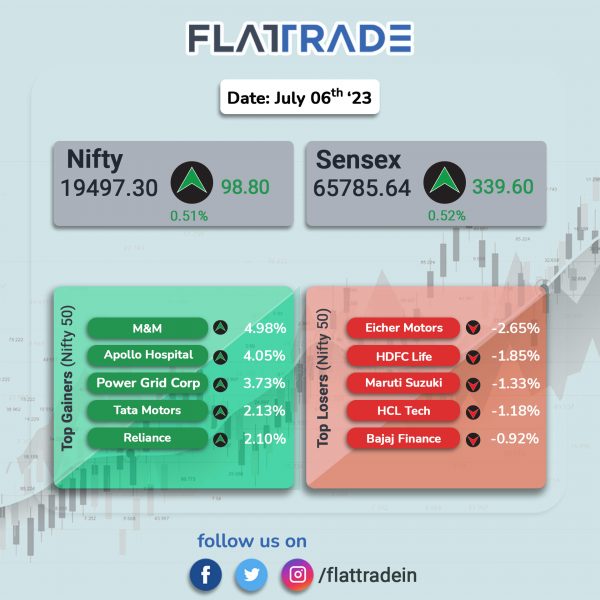

Dalal Street ended higher, helped by strong foreign buying and positive domestic cues. The Sensex rose 0.52% and the Nifty 50 index gained 0.51%.

In broader markets, the Nifty Midcap 100 index jumped 0.97% and the BSE Smallcap was up 0.67%.

Top gainers were Realty [2.25%], Energy [2.16%], Oil & Gas [1.89%], Media [1.71%], and Auto [1.12%]. Top loser was IT [-0.12%].

Indian rupee weakened by 28 paise to close at 82.51 against the US dollar on Thursday.

Stock in News Today

Reliance Jio Infocomm: Reliance Industries’ telecom arm is likely to finalise a $1.7 billion deal with Finland-based Nokia to buy 5G network equipment, The Economic Times (ET) reported citing sources. This new deal is in addition to the $2.1 billion worth of 5G equipment deal signed with Sweden’s Ericsson. The deals will help Jio’s plans of rolling out 5G services across the country by the end of this year, the report said.

Adani Green Energy: In a regulatory filing, the company said that the board has approved raising of funds by issuance of equity shares of face value of Rs 10 each for an aggregate amount up to Rs 12,300 crore through qualified institutional placement (“QIP”). The fundraising is subject to the receipt of the necessary approvals from shareholders and regulatory authorities.

BSE: The board of directors has approved a share buyback of up to Rs 375 crore via tender route. The buyback has been approved at Rs 816 per share. The company said it will buyback 4,593,137 equity shares, representing 3.39% of the total number of equity shares in the total paid-up capital. Buybacks are seen as a tax-efficient way to give cash back to investors.

JSW Steel: The steel major said that its consolidated crude steel production in Q1FY24 stood at 6.43 million tonnes, registering a growth of 11% from 5.77 million tones in Q1FY23. JSW Steel achieved combined production of 6.61 million tones in the quarter ended June 2023, up 12% YoY. The company’s Indian operations in Q1FY24 were at 6.19 million tones, up 10% YoY.

Puravankara: The company said its sales value zoomed 119% to Rs 1,126 crore in Q1FY24 from Rs 513 crore recorded in Q1FY23. Volumes jumped by 97% YoY to 1.36 million square feet (msft) while realization rose by 11% YoY to Rs 8,277 per square feet in Q1FY24. Customer collections from the real estate business increased to Rs 696 crore in Q1FY24 as against Rs 458 crore in Q1FY23.

Hatsun Agro Product: The company’s board has approved the sale of windmill division of the company to V.K.A. POLYMERS at a consideration of Rs 135 crore on slump sale basis. The slump sale will be executed on or before September 30, 2023.

G M Breweries: The company reported 23.21% rise in net profit to Rs 19.91 crore on 5.09% increase in revenue from operations to Rs 579.39 crore in Q1FY24 over Q1FY23. Total expenses rose 4.27% year on year to Rs 553.85 crore in Q1FY24.

Hindustan Zinc: The company said its board will meet on Saturday, 8 July 2023, to consider interim dividend on equity shares, if any, for the FY24. The record date for eligibility of interim dividend, if any so declared will be Saturday, 15 July 2023. Hindustan Zinc, a Vedanta Group company, is an integrated producer of zinc, lead and silver. As of March 2023, Vedanta held 64.92% stake in the company.

Premier Explosives: The company has received orders from Ministry of Defence, and Bharat Dynamics aggregating to Rs 86.51 crore. The order received from Ministry of Defence, Air HQ (Vayu Bhawan), New Delhi involves supply of 50 mm MTV flares for Rs 76.78 crore. The order bagged from Bharat Dynamics entails supply of booster grains for Rs 9.73 crore. Both the orders are to be executed within 12 months.

Waaree Renewable Technologies: The company has received a work order for turnkey engineering, procurement and construction (EPC) services for setting up of a solar power project of 100 MWp capacity. The scope of the aforementioned project also involves providing operation and maintenance services for a period of five years. The project is expected to be completed this fiscal, subject to the terms and conditions of the order.

Ajmera Realty & Infra India: The company said that it has recorded sales value of Rs 225 crore in Q1FY24, down 44% as compared with sales value of Rs 400 crore in Q1FY23. The carpet area sold declined 14% to 1,35,460 square feet (sq. Ft.) in Q1FY24 from 1,57,438 sq.ft. in Q1FY23. Collections tumbled 47% YoY to Rs 111 crore in Q1FY24 over Q1FY23.

Marico: The FMCG major said that its India business reported low-single digit volume growth in Q1FY24 due to significant trade de-stocking in Saffola edible oils and channel inventory adjustments in core portfolios. Marico said that the demand trends in the sector remained stable during the quarter, although signs of improvement on a sequential basis were not clearly visible. While urban markets were steady, the anticipated pickup in rural demand remained elusive.

RPP Infra Projects: The company announced that it has received letters of acceptance for new orders worth approximately Rs 289.30 crore. Further, the company said its order book as on June 30, 2023, stood at Rs 3,240 crore.