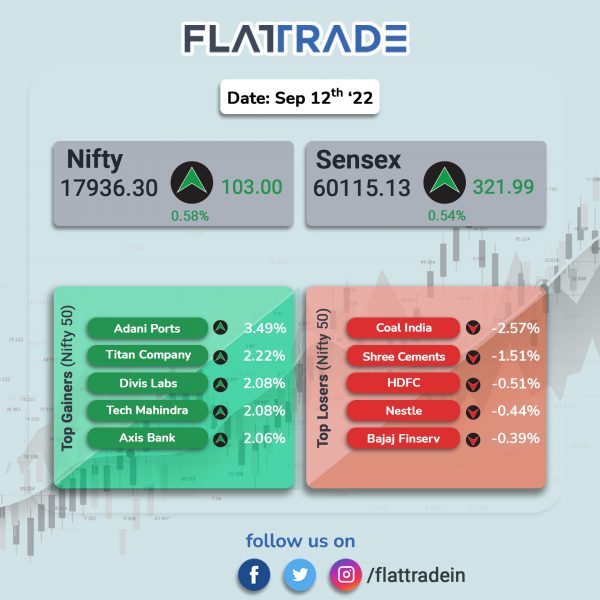

Benchmark equity indices extended gains on Monday led by a surge in IT, realty and public sector bank stocks. The Sensex closed 0.54% higher and the Nifty 50 index rose 0.58%.

Broader markets outperformed headline indices. The Nifty MidCap 100 index gained 0.97% and BSE SmallCap edged up 1%.

Top Nifty sectoral index gainers were Realty [2.2%], Media [1.98%], IT [1.42%], PSU Bank [1.22%] and Metal [0.92%]. All Nifty sectoral indices closed in the positive territory.

The Indian rupee appreciated 6 paise to 79.52 against the US dollar on Monday.

Stock in News Today

Hindustan Aeronautics (HAL): Shares of the company surged 7.40% after Antique Stock Broking initiated coverage of the stock with a ‘buy’ recommendation, according to Bloomberg news. The target price is set at Rs 3,140. The brokerage cited that the company’s large order book, India’s quest to modernize armed forces and procurement of domestic defence products as positives. The broking firm also expects success in procuring orders from friendly countries to boost growth outlook.

DB Realty and Adani Group: Adani Realty is in advanced talks with Mumbai-based DB Realty for a potential merger deal, The Hindu BusinessLine reported citing sources. After the merger, the combined entity would be renamed to Adani Realty, the report added. Adani may pump in capital into DB Realty, according to the report. Shares of DB Realty rose 4.98% per equity share.

Tata Consultancy Services (TCS): The IT major in an exchange filing said that it has successfully completed the first phase of the cloud transformation for Penumbra, a US-based healthcare company. TCS has upgraded its order management, finance and procurement functions with a new digital core. It has also integrated internal and external data sources to enable real-time insights for better decision making.

Nazara Technologies: Shares of the gaming software company jumped 4.77% after tech giant Google said it plans to run a pilot to permit daily fantasy apps, rummy games in Play Store in India. The one-year pilot will start from September 28 with India-incorporated firms requiring to submit an application form.

Oil Marketing Companies: Shares of fuel retailers edged up after Bloomberg reported that government is planning to pay about Rs 20,000 crore to oil companies toward LPG losses.

JSW Steel: The company said that its standalone crude steel production in August 2022 stood at 16.76 lakh tonnes, a growth of 22% YoY on standalone basis. The company’s crude steel production was 13.77 lakh tones in the same period last year. The production of flat rolled product increased by 34% to 12.01 lakh tones, the production of long rolled product rose 25% YoY to 3.75 lakh tones in August 2022.

Ramkrishna Forgings: Shares of the company gained 2.24% after the company announced that its board approved a fund raise of Rs 94.3 crore through preferential issue of 46 lakh warrants convertible to equivalent equity share of Rs 2 each at Rs 205 per warrant to promoters/non-promoters. The company will get Rs 23.6 crore upon allotemen of these warrants, in 2022. The balance Rs 70.7 crore will be received within 18 months from date of allotment of warrants.

PVR and Inox Leisure: Shares of both the companies rose between 3.5% and 5% after the PVR’s CEO clarified that PVR Cinemas gained over Rs 8 crore net box office from first day of the new Hindi movie Bramhastra. The CEO also said that the ticket revenue is likely to be encouraging, adding, PVR is likely to gain with several movies due to be released over the next three months.

Zydus Lifesciences: The company’s US subsidiary, Zydus Pharma, secured final approval from the USFDA to market Cariprazine Capsules, USP 1.5 mg, 3 mg, 4.5 mg and 6 mg. The drug is indicated for the treatment of schizophrenia and acute treatment of manic or mixed episodes associated with bipolar I disorder. The capsules had an annual sales of $2.39 billion in the U.S., according to IQVIA data in the 12 months ended July 2022.

Ajanta Pharma: Shares of the company fell after the US drug regulator issued Form 483 with two procedural observations post inspection of the drug maker’s Dahej facility. The USFDA inspected the unit from September 5 to September 9.

Engineers India: The company in an exchange filing said that ONGC has entrusted the project for Restoration of Gas Terminal, Phase-I (Part-A) at ONGC, Hazira Plant, to Engineers India. The project is expected to be executed on EPC reimbursable basis and the total order value is estimated at Rs 249 crore. The project is expected to be completed within 33 months.

Computer Age Management Services (CAMS): Shares of the company rose 4.7% after brokerage firm Motilal Oswal initiated coverage of the stock with a ‘buy’ recommendation and set a target price of Rs 3,000 apiece. The brokerage firm cited addition of new customers, rising market share and potential for the company to grow at 15% CAGR with respect to AUM in the next decade.

Cigniti Technologies: The company has strengthened its partnership with a leading American retailer by ensuring superior digital experience to their customers and by accelerating their digital ambitions. The Fortune 500 American retailer and Cigniti recently celebrated their 1st anniversary of the partnership, and they see tremendous scope for growth via digitalization that will assure the retailer’s business outcomes at an accelerated pace.

Sunteck Realty: The company has entered into a joint development agreement with JLL, a firm specializing in real estate and investment management, to undertake a 25 lakh square feet project on a 7.25 acre land parcel in Mira Road near Mumbai. The project is estimated to have a total revenue potential of around Rs 3,000 crore.