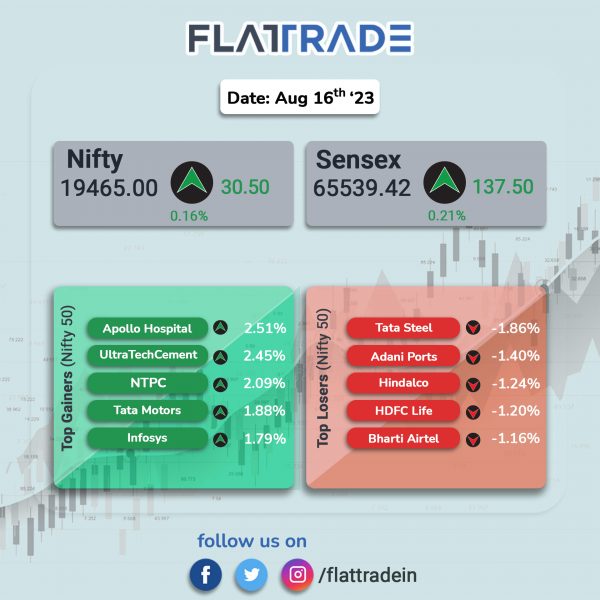

Domestic benchmark indices rebounded from day’s lows to close in the positive territory, aided by gains in IT, auto and pharma stocks. The Sensex rose 0.21% and the Nifty gained 0.16%.

In broader markets, the Nifty Midcap 100 edged up 0.08% and the BSE Smallcap jumped 0.52%.

Top gainers among Nifty sectoral indices were Media [1.2%], Realty [1.1%], Healthcare [0.98%], Auto [0.64%], Pharma [0.61%], and IT [0.59%]. Top losers were Metal [-0.94%], Private Bank [-0.46%], Consumer Durables [-0.39%], Financial Services [-0.34%], and Bank [-0.33%].

The Indian rupee fell 10 paise to 82.95 against the US dollar on Wednesday.

Stock in News Today

InterGlobe Aviation (IndiGo): Shares of the company fell 4% after Gangwal family sold IndiGo shares worth $450 million via a block deal, according to various media reports. Gangwal family has offered around 1.56 crore shares (4% stake) at a floor price of Rs 2,400 per share.

Tejas Networks: The company has received a purchase order worth Rs 7,492 crore for equipment from Tata Consultancy Services. The purchase order is for the supply, support and annual maintenance services of its Radio Access Network (RAN) equipment for BSNL’s pan-India 4G/5G network with TCS. Tejas would supply the equipment for one lakh sites that is to be executed during calendar years 2023 and 2024.

Infosys: The IT major and Liberty Global have expanded their collaboration to evolve and scale Liberty Global’s cutting-edge digital entertainment and connectivity platforms. The deal is for an an initial period of five years with an option to extend to 8 years.

Mahindra & Mahindra (M&M): The automaker launched the Mahindra OJA tractor range and the new range of lightweight tractors that promises to revolutionise farming. The tractors have been launched for Rs 5.64 lakh for OJA 2127 and Rs 7.35 lakh for OJA 3140 in Pune. The new range of vehicles was developed in collaboration between the engineering teams of Mahindra Research Valley in India, the R&D centre for Mahindra AFS and Mitsubishi Mahindra Agriculture Machinery in Japan with a total investment of Rs 1200 crore in the project.

UNO Minda: The company has commissioned two new plants for manufacturing electric vehicle components and systems. The company has received new orders with annualised peak value of more than Rs 600 crore for EV systems during the June-April quarter of the current fiscal, as per an exchange filing. With this, the company’s aggregate order book now stands at more than Rs 2,500 crore and it targets to achieve Rs 1,500 crore in revenue from EV systems by FY26.

Coal India: The company’s capital expenditure grew 8.5% YoY to Rs 4,700 Crore in Q1FY24, while its capex utilisation was nearly 100% of Rs 4,754 crore progressive target. Capex utilisation touched 28.3% of Rs 16,600 crore annual target.

Nazara Technologies: The gaming software company plans to invest $5,00,000 in Israel-based Snax Games, according to its exchange filing. The company has signed a publishing agreement with Snax Games through which it has acquired the exclusive rights to publish the games in the Indian subcontinent and the Middle-East region on a revenue-sharing basis for a period of five years.

Lupin: The pharma company has received the USFDA approval for proding metoprolol succinate tablets, which is used for treatment of hypertension and high blood pressure. Further, Lupin has also got the USFDA nod for Bromfenac Ophthalmic Solution, which will be produced at its Pithampur facility in India.

HCLTech: The IT services company has been selected by Cricket Australia (CA) for its next phase of digital transformation. CA has been a customer of HCLTech for digital transformation since 2019.

Uflex: Shares of the company tanked after the company reported a consolidated net loss of Rs 416.18 crore in Q1FY24 as against a net profit of Rs 374.49 crore posted in Q1FY23. Revenue from operations dropped 19.4% YoY to Rs 3,219.92 crore during the quarter under review. Total sales volume stood at 1,43,159 tons in Q1FY24, a decline of 7.5% YoY

SBFC Finance: The company had a strong stock market debut as the stock got listed at Rs 82 apiece on the NSE as against an issue price of Rs 57 per share. Shares touched a high of Rs 95.45 and closed at Rs 92.2 apiece.

Indiabulls Housing Finance: The company reported a 3.3% rise in consolidated net profit from continuing operations at Rs 296.19 crore in Q1FY24 as against Rs 286.64 crore in Q1FY23. Total income declined 7.8% YoY to Rs 1,915.62 crore in Q1FY24. Net interest income stood at Rs 562 crore in Q1FY24, while Net Interest Margin stood at 3% for the quarter ended June 2023. Net NPA to gross advances stood at 1.69% in Q1FY24 as against 1.71% in Q1FY23.

GMR Airports Infrastructure: The company reported a consolidated net profit of Rs 15.45 crore in Q1FY24 as against a net loss of Rs 115.37 crore in Q1FY23. Revenue from operations rose 40.2% YoY to Rs 2,017.63 crore during the quarter. Net revenue was at Rs 1,469 crore in Q1FY24 , registering a growth of 43.32% from Rs 1,025 crore in Q1FY23. EBITDA stood at Rs 752.5 crore in Q1FY24, a growth of 77.48% YoY. Meanwhile, the company’s board has approved fundraising up to Rs 5,000 crore in one or more tranches through issue of securities including a qualified institutions placement and/or foreign currency convertible bonds and/or any other securities.

Ramco Industries: The company said that it has executed the share subscription and purchase agreement for the purpose of sale and transfer of its entire shareholding held in Lynks Logistics to Bundl Technologies, who are the owners of Swiggy. Ramco will receive compulsorily convertible preference shares of Bundl in exchange for 46,15,83,065 equity shares of Lynks Logistics held by the company.

Quint Digital Media (QDML): The company’s board has approved the binding memorandum of understanding (MOU) amongst Quintillion Media (QML), a wholly owned subsidiary of the company, and AMG Media Networks (AMG media), a wholly owned subsidiary of Adani Enterprises, for the sale of remaining 51% stake held by QML in Quintillion Business Media to AMG Media. The deal with AMG Media is restricted only with respect to the divestment of 51% stake in Quintillion Business Media and does not involve any transaction with Quint Digital Media. The transaction is expected to be completed in the third quarter of FY24.

Pennar Industries: The company said in an exchange filing that it has bagged orders worth Rs 702 crore across its various verticals. The above orders are expected to be executed within the next two quarters, the company said in a statement.

Bajaj Healthcare: The company’s consolidated net profit tumbled 51% to Rs 7.03 crore in Q1FY24 from Rs 14.35 crore in Q1FY23. Revenue from operations declined 20.8% to Rs 129.74 crore during the quarter under review from Rs 163.79 crore in corresponding quarter last year. EBITDA stood at Rs 21.74 crore in Q1FY24, a decline of 11.12% from Rs 24.46 crore in Q1FY23. The company said it plans to increase its exports growth of 15-20% for FY24. It also expects that the EBITDA margins would be in the range of 16%-20% for FY24, mainly driven by growth in the formulation business and with the introduction of reverse engineering APIs launched in the last financial year.

NMDC: The company has revised lump ore and fines prices with effect from August 15. It has fixed lump ore price at Rs 4,650 per ton and fines price at Rs 3,910 per to.

Aurbindo Pharma: The company said it subsidiary, Eugia Pharma, has received the USFDA approval for Icatibant injection, which is used to treat hereditary angioedema.

Garden Reach Shipbuilders and Engineers (GRSE): Shares of the company rose 18.35% after the company posted strong quarterly numbers. The company recorded a net profit of Rs 76.68 crore in Q1FY24, up from Rs 50.18 crore reported in the year-ago period. Revenue from operations increased to Rs 755.9 crore in Q1FY24 from Rs 579.77 crore in the same period last fiscal.