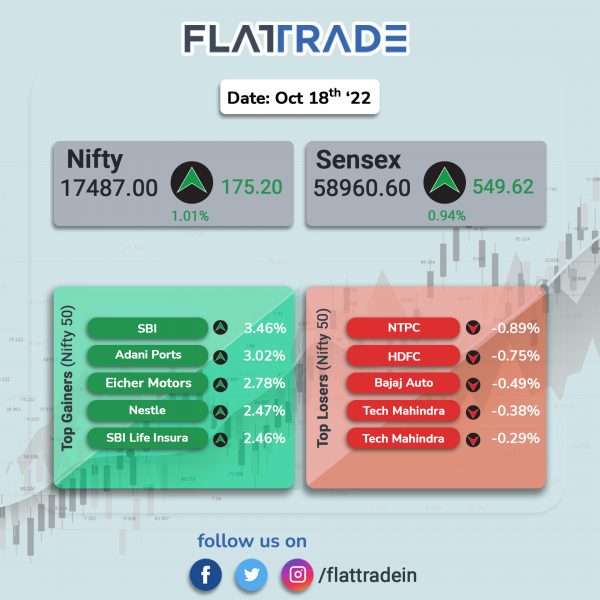

Dalal Street ended higher as investors’ sentiments were boosted by positive global cues and easing oil prices. The Sensex closed 0.94% higher and the Nifty jumped 1.01%.

In broader markets, the Nifty Midcap 100 index climbed 1.1% and the BSE Smallcap rose 0.71%.

Top gainers among Nifty sectoral indices were PSU Bank [3.97%], Media [2.14%], Realty [1.72%], Auto [1.35%] and Energy [1.3%]. All indices ended in the green.

The Indian rupee was inched down to 82.36 against the US dollar on Tuesday.

Stock in News Today

TVS Motor: Shares of the company rose after global investment bank UBS raised the target price of the company’s stock to Rs 1,385 from Rs 1,100 apiece. The brokerage has maintained a ‘buy’ recommendation on the stock. UBS expects TVS Motor to roll out five electric vehicles over the next 12-15 months. UBS noted that the company’s EV push as compared to peers places it in the prime position to emerge as a segment leader, citing strong response to the iQube and best-in-class EV launch pipeline.

HDFC: The NBFC is likely to be out of the Nifty 50 index by Dec-Jan as the merger with HDFC Bank may be completed a few months earlier than expected, The Economic Times reported citing analysts. Pidilite Industries and Ambuja Cements are among the top contenders to replace HDFC, the report said.

Wipro: The IT major and Finland-based Outokumpu, a leading multinational stainless steel manufacturer, announced a strategic deal to accelerate Outokumpu’s cloud transformation for applications. The five-year deal strengthens Wipro and Outokumpu’s existing eight-year partnership.

Tata Communications: The company reported 25.13% rise in consolidated net profit to Rs 532.29 crore and 6.15% increase in net sales at Rs 4,430.74 crore in Q2FY23 over Q2 FY22. EBITDA margins improved to 25.5% in Q2FY23. The company’s Data business revenues came in at Rs 3,493 crore, recording an increase of 11.2% YoY.

Mahindra & Mahindra Financial Services Limited (MMFSL): The company has announced strategic partnership with India Post Payments Bank (IPPB) to enhance credit access to a larger customer base. Under the partnership, IPPB will provide lead referral services to MMFSL for various loan products and provide cash EMI deposit facility to existing MMFSL customers at Post Offices spread across the country. The scheme will be initially available for customers in Maharashtra and Madhya Pradesh. The company said that the service will spread across other states over the next 4-6 months.

Mindtree and L&T Infotech: The Mumbai bench of the National Company Law Tribunal approved the scheme of amalgamation between Mindtree and L&T Infotech. The merger will become effective upon filing of certified copy of the orders passed by the respective jurisdictional NCLTs of both the companies.

Praj Industries: The company reported 44.4% YoY rise in consolidated net profit to Rs 48.13 crore and a 64.6% YoY increase in revenue from operations at Rs 876.58 crore in Q2FY23. Total expenses jumped 66% YoY to Rs 816.96 crore in the second quarter due to higher raw material costs and higher employee expenses.

Suzlon Group: The company has bagged 48.3 MW wind power order from Adani Green Energy, according to its exchange filing. Suzlon will install 23 wind turbine generators with hybrid lattice tubular tower of 2.1 MW rated capacity each. The project is located in Gujarat and is expected to be commissioned in 2023. Sahres of the company soared nearly 18% in intraday trading.

EKI Energy: The company and Impact Capital have jointly launched a Rs 1,000 crore climate impact fund for climate change mitigation projects across remote locations in India and other geographies. As an anchor investor, EKI will invest up to Rs 200 crore and Impact Capital will raise the balance corpus from institutional investors and manage the fund.

Alembic Pharmaceuticals: Shares of the company fell 1.67% after the firm received a Form 483 with four procedural observations for from the US drug regulator. The company said that the oncology injectable formulation facility at Panelav was inspected by the United States Food and Drug Administration from October 4 to October 14, 2022.

Tanfac Industries: The chemical manufacturer said its net profit declined 14.97% to Rs 8.52 crore in the quarter ended September 2022 as against Rs 10.02 crore during the same quarter last fiscal. Revenue from operations rose 6.73% to Rs 77.41 crore in the quarter ended September 2022 as against Rs 72.53 crore in the year-ago period.

Polycab India: The company said that its revenue from operations increased 10.8% YoY to Rs 3,332.36 crore. Net profit was up 36.72% year-on-year to Rs 270.45 crore. Meanwhile, EBITDA stood at Rs 417.6 crore in the reported quarter.

Capacite Infraprojects: The company said that it has secured contract worth Rs 150.72 crore from GIFT SEZ. The order pertains to the construction of IFSCA headquarter building in GIFT SEZ. , Rahul Katyal, Managing Director, said, that the new order will help them to further consolidate their position in high growth business.

Transformers & Rectifiers India: The company has received two orders of transformers for total contract value aggregating to Rs 145 crore from Indian firms. With this order, the company’s order book stands at Rs 1,521 crore.

Newgen Software Technologies: Shares of the company jumped 6.62% in intraday trading. Revenue from operations rose to Rs 226.11 crore in Q2FY23 from Rs 185.49 crore in the year-ago period. Profit after tax stood at Rs 30.27 crore in the reported quarter compared with Rs 37.39 crore in the corresponding quarter last fiscal.

PSP Projects: The company shares tumbled 12% after consolidated net profit declined 40.8% YoY to Rs 21.54 crore and revenue from operations fell 7.8% YoY to Rs 359.98 crore in Q2FY23.

Heritage Foods: The company said its net profit declined 41.87% YoY to Rs 19.05 crore in the quarter ended September 2022 and revenue rose 21.76% YoY to Rs 816.15 crore in the reported quarter.

J Kumar Infraprojects: The company said that Income Tax Department conducted search under Section 132 of the Income Tax Act, 1961, at its corporate office, residence of promters and at site offices of the company from October 11 to October 17, according to its exchange filing. The company said that it extended full co-operation to the authorities and it is committed to work with them to address their concerns.

63 Moons Technologies: The company said it has incorporated a new step down subsidiary in Dubai effective from October 14. The company’s subsidiary, Tricker, has incorporated a wholly-owned subsidiary – Three O Verse Global IT Services LLC – in Dubai, UAE. Three O Verse Global IT Services will carry on the business of Web 3.0 ecosystem technology solutions.