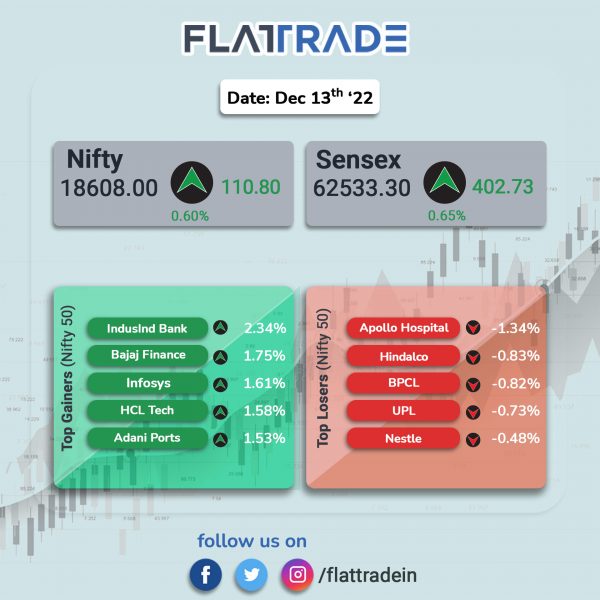

Indian markets ended positively, aided by gains in banking and IT stocks. Auto and pharma stocks also contributed to the rise. The Sensex rose 0.65% and the Nifty 50 index gained 0.60%.

In broader markets, Nifty Midcap 100 index advanced 0.54% and the BSE Smallcap rose 0.4%

Top gainers among Nifty sectoral indices were PSU Bank [3.81%], IT [1.12%], Private Bank[0.73%], Bank [0.54%] and Auto [0.44%]. Top losers were Realty [-0.8%] and FMCG [0.15%].

Indian rupee fell 27 paise to 82.81 against the US dollar.

Stock in News Today

Adani Enterprises: The company’s subsidiary, Adani Cement, has unveiled Geoclean, with renewed focus on offering sustainable and innovative waste management and replacement of traditional fuels with alternate fuels & raw materials (AFR). Geoclean targets to increase the Thermal Substitution Rate to 30% by 2027 for ACC and Ambuja Cements from 6% in the previous year. It offers sustainable and innovative waste management solutions to the agricultural, industrial, and public/municipal sectors.

Vedanta Group: The group has signed MoUs with 30 Japanese tech firms for development of the Indian semiconductor and glass display manufacturing ecosystem. The MoUs were inked at the Vedanta-Avanstrate Business Partners Summit 2022 held in Tokyo last week. A comprehensive manufacturing plan, with potential of generating business opportunities of over Rs 3.30 lakh crore for Vedanta’s partners, was launched at the conference.

Aditya Birla Capital: The company is considering selling its insurance brokerage unit as the group seeks to restructure its financial services business, Bloomberg reported citing people familiar with the matter. The company is in deal talks with potential buyers over the sale of Aditya Birla Insurance Brokers as it failed to scale up the 19-year-old business, the source said.

JSW Steel: The company announced that the its CDP (earlier known as Carbon Disclosure Project) rating has been upgraded to A (‘Leadership Level’) in 2022 from A- (‘Leadership Level’) in 2021. The company said that it has demonstrated focus on operational efficiency and environmental stewardship, across all its locations, and is committed to embed sustainability in its operations which has contributed positively to the present upgraded CDP score.

Tata Motors: The automaker will hike its commercial vehicle prices up to 2% from January 2023. The increase in prices are applicable across the entire range of commercial vehicles and it was attributed to steep rise in overall input costs.

Bandhan Bank: The bank said that it has received claim amount worth Rs 916.61 crore under the Credit Guarantee Fund for Micro Units (CGFMU) scheme for FY23. CGFMU is a Trust Fund set up by Government of India and managed by National Credit Guarantee Trustee Company (NCGTC) as a Trustee.

NTPC: The company announced that it has started the commercial operation of 150 MW & 90 MW Devikot Solar PV Projects at Jaisalmer, Rajasthan, with effect from December 13, 2022. With this, the standalone installed and commercial capacity of NTPC has become 58,041 MW, while group installed and commercial capacity of NTPC has become 70,656 MW.

Fusion Micro Finance: The company said that the credit rating agency ICRA has upgraded its rating on the non-convertible debentures and subordinate debt of the company to “[ICRA] A (Stable)” from “[ICRA] A- (Stable)”. The credit rating agency said that the rating revision was on the back of the company’s increased scale of operations, improvement in its profitability indicators, rise in yields and reduction in its credit costs in the first half of FY23. In addition, the rating agency has also taken into account the improvement in the company’s capitalisation profile after the recent fundraising through its initial public offer (IPO).

Kama Holdings: The company announced that its board has approved share buyback worth Rs 50.02 crore at a price not exceeding Rs 14,500 apiece through the tender offer route, on a proportionate basis. The company will buyback up to 34,500 equity shares, representing about 0.53% of the existing paid-up equity share capital of the company.

Kothari Sugars and Chemicals: The company said that its Kattur Sugar Unit in Tamil Nadu has commenced its sugarcane crushing operations for the sugar season 2022 – 2023. The company is an integrated sugar company with units at Kattur and Sathamangalam in Tamil Nadu. The company has a combined capacity of 6,400 TCD. It also has a distillery capacity of 60 KLPD and a total power co-generation capacity of 33 MW.