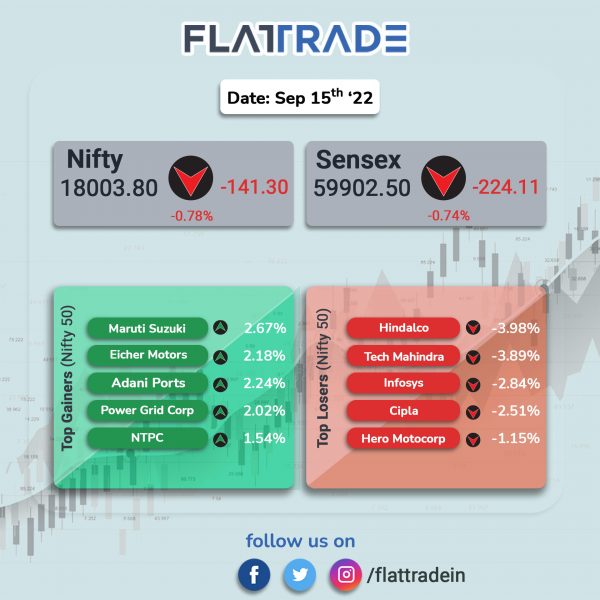

Benchmark indices lost ground and ended lower, weighed by losses in IT, pharma and realty stocks. The Sensex fell 0.68% and the Nifty 50 index was down 0.70%.

The Nifty MidCap 100 index rose 0.38% and the BSE SmallCap closed 0.06% higher.

Top Nifty sectoral index losers were IT [-1.43%], Pharma [-1.29%], Realty [-0.91%], Private Bank [-0.62%] and Financial Services [-0.48%]. Top gainers were Energy [0.78%] and Auto [0.71%]

The Indian rupee depreciated 26 paise to 79.70 against the US dollar on Thursday.

Stock in News Today

Maruti Suzuki: Shares of the company rose after global investment firm Bank of America Securities revised the target price of the company’s share to Rs 10,500 apiece from Rs 9500 earlier. The global brokerage firm in its report said that Maruti Suzuki is set to make a solid comeback on the back of promising new launches.

“Maruti’s new models can do well, backed by good design/ feature-rich models, strong brand salience & solid marketing machinery. The company can regain 5-6% market share over next 2 years with its 4 model launches, thereby driving volume CAGR of 14% over FY22-25E,” the BofA report noted.

YES Bank: The private lender will sell its bad loans worth Rs 48,000 crore to an asset reconstruction company (ARC) floated by JC Flowers. According to a report in Mint, YES Bank will also pick up a 20% stake in the ARC. JC Flowers ARC It is expected to pay Rs 1,677 crore to the bank in the next 60 days, the Mint report added. After this, the bank will have near-zero non-performing assets (NPAs), Mint reported citing sources.

Larsen & Toubro (L&T): The company’s construction arm, L&T Construction, has secured a repeat order from the Department of Water Resources, Government of Odisha, to execute a Pressurized Underground Pipeline Irrigation Network System for the Right Command of Lower Suktel Irrigation Project. According to the company’s project classification, the value of the order ranges between Rs 1000 crore to Rs 2500 crore.

The project scope involves survey, design, engineering, supply,laying, installation & commissioning of pumping main & distribution network with all allied electromechanical & automation works.

CEAT: Shares of the company zoomed 20% on healthy business outlook. In its annual report, the company said that export sales are likely to improve and the company will continue to strengthen its leadership position in two-wheeler segment. The company also plans to gain more market share in Passenger Car Radial tyres (PCR) and Truck and Bus Radial (TBR).

Besides, brokerage firm Motilal Oswal has given a buy call for the tyre company stock with a target price of Rs. 1,630 apiece. The brokerage house expects healthy demand and commodity deflation to drive recovery from H2FY23.

Veranda Learning Solutions: The company’s board has approved fund raising plans of Rs 300 crore through a mix of preferential issue of equity shares and convertible warrants. Promoters of the company will infuse Rs ₹61.40 crore into the company by subscribing to convertible warrants. The preferential offer and convertible warrants will have an issue price of Rs 307 per equity share. Each warrant is convertible into 1 equity share and the conversion can be exercised at any time within a period of 18 months from the date of allotment.

Astral: The company’s board has approved to purchase additional 15% equity shares of Seal IT Services, th eUK-based subsidiary of the company, from existing shareholder at a consideration of GBP 5.25 million (~INR 48 crore). The company has also executed Share Purchase Agreement for the said purchase of additional shares. With this acquisition, the total equity stake of the Company in Seal IT Services will increse to 95% from 80%.

Bharat Electronics: The company’s record date for the bonus issue of its equity shares that it had recommended in the ratio of 2:1 will be on Friday (September 16). The stock thus will start trading ex-bonus today, a day ahead of the record date.

Tamilnad Mercantile Bank: Shares of the bank had a tepid stock market debut with the stock listing at Rs 495 apiece on the NSE, a discount of more than 3% as compared to its IPO issue price of Rs 510 per share. The shares touched a high of Rs 515 apiece and closed at Rs 509.65 per share.