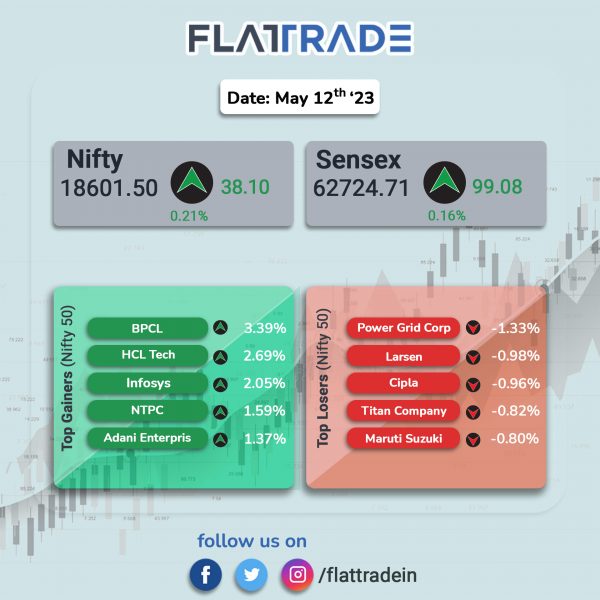

Dalal Street ended higher as technology-related stock gained and investors awaited key macroeconomic data, April’s IIP (Index of Industrial Production) and May’s CPI (Consumer Price Index), scheduled later today. The Sensex rose 0.16% and the Nifty gained 0.21%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index advanced 0.55% and the BSE Smallcap index climbed 0.72%.

Top gainers were IT [1.51%], Realty [1.41%], Media [1.13%], Oil & Gas [0.85%], and Metal [0.61%]. Top losers were Bank [-0.1%], Financial Services [-0.06%], Pharma [-0.04%], Private Bank [-0.03%].

Indian rupee strengthened by 4 paise to 82.43 against the US dollar on Monday.

Stock in News Today

InterGlobe Aviation (IndiGo): Shares of the company closed 2.1% lower amid reports that promoters Rakesh Gangwal and Shobha Gangwal may further trim their stake in the low cost airline. According to multiple reports, Rakesh and his wife Shobha Gangwal may sell 5-8% stake in the airline next month for up to Rs 7,000-7,500 crore.

Vedanta: The mining company said that it has been declared as the preferred bidder for iron ore mine (Block VII – Cudnem Mineral Block) by the Department of Mines & Geology, Goa, in electronic auction of iron ore mine.

Coforge: The company said that it has partnered with FundMore to develop a platform designed to automate quality control, risk management and regulatory compliance in the mortgage industry. “Lenders and insurers will have greater transparency into risks at a loan level, empowering them to make more informed decisions going forward” said Maddee Hegde, EVP and Head – Coforge BPS.

Titagarh Wagons: The company announced that its board has approved the proposal to raise Rs 288.8 crore via preferential allotment of shares to Smallcap World Fund Inc. The company plans to raise funds through the issuance of up to 76 lakh equity shares of Rs 2 each on a preferential basis at a price of Rs 380 per share as against a floor price of Rs 347.68 per share, subject to regulatory and shareholders’ approval.

Zen Technologies: The aerospace and defence company announced that it has bagged an order from the Ministry of Defence (MoD), Government of India, worth Rs 202 crore. The order is related to supply of training equipment, said the company. Zen Tech stated that training equipment stood at approximately Rs 171 crore and it has to be supplied within 12 months along with a warranty for 4 years. Post-warranty, comprehensive maintenance contract (CMC) of about Rs 31 crore will be spread over 4 years, it added.

Avantel: The company said that it has secured a contract worth of Rs 54.38 crore from the Ministry of Defence, Coast Guard Headquarters, New Delhi. The contract is for supplying SATCOM terminals and hub stations and the order is to be executed by September 2024. Shares of the company jumped 10.25% in intraday trade.

Sakthi Sugars: The company announced that its board approved the re-appointment of Dr.M.Manickam as managing director (MD) with effect from June 12, 2023 for a period of five years without remuneration. The re-appointment is subject to the approval of the members of the company. Further, the board has appointed of V.K.Swaminathan as additional director on the board of directors of the company.

Som Distilleries & Breweries: The company announced that its flagship beer brand ‘Hunter’ has emerged as the number one selling brand of strong beer in Delhi for the month of May 2023. Earlier this month, the company had announced that that it had achieved a market share of 42% in May 2023 in the beer industry of Madhya Pradesh (MP). Shares of the company rose over 4% in intraday trade on Monday.

MIC Electronics: The company has received work order from Nagpur Railway Division for Rs 8.37 crore. Under the contract, the company has will supply, installation, testing, commissioning of telecom assets/passenger amenities at 7 stations of Nagpur division under Amrit Bharath Scheme. The order will be executed within 9 months from the date of issue of letter of acceptance. Shares of the company rose 4.8% in intraday trade.

Lloyds Steels Industries: The company, in an exchange filing, said that its board will meet on June 14, 2023 to consider the proposal for raising of funds. The funds are likely to be raised via issuance of equity shares or convertible bonds or debentures or any other securities, through permissible modes.

Maharashtra Seamless: The company announced that it has made voluntary prepayment of outstanding long term loan of approximately Rs 234 crore. In view of its high order book and strong liquidity position, the company went ahead with this prepayment entirely from its internal accruals to become completely debt free, said the company. Shares of the company rose over 5% in intraday trade on Monday.

SEPC: The Chennai-based company announced the completion of the Integrated Al Qibla Project in Basra, Iraq, for $236 million. The project involved engineering, supply, installation of primary sanitary sewer system, storm sewer system, trunk sewer system with connected pumping station and road works. “This will enable SEPC to participate in International tenders of Contracts value up to $500 million and also open up new markets in GCC countries and others,” the company said in a statement. Shares of the company jumped 4.55% on Monday.

J.B.Chemicals & Pharmaceuticals: The company said that its formulations manufacturing facility- T20 located at Panoli, Gujarat, was inspected by the United States Food and Drug Administration (USFDA). The inspection was conducted by the USFDA from June 5 to June 9, 2023. After the inspection, the facility received ‘No Observations’ and thus, No Form 483 was issued.

Gujarat Pipavav Port: The operations at Pipavav Port have been suspended since Saturday, 10 June 2023, as a result of intensifying Cyclone Biparjoy. The firm said that it will keep the exchanges updated once the prevailing weather conditions have improved and the Port gets back to normal operations.

Caplin Point Labs: The company’s wholly owned subsidiary, Caplin Steriles, has been granted final approval from the US Food and Drug Administration (USFDA) for its ANDA Cisatracurium Besylate Injection. The injection’s USP is a nondepolarizing skeletal neuromuscular blocker, indicated as an adjunct to general anesthesia to facilitate tracheal intubation and to provide skeletal muscle relaxation during surgical procedures. According to IQVIA (IMS Health), Cisatracurium Besylate Injection USP had US sales of approximately $35 million for the 12 month period ending December 2022.

Ambalal Sarabhai Enterprises: Shares of the company hit an upper limit of 20% at Rs 27.64 after the company said its subsidiary, Asence Pharma, commenced its new oncology and synthetic API plant at Ranoli, Vadodara in Gujarat. “The new API plant is set up to meet all domestic and international regulatory standards and will manufacture niche molecules that have a global requirement,” Ambalal Sarabhai Enterprises said in a statement.

Urja Global: The company has entered into an agreement with Tesla Power India to manufacture and supply batteries under Tesla Power USA brand, the company said in an exchange filing. Shares of Urja Global hit an upper circuit of 20%.