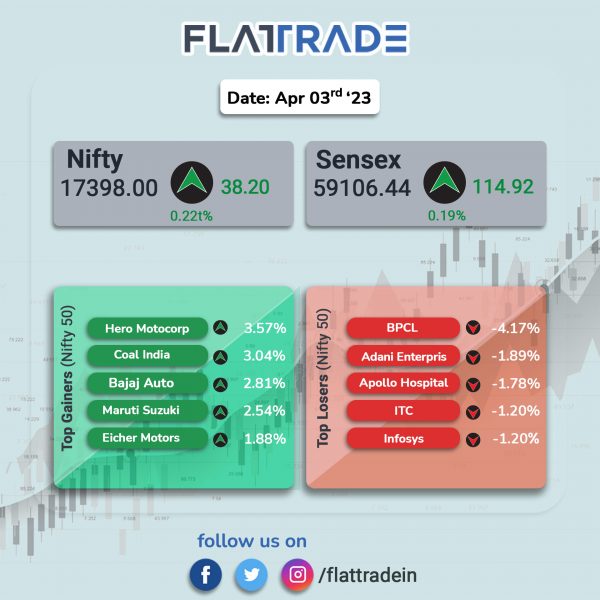

Benchmark indices closed higher, helped by gains in banking, auto and realty stocks. The Sensex rose 0.19% and the Nifty gained 0.22%.

In broader markets, the Nifty Midcap 100 index advanced 0.44% and the BSE Smallcap jumped 1.17%.

Top gainers were Auto [1.49%], PSU Bank [1.06%], Realty [0.9%], Private Bank [0.76%] and Media [0.68%]. Top laggards were Oil &Gas [-0.44%], Metal [-0.36%], FMCG [-0.36%] and IT [-0.23%].

Indian rupee fell 17 paise to 82.33 against the US dollar on Monday.

Tuesday [April 4, 2023] will be a market holiday on account of Mahavir Jayanti. However, MCX evening trading session will start at 5:00 p.m.

Stock in News Today

Tata Motors: The auto major’s total domestic sales rose 3% to 89,351 units sold in March 2023 as against 86,718 units sold in March 2022. The total domestic sales increased by 14.54% last month compared with 78,006 units in February 2023. Tata Motors said that its sales in the domestic and international market for Q4FY23 stood at 2,51,822 vehicles compared with 2,43,459 units during Q4FY22, up 3.4% year on year (YoY).

Hero MotoCorp: The company said that total two-wheeler sales increased by 15% to 519,342 units in March 2023 from 450,154 units in March 2022. The company’s domestic sales increased by 21% YoY to 502,730 units, exports fell sharply by 52% to 16,612 units during the period under review. The company sold 53,28,546 units in FY23, registering a growth of 8% over the corresponding period of the previous fiscal (FY22), when the company had sold 49,44,150 units.

Indraprastha Gas, Mahanagar Gas and Gujarat Gas: Shares of city gas distributors dropped after domestic gas prices were left unchanged pending a Cabinet decision. The Indian Government will provisionally keep the price of locally produced gas from old fields at $8.57 per million metric British thermal units (mmBtu), while it considers a potential change to the pricing formula. The ceiling has been reduced marginally to $12.1 from $12.5 per mmBtu.

KPIT Technologies: Shares of the company tanked more than 12% after the foreign brokerage JP Morgan initiated coverage with an “underweight” rating on the stock. The brokerage firm has given a target price of Rs 540, a 41% downside from its Friday’s closing price of Rs 925 per share. The brokerage cited that the company is likely to witness slowdown in growth and reduction in order book.

Ashok Leyland: The commercial vehicles maker reported 19% jump in total vehicle sales to 23,926 units in March 2023 from 20,123 units in March 2022. While medium & heavy commercial vehicles (M&HCV) sales increased 20% YoY to 16,773 units, total light commercial vehicles (LCV) sales rose by 17% YoY to 7,153 last month. The company’s domestic sales of commercial vehicles during the period under review aggregated to 22,885 units, higher by 23% compared with the same period last year.

Ultratech Cement: The company said that it had recorded 14% increase in consolidated cement sales volume to 31.7 million tons (MT) in Q4FY23 from 27.7 MT in Q4FY22. As compared with Q3FY23, the company’s consolidated sales volume has risen by 22%. The company’s total cement sales volume has improved by 12% to 105.7 MT in FY23 from 94 MT in FY22.

Steel Authority of India (SAIL): The state-owned company said it has achieved the best ever annual production during the financial year 2022-23 ending on 31 March 2023. SAIL recorded 19.409 million tonnes (MT) of hot metal and 18.289 MT crude steel production, a growth of 3.6% YoY and 5.3% YoY respectively over the previous best.

Bharat Electronics (BEL): The company has achieved a turnover of about Rs 17300 crore during the financial year 2022-23, against the previous year’s turnover of Rs. 15,044 crore, thereby registering a growth of 15% on YoY basis. BEL’s Order Book as on 1 April 2023, was around Rs 60,500 crore. In the year 2022-23, BEL secured significant orders of around Rs 20,200 crore. BEL achieved export sales of about $46.5 million during FY23 against the previous year’s export of $ 33.3 million, registering a growth of 40%.

Mahindra & Mahindra (M&M): The auto major said that its overall auto sales for the month of March 2023 stood at 66,091 vehicles, registering a growth of 21% as against 54,643 vehicles sold in March 2022. In the Utility Vehicles segment, Mahindra sold 35,976 vehicles in March 2023, up 31% YoY. The Passenger Vehicles segment (which includes UVs, cars and vans) sold 35,997 vehicles in March 2023, up 30% YoY from 27,603 units sold in March 2022. The company sold 22,282 units of commercial vehicles (LCV+MHCV) in March 2023 as against 19,837 units sold in March 2022, recording a growth of 12.33%. The company’s total tractor sales (domestic + exports) increased 17.6% YoY to 35,014 units in March 2023 from 29,763 units sold in March 2022.

Escorts Kubota: The company announced that its agri machinery business in March 2023 sold 10,305 tractors, registering a growth of 2.3% as against 10,074 tractors sold in March 2022. On a sequential basis tractor sales jumped 31.9% in March 2023 from 7,811 units sold in February 2023. Domestic tractor sales rose 1.2% to 9,601 units in March 2023 as against 9,483 tractors sold in March 2022. Meanwhile, tractor exports in March 2023 stood at 704 tractors registering a growth of 19.1% as against 591 tractors sold in March 2022. The company’s construction equipment business in March 2023 sold 606 machines, registering a growth of 15.4% as against 525 machines sold in March 2022.

SML Isuzu: The automaker said its total sales grew 59% to 2,169 units in March 2023 compared with 1,363 units sold in March 2022. The sale of passenger vehicles surged 167% to 1,778 units, while sale of cargo vehicles slipped 44% to 391 units in March 2023 over March 2022. On full year basis, the total sales jumped 68% to 12,442 units in FY23 as against 7,392 units in FY22.

APL Apollo Tubes: The company announced that it had registered sales volume of 649,726 ton in Q4FY23, up by 18% from 551,723 ton in Q4FY22. For FY23, the company reported sales volume of 2,279,846 ton compared to 1,754,963 ton in FY22, up 30% YoY. This was supported by recently commissioned new Raipur plant which contributed sales volume of 166,993 ton.

Garden Reach Shipbuilders & Engineers: The company has achieved an annual turnover to the tune of Rs 2,550 crore for FY23, up 45%. The company further said that it had also signed the contract with Ministry of Defence for construction of four next generation offshore patrol vessels (NGOPVs) on 30 March 2023. This contract, which is worth Rs 3,500 crore, was won on competitive bidding basis and the first NGOPV scheduled to be delivered in 44 months.

TVS Motor Company: The company announced that it had registered a growth of 3%, with sales increasing to 317,152 units in March 2023 from 307,954 units in March 2022. The company’s total two-wheeler sales increased by 5% YoY to 307,559 units in March 2023. Two-wheeler sales in the same period last year aggregated to 292,918 units. TVS iQube electric recorded sales of 15,364 units in March 2023 as against sales of 1,799 units in March 2022. Three-wheeler sales of the company stood at 9,593 units in March 2023 as against 15,036 units March 2022, down 36% YoY. The company’s total exports fell to 75,037 units in March 2023 from 109,724 units March 2022, down 32% YoY. Exports of two-wheeler declined by 30% to 66,779 units in March 2023 from 95,962 units March 2022.

NCC: The Hyderabad-based construction company said that it has received five orders worth Rs 1,919 crore from government agencies in March 2023. The five orders includes two orders valuing Rs 952 crore relating to transportation division, two orders worth Rs 792 crore relating to electrical division, one order valuing Rs 175 crore relating to building division.

Tejas Networks: The company said that it has won Rs 696 crore order for a pan-India router network from Bharat Sanchar Nigam Limited (BSNL). The advance purchase order from BSNL is for the upgradation of its pan-India IP-MPLS based Access and Aggregation Network (MAAN) using its routers.

JSW Energy: The company’s wholly-owned subsidiary, JSW Neo Energy, received letter of intent (LoI) from Power Company of Karnataka (PCKL) for procurement of 2,400 MWh energy storage from pumped hydro storage project. It will provide storage capacity for a period of 40 years.

Udayshivakumar Infra: The company has a tepid stock market debut. The shares opened at Rs 30 on the NSEcompared to an issue price of Rs 35 apiece. The shares hit a low of Rs 29.15 and finally closed for Rs 31.5 on the NSE, which was also the highest share price for the day.

Route Mobile: The company shall provide corporate guarantee of $10.14 million (Rs 83.49 crore) to Yes Bank Ltd. for term loan facility to Route Mobile (UK) Ltd. The corporate guarantee will be treated as a contingent liability for the company.

SpiceJet: The company completed the spin off of its cargo and logistics division SpiceXpress into a separately entity- SpiceXpress and Logistics Pvt. Ltd. effective April 1. SpiceXpress will issue a mix of equity shares and compulsorily convertible debentures to SpiceJet for an aggregate amount of Rs 2,555.77 crore.

Tips Industries: The music record label company said it has fixed 21 April 2023, as the record date for the proposed 10-for-1 stock split. Recently, the company’s shareholders approved splitting each share having face value of Rs 10 each into ten equity shares having face value of Re 1 each fully paid-up.

Dhanlaxmi Bank: The bank’s gross advances increased by 16.85% to Rs 9,867 crore as on 31 March 2023 from Rs 8,444 crore as on 31 March 2022. Of this, gold loans amounted to Rs 2,274 crore, up 23.39% YoY. Total deposits of the bank rose by 7.45% to Rs 13,327 crore in FY23, from Rs 12,403 crore in FY22. Total business of the bank aggregated to Rs 23,194 crore in FY23, up 11.26% YoY and up 4.56% QoQ.