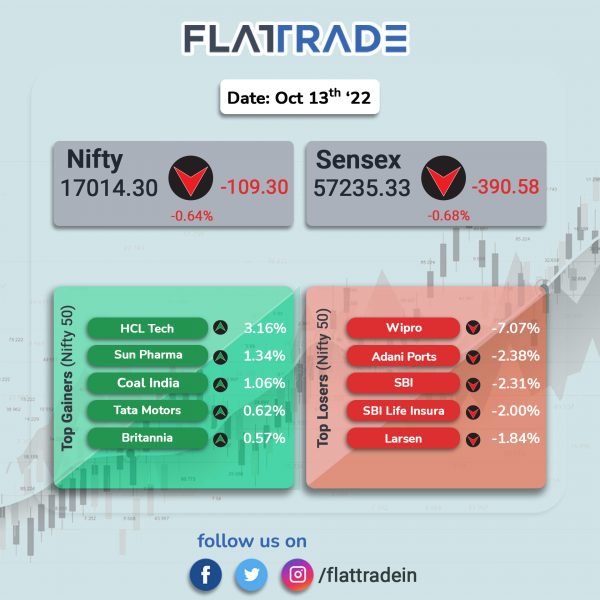

Benchmark indices closed lower as negative global cues dented traders’ sentiments and weighed by losses in banking as well as financial services stocks. The Indian markets remained volatile during the session due to weekly futures & options expiry. The Sensex closed 0.68% lower and the Nifty lost 0.64%.

Broader market mirrored the headline indices. The Nifty Midcap 100 index was down 0.69% and BSE Smallcap fell 0.45%.

Top losers among Nifty sectoral indices were PSU Bank [-1.58%], Bank [1.26%], Financial Services [-1.22%], Private Bank [-1.07%] and Realty [-0.99%]. Top gainers were Medai [0.27%] and Pharma [0.22%] and Metal [0.11%].

The Indian rupee slipped 3 paise to 82.35 against the US dollar on Thursday.

In the economic front, India’s consumer price inflation rose to a five-month high of 7.41% in September 2022 from 7% in August 2022, data from the National Statistical Office showed. In the same period last year, inflation was 4.35%. The inflation rate was well above the Reserve Bank of India’s medium-term target of 4%.

Meanwhile, Industrial production in India declined 0.8% year-over-year in August, reversing a 2.2% rise in July, official data showed. Further, this was the first decrease since February 2021. Among three main sectors, mining output fell by 3.9%, followed by a 0.7% contraction in manufacturing production, while electricity production registered a positive growth of 1.4%.

Stock in News Today

Larsen & Toubro (L&T): The company’s heavy engineering division has won several contracts in Q2 of FY23. As per the company’s project classification, the value of these contracts ranges between Rs 1000 crore to Rs 2500 crore. L&T Heavy Engineering secured a key order for the supply of Reactors for renewable diesel production from a prestigious client in Singapore. Further, in the petrochemicals segment, the business won two large critical Tubular Reactors from a global petrochemical major for their project in China. The company also bagged multiple strategic orders for IOCL’s Panipat P25 Project.

Tata Consultancy Services (TCS): The company will collaborate with Microsoft to leverage its deep domain knowledge in industrial control systems and build new AI-powered autonomous solutions using Project Bonsai, a low-code, secure, and compliant AI platform, on Microsoft Azure Cloud. These solutions will help companies modernize their manufacturing process, reduce downtime and material wastage, improve quality and throughput, and enhance employee safety.

IRB Infrastructure Developers: The company said its special purpose vehicle has received the date from UPEIDA for Meerut Budaun Ganga Expressway Group 1 Greenfield BOT project in UP. The company, further, said that resources have been mobilized to commence construction activity in full swing to ensure timely completion of the project. The project is a six lane Greenfield BOT (Build-Operate-Transfer) stretch of 129.7 Km between Meerut and Budaun with cost outlay of Rs.6,538 crore.

NTPC: The state-owned company and Siemens have signed a Memorandum of Understanding (MoU) to demonstrate the feasibility for hydrogen co-firing blended with natural gas in Siemens V94.2 gas turbines installed at NTPC Faridabad gas power plant. The total installed capacity of Faridabad gas power plant is 432 megawatt (MW) with two V94.2 gas turbines operating in combined cycle mode.

Under this MoU, both the companies will collaborate to study the feasibility of introducing hydrogen co-firing in Faridabad gas power plant. Based on the feasibility studies, a pilot project for 5% (by volume) hydrogen co-firing may be implemented for demonstrating the capability and the hydrogen required for the project shall be arranged by NTPC.

Yes Bank: The lender said that CARE Ratings has upgraded its rating on the long-term instruments of the bank worth Rs 145.28 crore. The agency has upgraded the rating of the bank’s infrastructure bonds, lower tier-II bonds, tier-II bonds (Basel-III) to CARE A- / Positive from CARE BBB+ / Positive. It has also upgraded the rating on the bank’s upper tier-II bonds to CARE BBB / Positive from CARE BBB- /Positive.

Tata Teleservices: The company in an exchange filing said that Tata Tele Business Services (TTBS) has partnered with Google Cloud to offer Google Workspace for Small and Medium Businesses (SMBs). It will also help business drive greater efficiency and market growth with Google Workspace on Google Cloud, and integrate key Google features like Gmail, Google Chat, Calendar, Drive, Docs, Sheets, Meet.

Maharashtra Seamless: The company informed the exchanges that it will consider issue of bonus shares as well as sub-division/split of the equity shares of Rs 5 each at its board meeting scheduled on October 17.

Birlasoft: the IT firm has been recognized as a US mid-market leader in the SAP S/4HANA System Transformation, in the ISG Provider LensTM SAP Ecosystem Report. This is the second consecutive year for Birlasoft to be positioned as a leader in the US mid-market in SAP S/4HANA System Transformation.

ITC: The FMCG major said its subsidiary ITC Infotech India has incorporated a wholly-owned subsidiary in Brazil under the name of ITC Infotech Do Brasil LTDA.

RITES: The company said that its consortium has secured a new business order for building a depot-cum-workshop worth Rs 499.41 crore from Bangalore Metro Rail Corporation.

JMC Projects (India): The company’s board approved the issuance of non-convertible debentures (NCDs) of Rs 75 crore on private placement basis. The board approved the issue of 750 non-convertible debentures of face value of Rs 10 lakh aggregating to Rs 75 lakh. The issue has been divided in Series A debentures and Series B debentures.

Under Series A debentures, the company will issue 375 NCDs having a tenor of 24 months from the deemed date of allotment. Similarly, Under Series B debentures, the company will issue 375 NCDs having a tenor of 36 months from the deemed date of allotment.

Bandhan Bank: The lender today announced that it has roped in Sourav Ganguly as its Brand Ambassador. “The association is another step towards connecting strongly with consumers across the spectrum and reinforcing our ongoing mission of inclusive banking,” Chandra Shekhar Ghosh, MD and CEO, Bandhan Bank.

Aditya Birla Money: The company said its net profit rose 51.01% to Rs 9.71 crore in the quarter ended September 2022 as against Rs 6.43 crore during the quarter ended September 2021. Revenue rose 18.51% to Rs 68.20 crore in the reproted quarter as against Rs 57.55 crore during the same quarter ended last fiscal.

Pennar Industries: shares of the company soared 12.6% in intraday trade after the Pennar Group secured orders worth Rs 1167 crore across its various business verticals. The orders have been received during the month of September 2022 and are expected to be executed within the next two quarters, the company stated.

Kalpataru Power Transmission: The company announced the completion of the sale and transfer of an additional 25% of the total equity shares of Alipurduar Transmission to Adani Transmission. In July 2020, Kalpataru Power had announced the signing of agreement to sell Alipurduar Transmission to Adani Transmission for a total enterprise value of about Rs 1,286 crore.

Tanla Platforms: Shares of the company rose over 11% in intraday trade after the company fixed October 25 as the record date for its proposed share buyback. The record date is for determining the names of shareholders eligible to participate in the proposed share buyback. The company had announced, earlier, that it plans to buyback shares at Rs 1,200 each for an aggregate amount not exceeding Rs 170 crore.

NxtDigital: The company reported a net loss of Rs 47.96 crore in the quarter ended September 2022 as against a net loss of Rs 29.89 crore during the same quarter last fiscalended September 2021. Revenue also declined 9.40% to Rs 245.22 crore in the reported quarter as against Rs 270.66 crore during the corresponding quarter last financial year.

Navoday Enterprises: The company’s board has approved resignation of Rajatmohan Gopalmohan Sinha as CFO of the company with immediate effect. The board has appointed Sandeep Prabhakar Khare as CFO of the company with immediate effect. Further, the company’s board has recommended the issue of up to 38,54,000 equity shares of Rs 10 each as bonus shares of an aggregate nominal value up to Rs 3.854 crore.

H.G. Infra Engineering: The company has received the provisional certificate for for development and upgradation of Bhawi-Pipar-Khimsar Highway in Rajasthan. The cost of the project was Rs 85.41 crore and the provisional certificate has been issued by the authority engineer for the length of 84.975 Km.

Dhanlaxmi Bank: The lender has received an extension of three months from the Ministry of Corporate Affairs to conduct its annual general meeting. The ministry in an order advised the company to be careful in future with respect to compliance of the provisions of the Companies Act.