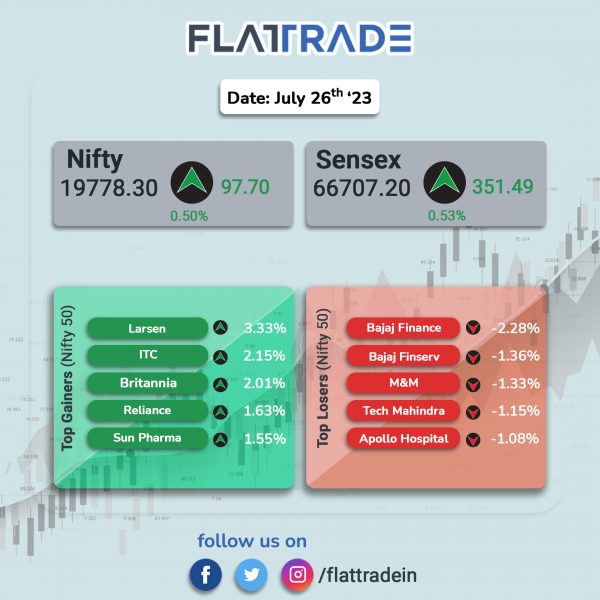

Benchmark equity indices rose on Wednesday, ahead of the US Fed interest decision, helped by gains in index heavyweights and upbeat results from L&T. The Sensex rose 0.53% and the Nifty gained 0.55.

In broader markets, the Nifty Midcap 100 advanced 0.44% and the BSE Smallcap rose 0.22%.

Top gainers among Nifty sectoral indices were PSU Bank [1.5%], Realty [1.19%], FMCG [1.05%], Media [0.93%], and Energy [0.82%]. Nifty Auto index ended 0.01% lower, while rest of the indices closed in the green.

Indian rupee fell by 11 paise to 81.99 against the US dollar on Wednesday.

Stock in News Today

Reliance Industries Ltd. (RIL): Qatar Investment Authority (QIA) is in talks to buy a minority stake in Reliance Retail Ventures, according to Financial Times (FT) report. It said that QIA is considering a $1 billion investment to buy a 1% stake in the company, bringing the valuation of the retail unit to $100 billion. Reliance Retail added 555 stores in the quarter and witnessed its highest-ever footfalls at 249 million across formats.

Bajaj Finance: The NBFC reported a 32.4% YoY rise in consolidated net profit for the quarter ended June to Rs 3,437 crore. Its total revenue from operations grew nearly 35% YoY to Rs 12,498 crore. Net interest income for the reported quarter increased by 26% YoY to Rs 8,398 crore. The number of new loans booked during the quarter grew sharply by 34% YoY to 99.4 lakhs. The assets under management (AUM) as of June 30, stood at Rs 2.70 lakh crore, up 32% from the year-ago period. Shares of Bajaj Finance dropped 2.28%

BPCL: The state-owned company reported a consolidated net profit of Rs 10,644 crore in Q1FY24 as against a loss of Rs 6,148 crore in the year-ago period. Consolidated revenue from operations fell 7% to Rs 1.28 lakh crore in the reported quarter as against 1.38 lakh crore in the same quarter of last fiscal.

Shree Cement: The company’s consolidated net profit increased by 105% YoY to Rs 572.3 crore in Q1FY24 from Rs 279.50 crore in Q1FY23. Consolidated revenue from operations rose by 15% YoY to Rs 5,064.83 crore in the first quarter of FY24. Ebitda was up 18% to Rs 944.92 crore in Q1FY24 as against Rs 800.82 crore in the year-ago period. The board has approved raising up to Rs 1,000 crore via NCDs in one or more tranches on private placement basis.

Separately, the company announced that its board has approved an investment proposal of Rs 7,000 crore for increasing capacity. The company plans to set up a clinker manufacturing plant of 3.65 million tonnes at Pali, Rajasthan, and cement capacity of 6 million tonnes in Pali, Rajasthan and Etah, Uttar Pradesh. The firm will also set up a clinker manufacturing plant of 3.65 million tonnes at Kodla and cement capacity of 6 million tonnes at Kodla and Bangalore in Karnataka. The said capacities would be added by the quarter ending March 2025. The board of directors of the company has also decided to make strategic diversification in ready mix concrete (RMC) business commencing with plan to set-up 5 RMC units by this financial year.

Punjab National Bank: The state-owned company reported a 307% jump in its standalone net profit to Rs 1,255.4 crore in Q1FY24 from Rs 308.4 crore in the same quarter last year. Its net NPA also declined to 1.98% in the June 2023 quarter from 2.72% in the preceding quarter. The net NPAs were 4.28% in the year-ago period. The bank’s total income was up 34.2% to Rs 28,579.27 crore in the June quarter as compared to Rs 21,294.03 crore last year.

Jubilant Foodworks: The company’s net profit fell 74% to Rs 28.9 crore in Q1FY24, compared to Rs 112.5 crore for the corresponding quarter of the previous year. Sequentially, the net profit stood at Rs 28.5 crore. Its revenue from operations for Q1FY24 came in at Rs 1,334.5 crore, compared to Rs 1,255 crore year-on-year (YoY). The revenue from for operations stood at Rs 1,289 crore in the preceding quarter. Ebitda declined to Rs 276.4 crore in Q1FY24, from Rs 304.5 crore in the corresponding period of the previous year. The growth was driven by Domino’s delivery channel sales which increased by 8.4%, while the average daily sales of mature stores came in at Rs 81,049, up 2.7% sequentially.

Sunteck Realty: The real estate developer said that it had recorded pre-sales of approximately Rs 387 crore in Q1FY24, up 16% YoY from Rs 333 crore in the same period last year. Sequentially, the pre-sales are lower by 28% compared with Rs 537 crore recorded in Q4FY23. The real estate developer’s collections in Q1FY24 were Rs 288 crore, up 1% YoY but down 13% QoQ.

Bharat Heavy Electricals (BHEL): The company announced that has achieved a major milestone with the successful synchronisation of the 660 MW Unit-2 of the 1,320 MW Maitree Super Thermal Power Project (STPP) in Bangladesh. The 2×660 Maitree STPP is located at Rampal, Mongla, Bagerhat, Bangladesh, and is being set up by BHEL for the Bangladesh-India Friendship Power Company (BIFPCL), a 50:50 joint venture between the Bangladesh Power Development Board (BPDB) and NTPC Limited.

HDFC Bank: The private bank has joined hands with Swiggy, to launch a co-branded credit card. The credit card will be hosted on Mastercard’s payment network and provide cardholders rewards and benefits across various online platforms, including Swiggy, HDFC Bank said in a statement.

Man Infraconstruction: The company reported a net profit of Rs 82 crore in Q1FY24, up by 112% as compared with Rs 39 crore in Q1FY23. Revenue increased by 45% YoY to Rs 510 crore in Q1FY24. EBITDA increased by 63% to Rs 109 crore in Q1 FY24 from Rs 67 crore in Q1 FY23. EBITDA margin was 21.4% in Q1 FY24 as against 19% in Q1 FY23. The firm also said that it has bagged another significant size EPC order worth Rs 680 crore from BMCT (PSA Group) for pavement work on the reclaimed earth on execution of Phase II Infrastructure Works at the Fourth Container Terminal of JNPT.

Orient Electric: The company said that its has completed the sale of land parcels measuring a total of 23 acres situated in Dusakal Village Secretariat and Mekaguda Gram Panchyat, Hyderabad, Telangana, for a total consideration of Rs 35 crore. The said land parcels were held as assets for disposal. Orient Electric is primarily engaged in manufacture/purchase and sale of electrical consumer durables, lighting & switchgear products.

Ajmera Realty & Infra India (ARIIL): Shares of the company rallied over 8% in intraday trade after the company’s net profit rose 82% to Rs 21.07 crore in Q1FY24 as compared with Rs 11.57 crore in Q1FY23. Revenue from operations jumped 121.9% in net sales to Rs 116.05 crore in Q1FY24 as compared with 52.31 crore in Q1 FY23. Ebitda stood at Rs 39 crore in Q1FY24, a growth of 112% from Rs 18 crore recorded in same quarter last year. Sales value declined 44% to Rs 225 crore in Q1FY24 from Rs 400 crore recorded in corresponding quarter last year. Collections dropped 47% YoY to Rs 111 crore in Q1FY24 over Q1 FY23.

Rane Madras: The company’s net loss stood at Rs 14.5 crore in Q1FY24 as against a net loss of Rs 3.3 crore in Q1FY23. Revenue was up 7.1% YoY at Rs 588.3 crore in Q1FY24 as against Rs 549.3 crore in Q1FY23. Ebitda rose 45.7% YoY at Rs 42.4 crore in the reported quarter as against Rs 29.1 crore in the year-ago period. The company registered a one-time loss of Rs 19 crore.

Kajaria Ceramics: The company’s net profit was up 16.5% at Rs 107.5 crore in Q1FY24 as against Rs 92.3 crore in Q1FY23. Revenue rose 5.6% to Rs 1,064.2 crore in Q1FY24 from Rs 1,008.2 crore in Q1FY23. Ebitda rose 10.3% to Rs 169 crore in Q1FY24 from Rs 153.2 crore in Q1FY23.

Aether Industries: The company’s net profit fell 2.5% to Rs 29.81 crore in Q1FY24 from Rs 30.62 crore in Q1FY23. Revenue from operations was down to Rs 161.1 crore in Q1FY24 from Rs 160 crore in the year-ago period. Ebitda was up 5.4% YoY at Rs 44.7 crore in Q1FY24 from Rs 42.4 crore in Q1FY23.

Glaxosmithkline Pharmaceuticals: The company’s net profit was up 10.8% at Rs 132.2 crore in Q1FY24 from Rs 119.3 crore in Q1FY23. Revenue was up 2.2% at Rs 761.6 crore in Q1FY24 as against Rs 745 crore in Q1FY23. Ebitda fell 3.3% YoY at Rs 143.9 crore in Q1FY24 as against Rs 148.8 crore in Q1FY23.

TeamLease: The company reported a net profit Rs 26.4 crore in Q1FY24, down 0.4% from Rs 26.52 crore in Q1FY23. Revenue from operations was up 15.5% YoY at Rs 2,171.6 crore in Q1FY24 from Rs 1,879.4 crore in Q1FY23. Total expenses rose to Rs 2,159.82 in Q1FY24 from Rs 1,863.77 crore in the year-ago period. Employee benefits expense stood at Rs 2,103.12 crore in Q1FY24 as against Rs 1,805.83 crore in the year-ago period.

Indian Metals & Ferro Alloys: The company reported a net profit of Rs 110.4 crore in Q1FY24, down 17.7% YoY from Rs 134 crore in Q1FY23. Revenue from operations fell 5.6% YoY at Rs 701.7 crore in Q1FY24 as against Rs 743.4 crore in Q1FY23. Ebitda fell 20.3% to Rs 173.6 crore in Q1FY24 as against Rs 217.8 crore in the year-ago period.

Embassy Office Parks: The company’s net profit jumped 31% YoY at Rs 234 crore in Q1FY24 as against Rs 179 crore in Q1FY23. Revenue from operations rose 10.2% YoY to Rs 913.56 crore in Q1FY24 as against Rs 829.36 crore in Q1FY23. The company’s board has approved fundraising of up to Rs 1,600 crore via debt.

Triveni Engineering & Industries: The company reported a marginal increase in consolidated net profit at Rs 67.61 crore in Q1FY24 compared with Rs 66.45 crore posted Q1FY23. Net sales declined 2.3% to Rs 1,197.94 crore in the quarter ended June 2023 from Rs 1,225.67 crore recorded in Q1FY23. The decline in revenue was attributed to lower turnover in the sugar business. Ebitda grew by 10.8% YoY to Rs 137.12 crore during the quarter. Sales volumes for the current quarter includes exports of 14,531 tonnes of sugar at remunerative prices, while there were no exports in previous corresponding period.