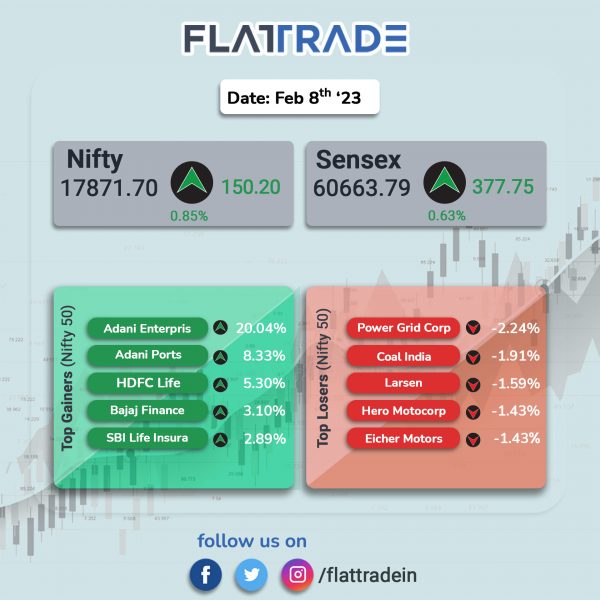

Indian stock market ended positively as RBI settled for a smaller 25 bps repo rate hike, in line with expectations, as well as gains in IT, Metals, and Adani group stocks. Most Adani Group firms rose in today’s session with Adani Enterprises jumping 23% and Adani Wilmar hitting the upper circuit. The S&P BSE Sensex rose 0.63%, while the Nifty50 index climbed 0.85%.

In broader markets, Nifty Midcap 100 index gained 0.91% and the BSE Smallcap was up 0.76%.

Top gainers were Metal [3.78%], IT [1.53%], Pharma [1.36%], Energy [0.77%] and Oil & Gas [0.63%]. All indices closed in the green.

RBI raised repo rate by 25 basis points to 6.5%. The central bank increased the FY23 GDP growth estimate to 7% from 6.8% and expects the retail inflation to be at 5.6% in Q4.

Indian rupee ended at 82.49/$ against Tuesday’s close of 82.70/$.

Stock in News Today

Adani Wilmar: The company said its net profit was up 16.5% at Rs 246.2 crore in Q3FY23 as against Rs 211.4 crore in Q3FY22. Its revenue was up 7.4% at Rs 15,438.1 crore as against Rs 14,370.9 crore. Its EBITDA was up 20.2% YoY at Rs 605.3 crore as against Rs 503.6 crore in the year-ago period. Its margin stood at 3.9% in the reported quarter as against 3.5% in the year-ago period.

Tata Consultancy Services (TCS): The company has announced an expansion of its long-standing partnership with Phoenix Group, UK’s largest long-term savings and retirement provider, through a contract valued at over £600 million. As part of the deal, TCS will digitally transform Phoenix’s ReAssure business, including its administration services, using the BaNCS-based platform. Under the agreement, TCS’s Diligenta will manage customer administration and servicing of ReAssure’s 3 million policies. Diligenta is TCS’s regulated subsidiary in the UK on behalf of the Phoenix Group.

Shree Cement: The company’s consolidated net profit tumbled 44% to Rs 276.77 crore in Q3FY23 as against Rs 491.99 crore posted in Q3FY22. Revenue from operations rose by 15% YoY to Rs 4,068.79 crore in the quarter ended December 2022. Total expenses increased 26.78% YoY to Rs 3,845.82 crore in Q3FY23. Its EBITDA fell 7% YoY to Rs 869 crore in Q3FY23 compared to Rs 936 crore in the same quarter of the previous year. The company’s board declared an interim dividend of Rs 45 per share for the year 2022-23.

Graphite India: The company’s net profit was down 59.8% to Rs 53 crore in Q3FY23 as against Rs 132 crore in Q3FY22. Revenue fell 20% YoY to Rs 701 crore in Q3FY23 as against Rs 880 crore Q3FY22. EBITDA tumbled 47.4% to Rs 72 crore in the reported quarter as against Rs 137 crore in the year-ago period.

NHPC: The state-owned hydro power giant has posted a 12.59% decline in its consolidated net profit to Rs 775.99 crore for the December 2022 quarter due to higher expenses. The consolidated net profit of the company was Rs 887.76 crore in the quarter ended December 2021. Its total income rose to Rs 2,691.34 crore in the quarter from Rs 2,373.72 crore a year ago. The board of the company announced an interim dividend of Rs 1.40 per equity share on the face value of paid-up equity shares of Rs 10 each for the financial year 2022-23.

Paytm: The company said that it has reached 89 million average monthly transacting users (MTU) for the month of January, a 29% YoY increase. The company continues to dominate the offline payments market with 6.1 million merchants now paying subscriptions for payment devices, an increase of 0.3 million in January. Paytm said it has seen a consistent growth in merchant payments volume with the total gross merchandise value (GMV) processed through the Paytm platform grew 44% YoY aggregating to Rs 1.2 lakh crore ($15 billion) in January. Paytm’s loan distribution business continues to witness an accelerated growth with disbursements through the platform growing 327% YoY to Rs 3,928 crore ($480 million).

Samvardhana Motherson: The company said its net profit surged 85.2% to Rs 453.9 crore in Q3FY23 as against Rs 245.1 crore in Q3FY22. Revenue rose 25.5% to Rs 20,226 crore in Q3FY23 as against Rs 16,117.5 crore in Q3FY22. EBITDA was up 46.2% to Rs 1,575.4 crore in Q3FY23 as against Rs 1,077.3 crore in Q3FY22.

Escorts Kubota: The company’s net profit fell 6.9 % to Rs 180 crore in Q3FY23 as against Rs 194.2 crore in Q3FY22. Revenue was up 14.7% to Rs 2,291 crore in the reported quarter as against Rs 1,998.3 crore in the year-ago quarter. EBITDA slumped 31.3 % to Rs 191.3 crore in the quarter under review as against Rs 278.5cr in the corresponding quarter last fical.

3M India: The company’s net profit fell 87.1% to Rs 124.8 crore in the quarter ended December 2022 as against Rs 67 crore in the quarter ended December 2021. Its revenue rose 20. 2% to Rs 993 crore in the quarter under review as against Rs 826.3 crore in the year-ago period. EBITDA jumped 78.6% YoY to Rs 170.6 crore in the reported quarter as against Rs 95.5 crore in the year-ago period.

TD Power: The company posted a net profit of Rs 20.1 crore in Q3FY23, up 3.1% from Rs 19.5 crore in Q3FY22. The company’s revenue rose 14.2% to Rs 205.3 crore in Q3FY23 from Rs 179.8 crore in Q3FY22. EBITDA was up 53.9% YoY to Rs 33.4 crore in the reported quarter as against Rs 21.7 crore in the year-ago period.

Symphony: The company net profit was up 85.7% at Rs 39 crore in Q3FY23 as against Rs 21 crore in Q3FY22. Revenue rose 35.1% to Rs 277 crore in Q3FY23 as against Rs 205 crore in q3FY22. EBITDA was up 46.7% to Rs 44 crore in Q3FY23 as against Rs 30 crore in Q3FY22.

Rane Madras: The Chennai-based automotive ancillary company said its net profit stood at Rs 23.7 crore in Q3FY23 as against a net loss of Rs 4.3 crore in Q3FY22. Its revenue up was 33.2% YoY to Rs 583.2 crore in Q3FY23 as against Rs 438 crore in Q3FY22. EBITDA stood at Rs 42.8 in the reported quarter as against Rs 12.3 crore in theyear-ago period.

Dreamfolks Services: The company’s net profit stood at Rs 18.9 crore in Q3FY23 as against Rs 6.2 crore in Q3FY22. Revenue stood at Rs 204 crore in Q3FY23 as against Rs 98.3 crore in Q3FY22. EBITDA rose to Rs 26.1 crore in Q3FY23 from Rs 8.5 crore in Q3FY22.

Uno Minda: The company’s net profit jumped 60% to Rs 162 crore in Q3FY23 from Rs 101.3 crore in Q3FY22. Revenue was up 33.7% YoY at Rs 2,915.5 crore as against Rs 2,181.4 crore in the year-ago period. EBITDA rose 43.2% to Rs 338.5 crore in the quarter under review as against Rs 236.4 crore in the year-ago period.

Patel Engineering: The company said its net profit was up 13.5% at Rs 31.2 crore in Q3FY23 from Rs 27.5 crore in Q3FY22. Revenue rose 18.1% YoY to Rs 1,037 crore in Q3FY23 from Rs 877.9 crore in Q3FY22. EBITDA grew 11.8% to Rs 163.7 crore in the reported quarter from Rs 146.4 crore in the year-ago period.