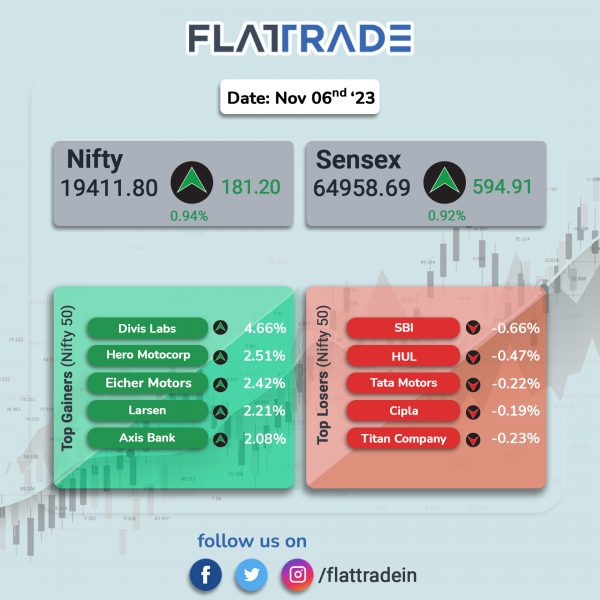

Dalal Street closed higher, helped by strong buying across sectors, as investors anticipate that the Fed has reached end of rate hike cycle. The Sensex rose 0.92% and the Nifty 50 index gained 0.94%.

In broader markets, the Nifty Midcap 100 jumped 0.88% and the BSE Smallcap advanced 1%.

Top gainers were Metal [1.36%], Oil & Gas [1.28%], Pharma [1.28%], Realty [1.2%], and Private Bank [0.97%]. Nifty PSU Bank [-1.09%] was the sole loser.

The Indian rupee rose 7 paise to 83.22 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The company said that the Buildings & Factories & Transportation Infrastructure businesses of L&T Construction have secured a project from the GMR Visakhapatnam International Airport Limited for Engineering, Procurement and Construction of the greenfield Bhogapuram International Airport at Bhogapuram, Andhra Pradesh. The project will initially be developed to handle 6 MPA (million passengers per annum) capacity to be further enhanced to a capacity to handle 12 MPA.

Bharat Forge: The company reported 29% YoY increase in its standalone net profit at Rs 345.9 crore in Q2FY24 compared with a net profit of Rs 268.1 crore in the corresponding quarter of last fiscal year. Its standalone revenue was at Rs 2,249.4 crore in Q2FY24, a rise of 20.7% from Rs 1,863.9 crore in the year-ago quarter. Ebitda during the quarter under review increased 34% to Rs 606.8 crore in Q2FY24 from Rs 453 crore in Q2FY23, while Ebitda margin improved to 27% in the reported quarter from 24.3% in the corresponding period last fiscal.

The company’s defence vertical, KSSL, bagged new orders worth Rs 1,100 crore taking the executable order book to Rs 3,000 crore, over the coming 24 months. The company’s board has approved the termination of the Global Depository Receipts program of the company. The company further said it will take necessary steps to terminate GDR program and its related aspects and consequently GDR will be delisted from Luxembourg Stock Exchange.

Varun Beverages: The company said its consolidated revenue from operations rose 21.2% to Rs 3,938 crore in Q2FY24 from Rs 3,248 crore in Q2FY23. Consolidated Ebitda was up 26.2% at Rs 882 crore in Q2FY24 as against Rs 699 crore in Q2FY23. Consolidated net profit jumped 30% to Rs 514 crore in Q2FY24 from Rs 395 crore in Q2FY23. The company intends to incorporate a subsidiary company in Mozambique to carry on the business of distribution of beverages.

Exide Industries: The company reported 17% rise in standalone net profit at Rs 287 crore in Q2FY24 and 10% increase in revenue from operations to Rs 4,107 crore in Q2FY24. Ebitda improved by 17% to Rs 483 crore in Q2FY24 from Rs 413 crore in Q2FY23. Ebitda margin stood at 11.8% in Q2FY24 as against 11.1% in the same period last year. The board has decided to further invest up to Rs 1100 crore, in one or more tranches, aggregating total equity investment up to Rs 3,000 crore in Exide Energy Solutions Limited. The investment will be utilized for setting up lithium-ion cell manufacturing plant in India

Divis Laboratories: The drugmaker said its consolidated net profit declined 29.41% to Rs 348 crore in Q2FY24 from Rs 493 crore reported in Q2FY23. Revenue from operations stood at Rs 1909 crore in Q2FY24, up 2.91% from Rs 1855 crore in the year-ago quarter. Total income grew by 3.1% YoY to Rs 1,995 crore in Q2FY24. Total expense grew 15.61% YoY to Rs 1,526 crore in Q2FY24. Cost of material consumed was at Rs 711 crore (down 12.97% YoY) while employee benefit expenses stood at Rs 266 crore (up 14.66% YoY) in Q2FY24.

VA Tech Wabag: The company posted a consolidated revenue from operation of Rs 665 crore in Q2FY24 as against Rs 750 crore in Q2FY23, down 11.4% YoY. Consolidated Ebitda was at Rs 86.1 crore in Q2FY24 as against Rs 74.39 crore in Q2FY23, up 15.72% YoY. Its Ebitda margin improved to 12.94% in Q2FY24 from 9.91% in the year-ago period. Consolidated net profit was at Rs 60.1 crore in Q2FY24 as against Rs 46.5 crore in Q2FY23, up 29.24% YoY.

Bajaj Electricals: The company’s consolidated revenue from operations fell 3.9% at Rs 1113 crore in Q2FY24 as against Rs 1159 crore in Q2FY23. Consolidated Ebitda fell 44.1% to Rs 56.7 crore in Q2FY24 as against Rs 101 crore in Q2FY23. Ebitda margin was down to 5.09% in Q2FY24 from 8.74% in Q2FY23. Consolidated net profit tumbled 56% to Rs 27.3 crore in Q2FY24 from Rs 62 crore in Q2FY23.

KPR Mill: The company’s consolidated revenue jumped 23.8% to Rs 1,511 crore in Q2FY24 from Rs 1,220 crore in Q2FY23. Consolidated Ebitda slipped 6.1% to Rs 298 crore in Q2FY24 from Rs 317.4 crore in Q2FY23. Ebitda margin stood at 19.72% in Q2FY24 as against 26.01% in Q2FY23. Consolidated net profit was down marginally by 0.7% at Rs 201.8 crore in Q2FY24 as against Rs 203.3 crore in Q2FY23.

Bikaji Foods: The food processing company said its revenue from operations stood at Rs 609 crore in Q2FY24 as against Rs 577 crore in Q2FY23, up 5.49% YoY. Consolidated Ebitda was at Rs 87.7 crore in Q2FY24 as against Rs 64.2 crore in Q2FY23, up 36.6% YoY. Ebitda margin was at 14.4% in Q2FY24 compared with 11.12% in Q2FY23. The company’s net profit rose 46.21% to Rs 59.8 crore in Q2FY24 from Rs 40.9 crore in the year-ago period.

Indian Energy Exchange (IEX): The company achieved 9260 MU total electricity volume in October 2023, up 21% YoY. IEX achieved 9,483 MU overall volume, including 2.17 Lac Renewable Energy Certificates (RECs) (equivalent to 217 MU) and 5,814 Energy Saving Certificates (ESCerts) (equivalent to 5.8 MU). The overall volume traded during October increased 18% YoY. The Day-Ahead Market (DAM) prices on the Indian Energy Exchange (IEX) rose to Rs. 6.45 per unit, representing a substantial 68% YoY rise on a lower base price from the same month last year.

Man Industries (India): The company has received new orders of approximately Rs 380 crore and the total unexecuted order book stood at approximately Rs 1400 crore which is to be executed in the next six months.

Zydus Wellness: The company’s consolidated revenue from operations rose 2.5% to Rs 440 crore in Q2FY24 from Rs 429 crore in Q2FY23. Consolidated Ebitda was up 3.7% at Rs 16.8 crore in Q2FY24 from Rs 16.2 crore in Q2FY23. Consolidated net profit fell 30.6% to Rs 5.9 crore in Q2FY24 from Rs 8.5 crore in Q2FY23.

HeidelbergCement India: the company reported a net profit of Rs 35.8 crore in Q2FY24 compared with a PAT of Rs 7 crore in Q2FY23. The company’s revenue increased by 11.9% year-over-year to Rs 566.5 crore in Q2FY24. Sales volume rose by 16.3% to 1,163 KT in Q2FY24 from 999 KT in the year-ago period. Ebitda improved by 46.1% to Rs 69.5 crore and margin rose by 287 bps to 12.3% in the quarter under review.

Aarti Industries: The specialty chemical maker’s consolidated net profit rose 30% QoQ to Rs 91 crore and consolidated revenue from operations rose 2.83% QoQ to Rs 1,454 crore in Q2FY24. As compared with Q2FY23, net profit declined by 26.61% while revenue from operations decreased by 13.71%. Ebitda de-grew by 12.7% to Rs 233 crore during the quarter and Ebitda margin improved to 14.6% in Q2FY24 as against 14.5% in Q2FY23.

Gujarat Fluorochemicals: The company’s consolidated net profit tumbled 85.24% to Rs 52.74 crore in Q2FY24 from Rs 357.23 crore recorded in Q2FY23. Revenue from operations dropped 35.2% YoY to Rs 946.79 crore in quarter ended September 2023. Ebitda stood at Rs 163 crore in the second quarter of FY24, registering a de-growth of 70% as against Rs 536 crore posted in Q2FY23. Ebitda margin fell to 17% in Q2FY24 from 37% registered in the corresponding quarter last year.

Cello World: The company had a strong stock market debut. The company shares were listed at Rs 829 apiece on NSE, up 28% as against an issue price of Rs 648. The shares hit a high of Rs 837.4 and closed at Rs 791.7 apiece.