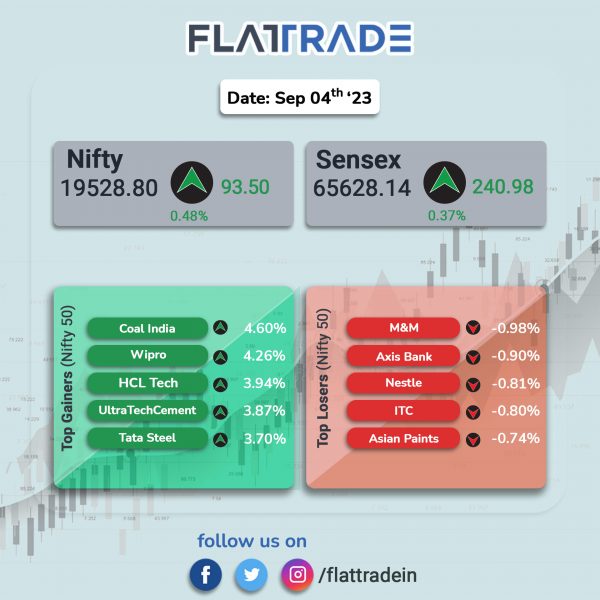

Dalal Street rose on Monday due to positive global cues as investors were hopeful that the Fed would pause rate hikes in September following a rise in August’s unemployment rate in the US. The Sensex rose 0.36% and the Nifty jumped 0.48%.

In broader markets, the Nifty Midcap 100 jumped 0.98% and the BSE Smallcap rose 0.84%.

Top gainers were PSU Bank [2.43%], Metal [2.28%], IT [2.06%], Media [1.59%], and Realty [1.14%]. Top loser was FMCG [-0.13%], while other indices closed in the green.

The Indian rupee lost 2 paise to end at 82.74 against the US dollar on Monday.

Stock in News Today

Reliance Jio: The telecom arm of Reliance Industries Jio Infocomm, is in talks to raise up to $2 billion in offshore loans, with BNP Paribas acting as lead arranger, to fund the purchase of 5G network gear from Ericsson, the Economic Times reported, citing sources. BNP Paribas is expected to loan $1.9 billion-$2 billion over a nine-month period, and the loan amount will be used pay back Ericsson, BNP and some other banks, the newspaper said, citing sources.

Bharti Airtel: The telecom company announced that it will purchase 23,000 MWh of renewable energy by Q4FY24 for its data center company, Nxtra. Airtel will acquire stakes in the renewable energy project companies established by Continuum Green India Pvt. Ltd. and Vibrant Energy Holdings Pte. Ltd. to power six of Nxtra’s Edge data center facilities.

InterGlobe Aviation (IndiGo): The company reported that IndiGo announced the approval of the placement of an order for an additional 10 A320 NEO aircraft with Airbus. The company will also execute an Amendment Agreement to the Purchase Agreement. Separately, InterGlobe Aviation announced the formation of a wholly-owned subsidiary (WOS) with an investment of up to Rs 30 crore for financing aviation assets.

Nazara Technologies: The company announced that its board has approved preferential allotment of equity shares to Kamath Associates & NKSquared to raise funds aggregating up to Rs 100 crore. The company is proposing to issue 14,00,560 equity shares of face value of Rs 4 each at a price of Rs 714 per equity share aggregating to Rs 999,999,840, proportionately to Kamath Associates & NKSquared. As per the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements), Regulations, 2018, these equity shares will be locked in for a period of 6 months from the date of issue. The company said that the fresh funds will be utilized to invest in funding requirements and growth objectives of the company, including for making strategic acquisitions and investments in various entities.

Adani Ports and SEZ: The company said that it has handled cargo volumes of 34.2 million metric tonnes (MMT) in August 2023, a rise of 17% YoY. The company said that growth in cargo volumes was supported by solid growth in containers (+27.6%) and liquids & gas (+69%) cargo types. The company’s flagship port Mundra recorded its highest-ever monthly cargo volume of 15.32 MMT. During the initial five months (April-August) of FY24, APSEZ has handled 169.6 MMT of total cargo, a 12% YoY growth.

NBCC (India): The company has received a work order from Indian Government Mint aggregating up to Rs 20 crore. The order entails planning, designing and execution of structural and non-structural repairs at factory premises along with renovation works & structural and non-structural repairs of residential quarters at Mint premises. The order also includes construction of transit camp at Mint Colony, Parel, Mumbai.

Bharat Heavy Electricals (BHEL): The PSU company has secured a 2,880 MW hydropower order for Dibang Multipurpose Project from NHPC. The order entails design, engineering, manufacture, supply, erection and commissioning of the electro-mechanical package.

KPI Green Energy: The company announced that it has received new order for executing solar power project of 9 MW capacity from Gujarat Polyfilms Pvt. Ltd. under ‘Captive Power Producer (CPP)’ segment of the company. The project is scheduled to be completed in the fiscal 2024.

One 97 Communications (Paytm): The company said that it has launched a Card Soundbox for merchants to accept mobile and card payments. With this, the company empowers merchants to accept both mobile and card payments across all Visa, Mastercard, American Express and RuPay networks through its Soundbox.

Paras Defence And Space Technologies: The company said it has re-appointed Munjal Shard Shah as Managing Director and Shilpa Amit Mahajan as Whole-Time Director.

Shakti Pumps: The company announced that it has received a patent for inventing the S4RM high starting torque direct line operated energy-efficient motor. The patent will be valid for 20 years from the date of filing.

Shilpa Medicare: The pharma company announced that its subsidiary, Shilpa Pharma Lifesciences’ API manufacturing facility at Raichur in Karnataka has cleared PMDA (Pharmaceuticals and Medical Devices Agency) Japan, good manufacturing practice (GMP) inspection. The inspection had concluded successfully on 1 September 2023 without any critical or major observation, it added. The facility is involved in manufacturing various oncology and non‐oncology APIs. Meanwhile, Shilpa Medicare informed that it has received marketing authorization from Medicines and Healthcare Products Regulatory Agency (MHRA), UK, for Betahistine Dihydrochloride Orodispersible Films, 24 mg.

Maharashtra Seamless: The company said that it has received orders totalling Rs 157 crore from Oil India and IOCL for supply of seamless pipes. Of the total value, orders worth Rs 106 crore are from Oil India and Rs 51 crore is from IOCL. The delivery locations for the seamless pipes are Assam and Haryana.

Caplin Point Laboratories: The pharmaceutical firm announced that its subsidiary, Caplin Steriles has received establishment inspection report (EIR) from the US drug regulator for its injectable and ophthalmic manufacturing unit located at Gummidipoondi, Chennai. The unit underwent an inspection from the United States Food and Drug Administration (US FDA) during 22 May-31 May and the inspection classification was determined by the agency as Voluntary Action Indicated (VAI).

Jubilant Ingrevia: The company said that CRISIL Ratings has reaffirmed its ‘CRISIL A1+’ rating on the commercial paper programme of the company. CRISIL said that the rating continues to reflect the healthy business risk profile of the company, supported by its leading market position across most products, vertically integrated operations, and diversified revenue profile across business segments, geographies and end-user industries.

MOIL: Shares of the company rose after the company said that it has produced 1.23 lakh tonnes of manganese ore in August 2023, registering a growth of 53% on YoY basis. Cumulative production for the financial year up to August 2023 has been 6.79 lakh tonnes, which is higher by 44% on YoY basis. MOIL’s sales for the month of August 2023 aggregated to 1.11 lakh tones, which is more than double than that recorded in August 2022.