Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.26% higher at 18,017, signalling that Dalal Street was headed for a positive start on Thursday.

Most Asian shares rose in early trade, tracking the US markets overnight. Japan’s Nikei 225 index rose 0.38% and Topix gained 0.28%. China’s Hang Seng was 0.39% higher, while CSI 300 index lost 0.27%.

The Indian rupee fell 29 paise to 79.44 against the US dollar on Wednesday.

Tamilnad Mercantile Bank will make its stock market debut today (September 15). The final issue price has been fixed at Rs 525 per share.

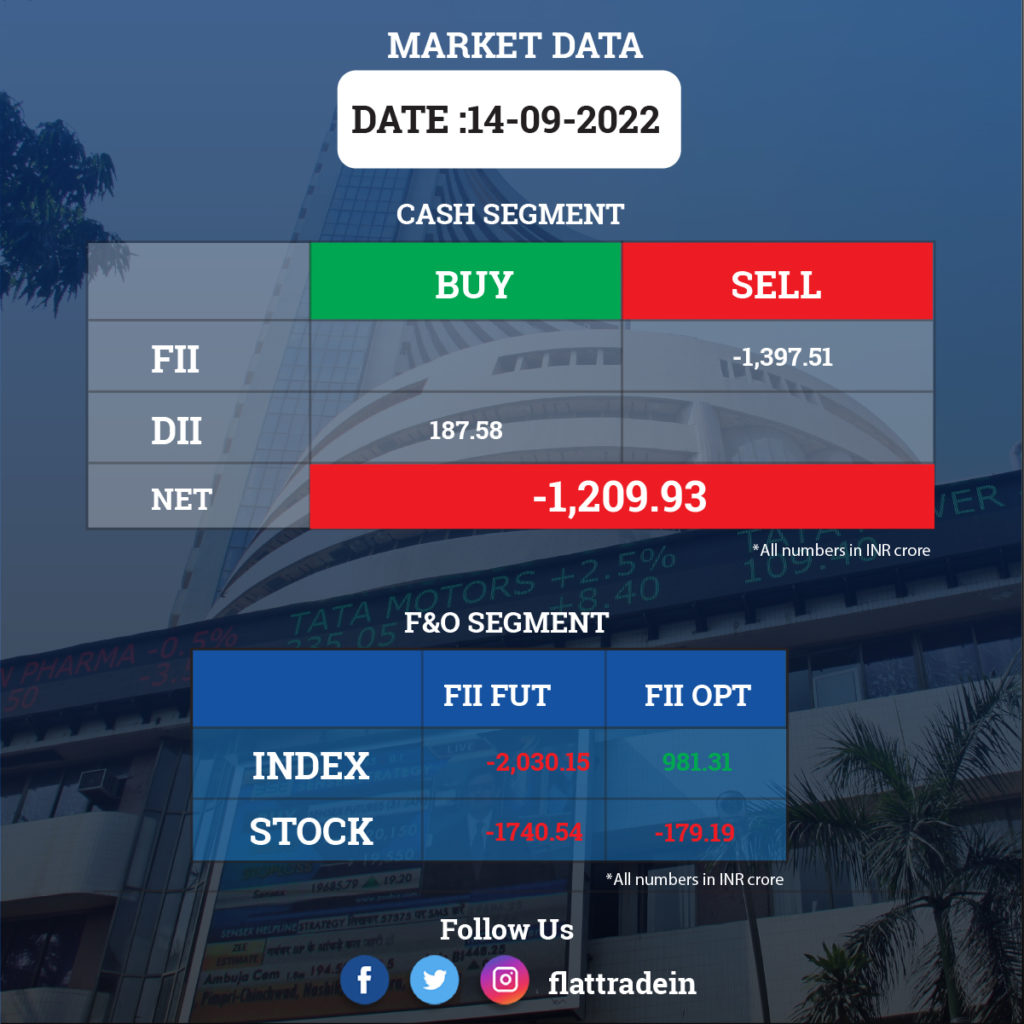

FII/DII Trading Data

Stocks in News Today

Vedanta Ltd: In a series of tweets late on Wednesday, the company’s chaiman, Anil Agarwal, said that the investments in semiconductor and display glass production would create an ecosystem of industries across the country. He tweeted, “We are committed to investing in Maharashtra. We will soon create a hub where Maharashtra will be part of our forward integration.”

In other news, the company has emerged as the highest bidder for two coal mines in Odisha on the second day of commercial coal mines auction. Both the coal mines are fully explored and have Peak Rate Capacity (PRC) of 20 million tonnes per annum.

Tata Steel: The Tata Group company said that the board of directors has approved the fund raising plan through the issue of non-convertible debentures up to Rs 2,000 crore in two series. In the first series, they will raise Rs 500 crore and in the second series, the fund raising via NCDs would be Rs 1,500 crore.

Tata Power and Tata Motors: Tata Power said that it has signed a Power Purchase Agreement (PPA) with Tata Motors to develop a 4-MWp solar project at Tata Motors’ Pune plant. The installation is collectively expected to generate 5.8 million units of electricity, potentially mitigating over 10 lakh tonnes of carbon emission. This is equivalent to planting over 16 lakh teak trees over a lifetime, it stated.

Tata Consultancy Services (TCS): The IT company has become India’s most-valuable brand in 2022 replacing HDFC Bank, which held the number one spot since 2014, according to Kantar BrandZ report on India’s most-valuable brands. TCS was able to take the top position on the back of rising global demand for automation and digital transformation, following the pandemic.

Adani Wilmar Ltd: The company is searching for local and overseas acquisition targets as Gautam Adani doubles down on boosting his empire’s food operations weeks after Reliance Industries announced plans to launch a consumer goods business, Bloomberg reported. “We are looking at acquiring brands in staple foods and distribution companies to boost our consumer goods offering and reach,” Angshu Mallick, chief executive officer and managing director at Adani Wilmar, said in an interview. “We are expecting to conclude a couple of acquisitions by March,” he added. The company has earmarked 5 billion rupees ($62.9 million) from its initial public offering for purchases, Mallick said.

Balaji Amines: The company said the Phase 1 of 90-acre greenfield project (Unit IV) has been completed. The di-methyl carbonate, propylene carbonate, and propylene glycol plant will be ready to start commercial production by the end of September 2022. In addition, it has also started construction of phase 2 of greenfield project (Unit IV) for 2 plants. The company already has environmental clearance for the said expansion.

KPI Green Energy: KPI Green Energy said that it has inked a power purchase agreements to supply a total of 15.88 MW wind-solar hybrid power from its projects to six companies. The companies will be supplied power from the upcoming Wind-Solar Hybrid power project, which comprises of 16.10MW wind and 10 MW solar capacity, at Bhungar site in Bhavnagar district of Gujarat.

In a separate filing, the company said it has received new order of 4.20 MW under wind-solar hybrid power project. The order is from Nouveau Jewellery, Surat under ‘captive power producer (CPP)’ business segment.

G R Infraprojects: Promoters of the company will be selling up to 57,04,652 equity shares or 5.9% stake in the company via offer for sale (OFS) on September 15 and September 16. In addition, they have also planned to sell additional 8,70,202 shares in an oversubscription option. The floor price has been fixed at Rs 1,260 per share, a discount of 9.3% on Wednesday’s closing price. The OFS will open on September 15 for non-retail investors and September 16 for retail investors.

HFCL: The company has received the advance purchase orders worth Rs 447.81 crore, consisting of Rs 341.26 crore from Bharat Sanchar Nigam (BSNL), and Rs 106.55 crore from RailTel Corporation of India.

Glaxosmithkline Pharmaceuticals: Life Insurance Corporation of India has offloaded 34.63 lakh equity shares or 2.04% stake in the company via open market transactions. With this, LIC’s shareholding in the company reduced to 4.35%, down from 6.4% earlier.

PVR: Investors Gray Birch, Plenty PE & Multiples PE may sell up to 7.74 per cent stake in the company today in a price range of Rs 1,852-1,929 per equity share, according to a report by CNBC TV-18.

C.E. Info Systems: The board has approved acquisition of 26.37% stake on a fully diluted basis of Kogo Tech Labs for Rs 10.00 crore, with an option to raise the stake to 50% within 2 years.

HFCL: The company has received advance purchase order of Rs 341.26 crore from Bharat Sanchar Nigam Ltd. and of Rs.106.55 crore from RailTel Corporation of India Ltd