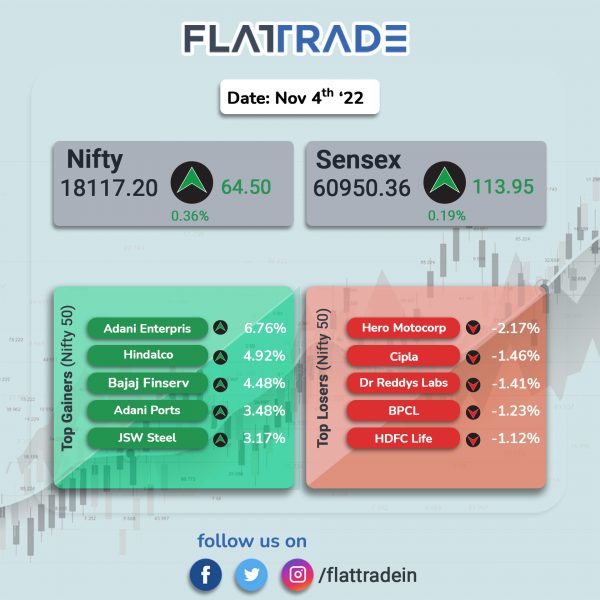

Benchmark stock indices ended higher, aided by gains in metal and public sector bank stocks. The Sensex rose 0.19% and the Nifty 50 index was rose 0.36%.

In broader markets, the Nifty Midcap 100 index dropped 0.25%, while the BSE Smallcap index rose 0.41%.

Top gainers among Nifty sectoral indices were Metal [4.21%], Media [1.07%], PSU Bank [1.04%], Oil & Gas [0.85%] and Energy [0.47%]. Top losers were Pharma [-1.02%], IT [-0.36%], FMCG [-0.34%] and Private Bank [-0.25%]

The Indian rupee surged 44 paise to 82.44 against the US dollar on Friday.

Stock in News Today

Reliance Retail: The company is in talks to buy a 49% stake in Naturals Salon & Spa, according to a report by The Economic Times. With this probable acquisition, the company will directly compete with Hindustan Unilever’s Lakme and other brands like Geetanjali. Naturals Salon has about 700 outlets in India.

Aditya Birla Fashion: The clothing retailer said its consolidated revenue jumped 50% to Rs 3,074.61 crore in Q2FY23 as against Rs 2,054.34 crore in Q2FY22. The consolidated net profit surged more than five-fold to Rs 29.42 crore in Q2FY23 from Rs 5.09 crore in Q2FY22. Ebitda rose 27% YoY to Rs 396.71 crore from Rs 315.53 crore in the year-ago period.

GAIL India: The state-owned company said its consolidated revenue from operations rose 78% YoY to Rs 38,728.86 crore in Q2FY23 from Rs 21,781.87 crore in the year-ago period. Its net profit fell about 55% to Rs 1,304.61 in Q2FY23 from Rs 2,872.62 in Q2FY22. Ebitda stood at Rs 1,903.79 crore in the quarter under review as against Rs 3,621.62 crore in the year-ago period.

Cipla: The pharma company said its consolidated revenue rose 6% to Rs 5,829 crore in Q2FY23 from Rs 5,520 crore in the same quarter last fiscal. Its consolidated net profit was up 11% YoY to Rs 789 crore in Q2FY23 from Rs 711 crore in Q2FY22. EBITDA increased 6% to Rs 1,302 crore in Q2FY23 from Rs 1,226 crore in Q2FY22.

GMM Pfaudler: The manufacturer said its consolidated revenue from operations jumped 20.5% to Rs 780.05 in Q2FY23 as agianst Rs 647.24 in Q2FY22. Its net profit soared 150% YoY to Rs 96.9 crore in Q2FY23 as against Rs 38.8 crore in the corresponding quarter last fiscal. Ebitda also surged 47% YoY to Rs 138.25 crore in the quarter under review.

Lupin: The pharma company said that the USFDA has issued a warning letter for its Tarapur plant after it inspected the plant between March 22 and April 4. The company added that the warning letter will not have an impact on supplies and revenue. It further said that it will work with the FDA to resolve the issues.

JMC Projects: The engineering firm said it has bagged new orders worth Rs 2,277 crore. The orders include water projects in India worth Rs 1,497 crore, and B&F (building and factories) projects in the country worth Rs 780 crore.

Gillette India: The company reported 5.92% YoY rise in net profit to Rs 86.78 crore for the quarter ended September 2022 and revenue from operations rose 8.13% YoY to Rs 619.92 crore in the quarter ended Septemeber 2022. Revenue from grooming segment stood at Rs 489.40 crore, up 15.84% YoY, while revenue from oral care segment stood at Rs 130.52 crore, a decline of 13.47%.

Computer Age Management Services: The company said its consolidated net profit declined 0.58% to Rs 72.14 crore in the quarter ended September 2022 as against Rs 72.56 crore during the quarter ended September 2021. Revenue rose 6.49% to Rs 242.37 crore in the quarter ended September 2022 as against Rs 227.60 crore during the quarter ended September 2021.

TTK Prestige: The company’s consolidated net profit declined 19.01% to Rs 83.85 crore in the quarter ended September 2022 as against Rs 103.53 crore in the year-ago period. Revenue declined 1.89% to Rs 842.35 crore in the quarter ended September 2022 as against Rs 858.55 crore in the corresponding quarter last fiscal.

Indian Terrain Fashions: The company’s standalone net profit zoomed 341.84% to Rs 8.66 crore in the quarter ended September 2022 as against Rs 1.96 crore during the quarter ended September 2021. Revenue jumped 58.96% to Rs 154.38 crore in the quarter ended September 2022 from Rs 97.12 crore in the corresponding quarter last fiscal.

Indian Energy Exchange: The company said the total power trade volume dipped 13% YoY to 7,972 million units (MU) in October 2022. Th company achieved 7,972 MU volume in October 2022, including Green Power trade of 403 MU, and 3.58 lac RECs, according to its exchange filing. Improved supply of domestic coal led to easing of supply side constraints, resulting in decline in prices on the IEX, the company added. The average clearing price in the Day-ahead market was Rs 3.83 in October, which was lower by 32% on a monthy basis and a decline of 52% YoY.

Kalpataru Power Transmission: The company secured new orders worth Rs 1,290 crore. The contracts include an order in overseas market in the T&D business, an order for Oil & Gas Pipeline Works in India and an order for Railway works in India. Its total order intake year-to-date in FY23 is about Rs 6,890 crore, which reflects significant growth compared to similar period last financial year.