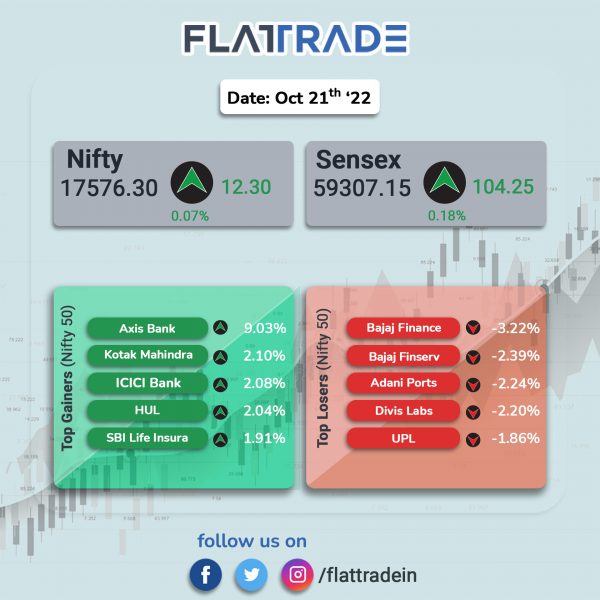

Benchmark equity indices managed to end in the positive territory supported by gains in banking stocks. The Sensex rose 0.18% and the Nifty edged up 0.07%.

Broader markets underperformed compared to benchmark indices. The Nifty Midcap 100 index fell 0.68% and the BSE Smallcap dropped 0.60%.

Top gainers among Nifty sectoral indices were PSU Bank [1.85%], Bank [1.71%], Private Bank [1.66%], Financial Services [0.76%]. Top losers were Media [-1.93%], Metal [-0.92%], Pharma [-0.84%], Energy [-0.66%] and Oil & Gas [-0.37%].

The Indian rupee rose 9 paise to 82.68 against the US dollar on Friday.

Stock in News Today

Adani Group: The group controlled by billionaire Gautam Adani is looking to raise at least $10 billion in new debt over the next year as his conglomerate seeks to refinance its high-cost borrowings and fund projects in the pipeline, Bloomberg reported citing sources familiar with the matter. The report said that the group plans to use multiple instruments including foreign currency debt and green bonds to raise up to $6 billion and swap its existing high-interest debt with lower-cost borrowings and deploy the rest for project financing, one of the people said. The effort could start as early as the ongoing December quarter, sources said.

Bajaj Finserv: The company reported a 39% YoY rise in consolidated net profit at Rs 1,557 crore on a 16% YoY increase in total income at Rs 20,803 crore in Q2FY23 .Total expenses increased by 8.7% to Rs 16,545.23 crore in Q2FY23 from Rs 15,215.84 crore in Q2FY22.

Ambuja Cements: the company’s standalone revenue stood at Rs 3670.40 crore in third-quarter of CY2023 as against Rs 3993.45 crore in the preceding quarter. Standalone net income stood at Rs 137.89 crore in the reported quarter compared with Rs 1,047.90 crore in Q2 2023. EBITDA was at Rs 304.33 crore in the reported quarer as against Rs 684.54 crore in the preceding quarter. The company follows January to December as its financial year.

Mphasis: The company reported 4.1% QoQ rise in consolidated net profit to Rs 418.46 crore on a 3.2% QoQ increase in net sales to Rs 3,519.82 crore in Q2FY23. Compared to Q2FY22, the company’s revenue and net profit rose by 22.6% and 22.7%, respectively. The company recorded new TCV wins of $302 million in Q2 FY23 in Direct, of which 81% is in new generation services. Further, two large deal wins in Q2 FY23 totalled to $110 million. With this, TCV wins in H1FY23 stood $604 million. In dollar terms, the company recorded revenues of $440 million, up 0.9% QoQ and up 14.3% YoY. In constant currency terms, growth was 1.8% QoQ and 16.8% YoY.

Bharat Dynamics: The company has signed a MoU with Dassault Aviation for integration of the former’s weapons systems like Astra and Smart Anti-Airfield Weapon on Rafale aircraft. Bharat Dynamics launched three new products including an anti-tank guided missile and two vehicle-mounted weapon systems. Shares of Bharat Dynamics jumped 4% in intraday trade on Friday and over 11% this week.

Hindustan Zinc: The company’s consolidated net profit stood at Rs 2680 crore in Q2FY23 as against Rs 3092 crore in the preceding quarter. Revenue fell to Rs 8127 crore in Q2FY23 from Rs 9236 crore in Q1FY23. Its EBITDA was at Rs 4407 crore in the quarter under review compared with Rs 5137 crore in Q1FY23.

Hindustan Petroleum Corporation Limited (HPCL): The National Green Tribunal has imposed a Rs 18.35 crore fine on Hindustan Petroleum Corporation Limited (HPCL)-Visakh Refinery over violation of environmental norms. A plea was moved by Visakha Pawan Praja Karmika Sangham and the tribunal’s southern zone bench, in its order, said that there is a merit in the recommendations of the Joint Committee that HPCL had failed to take effective steps despite the long period between 2011 and 2020.

UPL: The company has approved transfer of crop protection business on slump sale basis as a going concern to UPL Sustainable Agri Solutions (UPL SAS), a wholly owned subsidiary. The company has also approved transfer of Advanta seeds business on slump sale basis to Advanta Enterprises, a wholly-owned subsidiary. Adarsh Farm Services business will be transferred to its subsidiary Nurture AgTech Pvt. The company’s board also gave its nod for investment in UPL Sustainable Agri Solutions, Advanta Enterprises by PE investments, subject to regulatory approvals.

A wholly owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”), Brookfield and TPG’ to invest Rs 1,580 crore (~US$ 200 million) for 9.09% stake in UPL SAS – India Agtech Platform at an equity valuation of ~Rs 17,380 crore (~US$ 2.2 billion). KKR to invest US$ 300 million (~Rs 2,460 crore) for 13.33% stake ‘Advanta Enterprises – Global Seeds Platform’ at an equity valuation of ~US$ 2.25 Bn (~Rs 18,450 crore). A wholly-owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”) & TPG to hold 22.2% stake in UPL Cayman, which will be the Global Crop Protection Platform (ex-India). According to the company’s exchange filing, these investments are independent transactions for which separate agreements have been agreed pursuant to negotiations between each of the investors and UPL Ltd.

IRB Infrastructure Developers: The company reported a 101.65% jump in consolidated net profit to Rs 85.30 crore for the second quarter ended September 2022. It had posted a consolidated net profit of Rs 42.30 crore in the corresponding quarter of the previous fiscal. Total income during the quarter under review declined to Rs 1,438 crore as against Rs 1,504 crore in the year-ago period.

Meanwhile, IRB Infrastructure Developers said Singapore-based GIC Affiliates will be investing Rs 1,045 crore in the Ganga Expressway project. The company also said its Ganga Expressway Project has raised equity capital of Rs 533.20 crore in the first tranche. The company in a statement said Singapore-based GIC Affiliates contributed Rs 261.29 crore and IRB Infra contributed Rs 271.90 crore.

Delhivery: Shares of the logistics company fell 18.52% to Rs 384, extending losses for the second straight session. Shares of Delhivery have slumped more than 30% in this week. The stock hit a record low of Rs 377.05 in intraday on Friday. The shares got listed at Rs 493 per shares on its stock market debut, a premium of 1.23% to its IPO price of Rs 487.

Jammu and Kashmir Bank: The lender’s consolidated net profit rose 123.14% to Rs 239.72 crore in the quarter ended September 2022 as against Rs 107.43 crore during the quarter ended September 2021. Its consolidated total operating income rose 15.51% to Rs 2,298.90 crore in the quarter ended September 2022 as against Rs 1,990.29 crore during the quarter ended September 2021.

Glenmark Life Sciences: The company’s net profit declined 7.22% to Rs 106.88 crore in the quarter ended September 2022 as against Rs 115.20 crore during the quarter ended September 2021. Revenue fell 9.34% to Rs 509.30 crore in the quarter ended September 2022 as against Rs 561.76 crore during the quarter ended September 2021.

Mastek: The company reported a net profit of Rs 79.1 crore in Q2FY23, up 9.42% from Rs 72.29 crore during Q2FY22. Revenue increased 17.11% to Rs 625.30 crore in the quarter ended September 2022 as against Rs 533.93 crore during the quarter ended September 2021.

Ultracab (India): The company’s net profit rose 104.29% to Rs 1.43 crore in the quarter ended September 2022 as against Rs 0.70 crore during the quarter ended September 2021. Revenue rose 45.16% to Rs 31.21 crore in the quarter ended September 2022 as against Rs 21.50 crore during the quarter ended September 2021.

PNB Housing Finance and Can Fin Homes: Punjab Housing Finance’s MD & CEO Hardayal Prasad has resigned citing personal reasons. Girish Kousgi, who was earlier MD & CEO of Can Fin Homes, will succeed Prasad.

Zensar Technologies: The company’s consolidated revenues rose 3% QoQ to Rs 1,234.6 crore in Q2FY23. Net profit was down 24% QoQ at Rs 56.8 crore. Ebitda fell 23% QoQ to Rs 105.4 crore in the quarter under review.