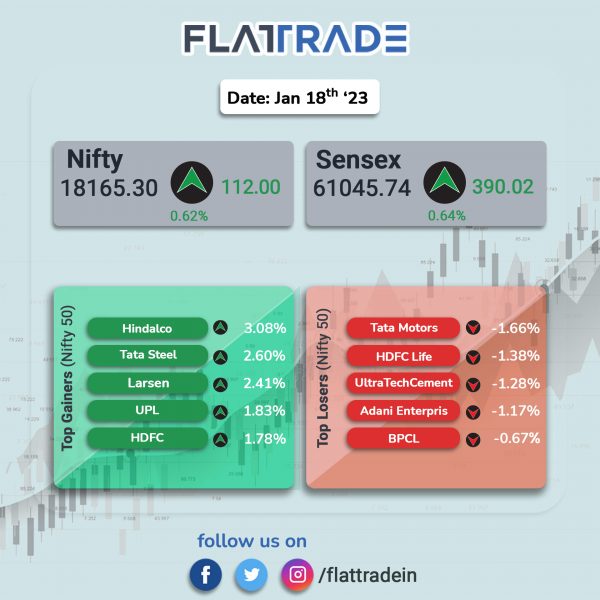

Indian benchmark equity indices ended higher, aided by gains in metal, financial services and pharma stocks. The Sensex rose 0.64% and the Nifty 50 index gained 0.62%.

Broader markets also closed higher, tracking headline indices. The Nifty Midcap 100 index advanced 0.52% and the BSE Smallcap was up 0.17%.

Top gainers among Nifty sectoral indices were Metal [1.65%], Financial Services [0.80%], Pharma [0.68%], Private Bank [0.54%], Bank [0.53%]. Top losers were PSU Bank [-1.25%] and Energy [-0.22%]

Indian rupee rose 52 paise to 81.24 against the US dollar on Wednesday.

Stock in News Today

Adani Enterprises: The company has sought market regulator’s nod for its Rs 20,000 crore follow-on public offering, which will be open from January 27 to January 31, 2023. The company will issue shares on a partly paid basis and anchor investor bidding date is fixed on January 25.

Adani Green Energy: The company said its wholly-owned subsidiary, Adani Renewable Energy Holding Two, has entered into a binding term sheet for acquisition of 50% equity interest in Essel Saurya Urja Company of Rajasthan (ESUCRL) for Rs 15 crore. ESUCRL owns and operates a solar park with a capacity of 750 megawatt (MW) in Rajasthan. ESUCRL had a turnover of Rs 9.88 crore in financial year 2022.

Hindalco Industries: The company’s board approved allotment of 70,000 non-convertible debentures (NCDs) of Rs 1 lakh each aggregating to Rs 700 crore, on private placement basis. These rated, listed, unsecured, redeemable, NCDx will have a coupon rate of 7.60% per annum and shall be redeemed at par at the end of the 14 months from the date of allotment, which is 18 January 2023. The NCDs will be listed on wholesale debt market segment of National Stock Exchange of India.

Maruti Suzuki India: The automaker has announced to recall a total of 17,362 vehicles manufactured between 08th December, 2022 and 12th January, 2023. The affected models are Alto K10, S-Presso, Eeco, Brezza, Baleno and Grand Vitara. The recall is for inspecting and replacing Airbag Controller (affected part), free of cost, if required in these vehicles.

Cipla: The company launched Cippoint, a point-of-care testing device, which offers a wide range of testing parameters including cardiac markers, diabetes, infectious diseases, fertility, thyroid function, inflammation, metabolic markers, and coagulation markers. The device is approved by the European In-Vitro Diagnostic Device Directive, thus ensuring reliable testing solutions.

Central Bank of India: The lender’s net profit jumped 64.3% YoY at Rs 458.2 crore in Q3FY23 as against Rs 278.9 crore in the year-ago period. Its NII was up 19.9% YoY to Rs 3,284.5 crore compared to Rs 2,738.4 crore in the corresponding quarter last fiscal. The lender’s gross NPA ratio stood at 8.85% in the reported quarter as against 9.67% in the preceding quarter.

Salasar Techno Engineering: The company has secured the letter of intent (LoI) worth Rs 143 crore from Nepal Electricity Authority for procurement of material equipment, associated accessories and necessary installation services including design, erection, testing and commissioning of 33/11 KV substations and 33 KV, 11 KV, 400 V lines and distribution system networks in Dang, Rukum East and Baitadi districts of Nepal.

Eris Lifesciences: The company’s consolidated net profit rose marginally to Rs 101.86 crore in Q3FY23 as against Rs 100.77 crore in Q3FY22. Revenue from operations jumped 27.4% to Rs 417.84 crore in the reported quarter as compared to Rs 328.07 crore in Q3FY22. EBITDA rose 12.7% to Rs 137.2 crore in Q3FY23 as compared with Rs 121.7 crore in the year-ago period. Its EBITDA margin reduced to 32.4% in Q3FY23 as against 36.6% in Q3FY23.

PSP Projects: The company’s consolidated net profit declined 29.47% to Rs 35.36 crore in Q3FY23 from Rs 50.13 crore in Q3FY22. However, revenue from operations stood at Rs 500.15 crore in the reported quarter, registering a growth of 3% on YoY basis. Its EBITDA fell 18.5% to Rs 61.7 crore in Q3FY23 from Rs 75.7 crore in the year-ago period.

Krsnaa Diagnostics: The company announced that it has operationalized diagnostics centers at four more locations. With this, the company has operationalized 24 CT Scanners, 6 MRI Machines, 30 Pathology Labs including 1 Referral Laboratory and 95 Collection Centers in the State of Punjab which amounts to completion of 99% of the Project as on the date of this disclosure. The company had signed an agreement with the Punjab Government for procurement, operation and maintenance of 25 CT Scanners, 6 new MRI Machines, 30 Pathological Laboratories, 1 Referral Laboratory and 95 Collection Centers across Punjab.

Stylam Industries: The company said its consolidated net profit rose 53.8% to Rs 24.03 crore as against Rs 15.6 crore in the year-ago period. Its total income from operation was up 34.7% to Rs 234 crore in the reported quarter as against Rs 173.3 crore in the year-ago period. Its EBITDA increased 33.6% YoY to Rs 39.4 crore in Q3FY23. EBITDA margin stood at 16.8% in q3FY23 compared with 17% in the corresponding quarter last year.

Surya Roshni: The company said its net profit rose to Rs 89.7 crore in Q3FY23 from Rs 40.5 crore in Q3FY22. Revenue slipped 0.5% to Rs 2,022 crore in Q3FY23 from Rs 2,030 crore in the year-ago period. Its EBITDA climbed 66.5% to Rs 163 crore in the reported quarter from Rs 98 crore in the same period last fiscal. The company’s board declared an interim dividend of Rs.3/- per equity share of rs.10/- each of the company. The interim dividend shall be paid on February 3, 2023, to the equity shareholders of the company, whose names appear on the register of members of the company or in the records of the depositories as beneficial owners of the shares as on January 27, 2023 , which is the record date fixed for the purpose.

Vinyl Chemicals (India): The company’s net profit fell 36.4% YoY to Rs 7 crore Q3FY23 from Rs 11 crore in the year-ago period. Revenue from operations was down 18.8% YoY to Rs 27.6 crore. EBITDA declined 28.7% YoY to Rs 10 crore in the reported quarter.

CCL Products (India): The company’s net profit climbed by 25% YoY to Rs 73 crore in Q3FY23 from Rs 58 crore in Q3FY22. Revenue also rose 26.5% YoY to Rs 535.3 crore in Q3FY23. Its EBITDA was 8.9% higher at Rs 100.7 crore in Q3FY23 compared with Rs 92.4 crore in the same period last fiscal.