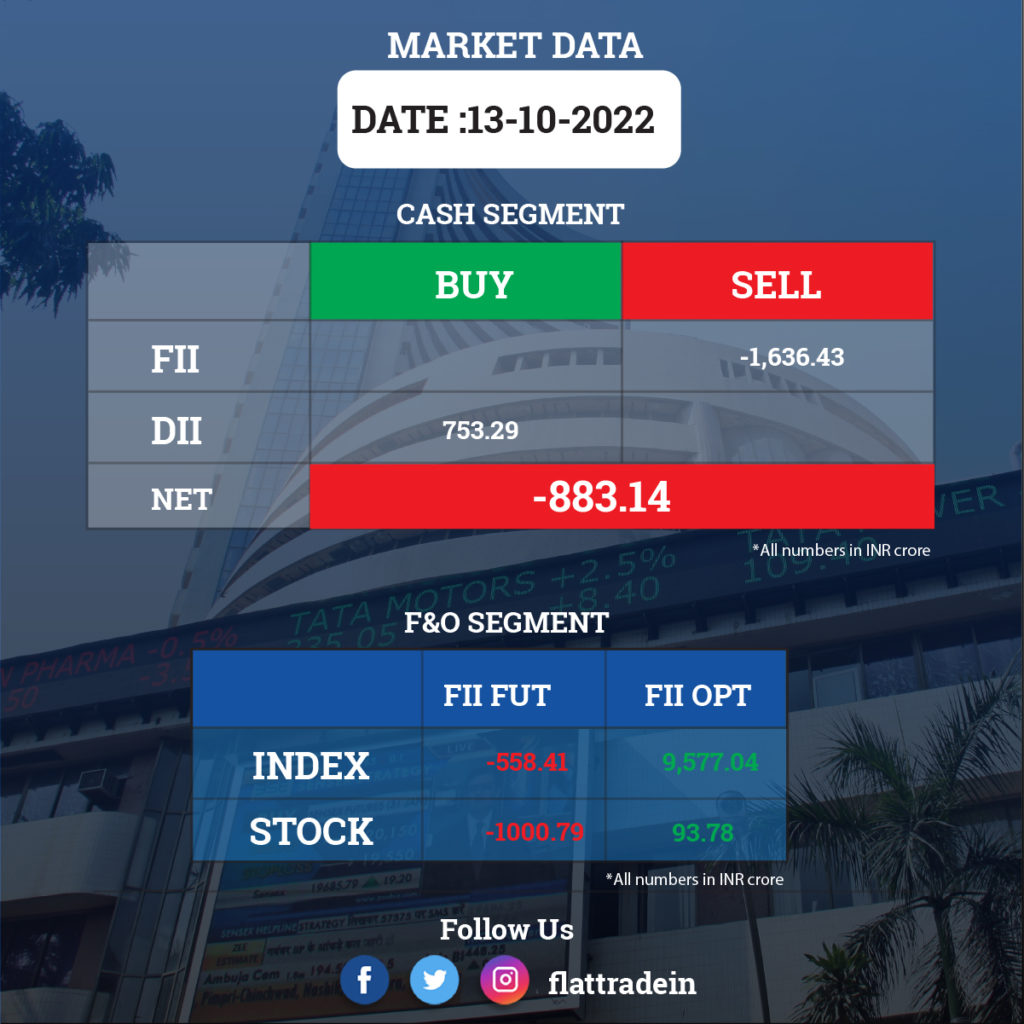

FII/DII Trading Data (13-10-2022)

Upcoming Results

Bajaj Auto, Shree Cement, Tata Elxsi, Federal Bank, Oberoi Realty, Just Dial, GI Engineering Solutions, Infomedia Press, and Plastiblends India will report their quarterly earnings on October 14.

Stocks in News Today

Infosys: The IT major posted better-than-expected 11.07% rise in consolidated net profit at Rs 6,021 crore for the September quarter and announced buyback of shares worth Rs 9,300 crore. The revenue rose 23.4% year-on-year to Rs 36,538 crore in the second quarter ended September. The company raised its FY23 revenue growth guidance to 15-16% buoyed by strong large deals pipeline and good demand momentum despite global macroeconomic concerns.

Infosys board has also declared an interim dividend of Rs 16.50 per share. The interim dividend payout will be about Rs 6,940 crore, the company said in a statement. The company has announced share buyback worth Rs 9,300 crore via open market route, for a price of up to Rs 1,850 per equity share.

Reliance Industries Ltd (RIL): The conglomerate is in advanced discussions to acquire German firm Metro AG’s wholesale operations in India, Bloomberg reported citing people familiar with the matter, as RIL led by billionaire Mukesh Ambani seeks to dominate India’s mammoth retail sector. Charoen Pokphand Group is no longer actively in talks with Metro, leaving only RIL to pursue the so-called cash-and-carry business, sources said. A final decision could emerge as early as next month, one of the people said.

Mindtree: The Midcap IT firm reported a net profit of Rs 508.7 crore in Q2FY23, up 27.5% year-on-year and sequential rise of 7.9%. Revenue for the reported quarter was up 31.5% year-on-year at Rs 3,400 crore. Revenue was up 8.9% sequentially. The company signed total contract value (TCVs) worth $518 million, taking its first half of FY23 TCV to $1 billion.

HDFC Life Insurance Company: The company has received final approval from insurance regulator Insurance Regulatory and Development Authority of India (IRDAI) for the merger of Exide Life Insurance with itself. The appointed date for the scheme of amalgamation is April 1, 2022 and the scheme will be effective from end of day on October 14, 2022.

MTNL: The state-owned company said its shareholders have approved a proposal to raise up to Rs 17,571 crore through government-guaranteed debt bonds on private placement basis. Shareholders of the loss-making public sector telecom firm have also enhanced power of the board to borrow up to Rs 35,000 crore from banks and other financial institutions, according to MTNL’s annual general meeting held on October 10.

Coal India Ltd (CIL): The company will set up a 1,190-MW solar power plant in Bikaner district of Rajasthan. CIL signed a Memorandum of Understanding (MoU) with the Rajasthan Vidyut Utpadan Nigam Ltd (RUVNL). The solar plant will be set up in a 2,000-MW solar park being developed by RVUNL in Poogal, Bikaner.

Angel One: The company posted a 17.7% sequential growth in profit at Rs 213.6 crore for the quarter ended September FY23, with consolidated total income growing 9% QoQ to Rs 745.9 crore during the same period. It reported gross addition of around 1.2 million clients in Q2FY23, crossing 11 million mark in total client base during the quarter. The company announced second interim dividend of Rs 9 per share, which is equivalent to 35% of consolidated profit for the quarter.

Den Networks: The company has posted a 27.7% year-on-year growth in consolidated profit at Rs 48.12 crore for the quarter ended September FY23 due to lower tax expenses and loss by associates, but revenue fell 11.6% to Rs 287.3 crore during the same period.

Anand Rathi Wealth: The company reported a 8.15% growth sequentially in consolidated profit at Rs 42.95 crore for the quarter ended September FY23, and revenue rose 3.4% to Rs 136 crore compared to year-ago period. Operating profit also rose 8.4% QoQ to Rs 60.4 crore for the reported quarter.

Karur Vysya Bank (KVB): The lender said it has re-appointed non-executive independent director KG Mohan for three years on its board with effect from October 12, 2022. He was re-appointed as an additional director under the independent category, the bank said in a regulatory filing.

MAS Financial Services: The company has raised Rs 55 crore through issuance of commercial papers. The maturity date for the commercial papers is October 31 and it has credit rating of CARE A1+.

Chemcon Speciality Chemicals: The company has acquired land in Vadodara for Rs 22.3 crore for its business operations.