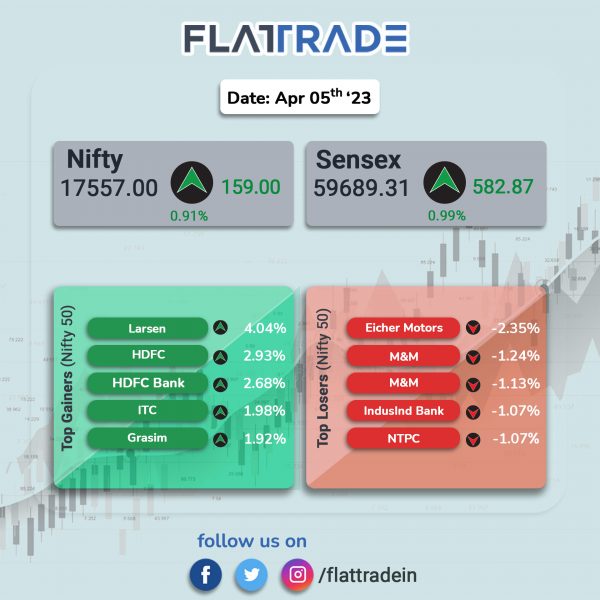

Dalal Street ended higher ahead of RBI’s monetary policy decision on Thursday, led by gains in FMCG, IT and financial services stocks. The Sensex jumped 0.99% and the Nifty index rose 0.91%.

In broader market, the BSE Smallcap index advanced 0.95%, while the NSE Midcap index slipped 0.02%.

Top gainers were FMCG [1.36%], IT [1.2%], Financial Services [1.14%], Pharma [0.94%] and Media [0.67%]. Top losers were PSU Bank [-0.79%], Auto [-0.55%] and Energy [-0.43%].

Indian rupee gained 33 paise to 82 against the US dollar on Wednesday.

The S&P Global India Services Purchasing Managers’ Index fell to 57.8 in march 2023 from 59.4 in February. A reading of more than 50 indicated that the services sector has witnessed growth for a 20th consecutive month.

Stock in News Today

Larsen & Toubro (L&T): The company announced that its hydrocarbon business, L&T Energy Hydrocarbon (LTEH), has secured mega orders from a client in the Middle East. As per L&T classification, the value of the orders is more than Rs 7,000 crore. The scope of work comprises engineering, procurement, construction & installation for various new offshore facilities and integration with existing installations.

Coal India Ltd (CIL): The company plans to supply 610 million tonnes of coal to power sector in FY24 to meet the demand of coal fired plants in 2023-24. This is 4% higher than the record 586.6 MT that company supplied in FY23. Its apportioned quantity accounts for a little over 74% of the estimated coal requirement of domestic coal based plants during the year, which is 821 MT.

HDFC: During the quarter ended March 31, 2023, the company disbursed individual loans amounting to Rs 9,340 crore compared to Rs 8,367 crore in the corresponding quarter of the previous year. Individual loans sold in the preceding 12 months amounted to Rs 36,910 crore compared to Rs 28,455 crore in the previous year.

Tata Motors: The automaker has announced its partnership with Inchcape plc as their distributor for their commercial vehicles in Thailand. With this partnership, Tata Motors will commence the sales and service of its commercial vehicles (CVs) across Thailand. Inchcape is the leading global automotive distributor, with operations across six continents.

One 97 Communication (Paytm): The value of loans disbursed jumped 63% YoY to 4.1 million as on 31st March 2023. The number of loans disbursed through the company’s platform zoomed 253% YoY to Rs 12,544 crore in the quarter. The number of merchants paying subscription for payment devices has reached 6.8 million, an increase of 1 million in the quarter. Merchant payment volumes (GMV) for the quarter stood at Rs 3.62 lakh crore, a rise of 40% YoY.

YES Bank: The private sector lender said its advances rose 11.3% YoY to Rs 201,523 crore in Q4FY23. Gross retail disbursements rose to Rs 12,847 crore in Q4FY23 as against Rs 10,201 crore in the year-ago period. The private bank’s deposits increased by 10.6% YoY to Rs 218,018 crore. CASA stood at Rs 67,419 crore as on 31 March 2023, up 9.09% YoY. Credit to Deposit ratio was at 92.4% as on 31 March 2023 as against 91.8% as on 31 March 2022.

Bajaj Auto: The two wheeler maker’s total sales declined 2% to 2,91,567 units in March 2023 compared with 2,97,188 units sold in March 2022. The domestic sales surged 47% to 1,86,522 units, while exports slumped 38% to 1,05,045 units in March 2023 over March 2022. The company’s total two-wheeler sales decreased 4% to 2,47,002 units in March 2023 compared with 2,56,324 units sold in March 2022. The commercial vehicles sales in March 2023 stood at 44,565 units, registering growth of 9% as against 40,864 units in March 2022. On full year basis, total sales declined 9% to 39,27,857 units in FY23 as against 43,08,433 units sold in FY22.

Grasim Industries: The company said that it has entered into three term loan agreements on 3 April 2023 to avail the rupee term loan facility aggregating to Rs 5,000 crore from Axis Bank in terms of the approval by the finance committee of the company. One secured term loan of Rs 4,850 crore will be used for capital expenditure to be incurred, reimbursement of capex that has already been incurred in the last 12 months, and repayment of existing borrowings, said the company. Further, two other unsecured term loans of Rs 70 crore and Rs 80 crore respectively, will be used for identified projects, it added. All of the aforesaid rupee term loans are for the period of 10 years.

Vedanta: The company’s unit Bharat Aluminium Company Ltd. (BALCO) will source 105 MW hybrid renewable power for its aluminium operations at Chhattisgarh. It will execute deal via affiliates of Serentica Renewables India Pvt. Ltd., a special purpose vehicle. The project will be funded on 70:30 debt to equity basis and BALCO will own 26% of equity in the SPV. The term of the agreement will be for a period of 25 years from date of commissioning.

Godrej Consumer Products: The FMCG company on Wednesday announced that in India, it expects to deliver double-digit volume and value growth in Q4FY23. Godrej Consumer stated that its domestic branded business growth was very strong registering volume and value growth in teens. Overall, the growth was broad based and led by double-digit volume and value growth in both Home Care and Personal Care.

Poonawalla Fincorp: The company’s standalone total disbursements zoomed 151% to about Rs 6,370 crore in Q4FY23 as against Rs 2,539 crore recorded in Q4FY22. ssets under management (AUM) stood at Rs 16,120 crore as of 31 March 2023, recording a growth of 37% YoY. The net non-performing assets (NNPA) is expected to further decline to 0.85%.

Som Distilleries and Breweries: The company said its wholly-owned subsidiary, Woodpecker Distilleries and Breweries, has started trial production of enhanced beer capacity in its Hassan plant in Karnataka. The company expects the commercial production to start within the next fortnight. With this increase in production capacity, the company expects to better serve their customers and meet the growing demand for their products.

Adani Ports and Special Economic Zone (APSEZ): The company said it has handled about 32 MMT of total cargo in March 2023, a growth of about 9.5% YoY. For the first time since July 2022, the company’s volumes crossed the 30-MMT mark. With 339 MMT in FY23, APSEZ has recorded its largest port cargo volumes ever, a 9% Y-o-Y growth. The overall container volumes handled by APSEZ in India jumped to 8.6 MTUs, up 5% YoY, including 6.6 MTEUs at Mundra alone. It continues to be India’s largest seaport with 155 MMT of total cargo handled during the year.

National Fertilizers (NFL): The company said that it had produced 39.35 lakh metric tons (MT) of urea during 2022-23 against 35.23 lakh MT of urea produced in the corresponding period last year, registering a growth of 11.7% YoY. The capacity utilization level during the period under review stood at 122%. On sales front, the company achieved total fertilizer sale of over 66.72 lakh MT (LMT).

Indian Energy Exchange (IEX): The company said that it has recorded 9,212 MU overall volume in March 2023, registering a decline of 4% YoY. Sequentially, the company’s total volume grew 12% month on month (MoM) in March 2023. The overall volume in March 2023 was including green market trade of 391 MU, 8.69 lac RECs (equivalent to 869 MU) and 22,881 ESCerts (equivalent to 23 MU). During Q4 FY23, IEX achieved 26,052 MU volume across all segments, growing 7% over the previous quarter. Cumulatively for the fiscal year 2023, IEX traded 96.8 BU, a de-growth of 5% YoY basis.

NITCO: The designer tiles manufacturer said that Anjanikumar Sharma, Chief Financial Officer, has tendered his resignation with immediate effect as a Chief Financial Officer and Key Managerial Personnel. Anjanikumar will remain available to the company during the transition period till 25 May 2023.

PNC Infratech: The company has received a letter of award (LoA) from National Highway Authority of India (NHAI) for three projects in Bihar, aggregating to Rs 3,264.43 crore. The project entails construction of six lane roads as per the agreement.

Urja Global: The company said it has inked a pact with Government of Uttar Pradesh for solar based charging stations & electric car manufacturing unit. Separately, the company announced that its board has decided to terminate the tenure of Gaurav Aggarwal from the position of chief executive officer (CEO) of the company with effect from 3 March 2023. Shares of the company surged 47.54% in the past four sessions.

AU Small Finance Bank: The company reported a 32% rise in total deposits at Rs 69,365 crore in the quarter ended 31 March 2023 from Rs 52,585 crore posted in the quarter ended 31 March 2022. CASA ratio stood at 38.4% in the quarter ended 31 March 2023 as against 37.3% in the quarter ended 31 March 2022. Gross advances rose by 26% to Rs 59,158 crore in the quarter ended 31 March 2023 from Rs 46,789 crore in the quarter ended 31 March 2022.

Ugro Capital: The company announced the launch of GRO X App, a credit line on UPI for MSMEs. The GRO X App will enable small business owners, retailers, traders, professionals, and small manufacturers across India to obtain collateral-free instant credit for immediate working capital requirements and to manage their financial liquidity. The company plans to acquire and service over 1 million MSME customers in the next 3 years on the GRO X platform.

Sonata Software: The company announced the appointment of Suresh HP as Chief Delivery Officer. In this role, Suresh will spearhead Sonata’s global delivery strategy, enablement and excellence across all verticals and businesses.