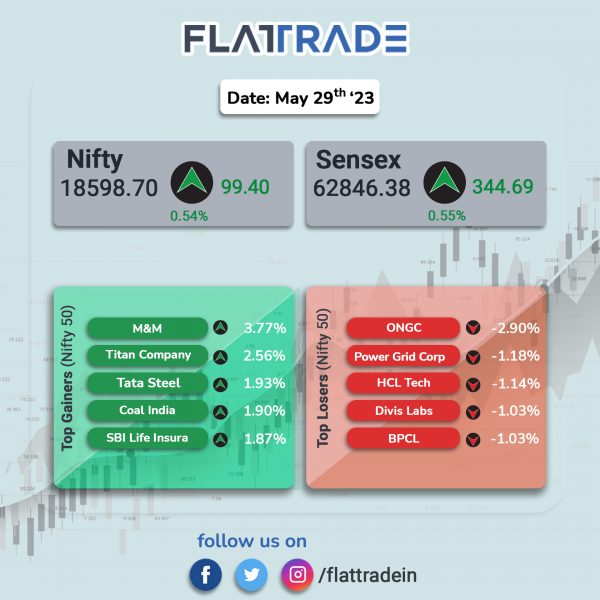

Benchmark equity indices rallied on Monday tracking positive global cues after the US debt ceiling deal boosted investor sentiments. The Sensex rose 0.55% and the Nifty 50 index gained 0.54%.

In broader markets, the Nifty Midcap 100 index was up 0.38% and the BSE Smallcap index rose 0.3%.

Top gainers were Metal [0.94%], Financial services [0.84%], Realty [0.77%], Bank [0.67%], and Auto [0.63%]. Top losers were Oil & Gas [-0.54%] and IT [-0.39%].

Indian rupee fell 6 paise to 82.63 against the US dollar on Monday.

Stock in News Today

ICICI Bank: The private sector lender’s board has approved to raise its stake in ICICI Lombard General Insurance Company by up to 4% in multiple tranches, and makes the general insurance company its subsidiary. ICICI Bank already holds 48.02% stake in the general insurer, and it plans to acquire at least 2.5% of the 4% before September 9, 2024. The board has also approved the re-appointment of Sandeep Batra as executive director of the bank for a period of two years with effect from 23 December 2023 to 22 December 2025, subject to RBI approval.

Larsen & Toubro (L&T): The company announced the formation of a Green Energy Council to achieve carbon neutrality by 2040. L&T Green Energy Council, which is a think-tank, will focus on building a global green energy business for the company. Eicke R. Weber, Bart Biebuyck, Dr. Christopher Hebling and Patrice Simon will form the L&T Green Energy Council.

Ipca Laboratories: The company’s consolidated net profit tumbled 41.24% to Rs 76.52 crore in Q4FY23 from Rs 130.23 crore in Q4FY22. Revenue from operations increased 17% to Rs 1,511.63 crore during the quarter under review from Rs 1,289.10 crore in the corresponding quarter last year. Ebitda before forex declined 12% to Rs 206.92 crore in Q4FY23 from Rs 236.05 crore posted in Q4FY22. On full year basis, the company reported 47% decline in net profit to Rs 471.32 crore despite of a 7% increase in net sales to Rs 6,244.32 crore in the financial year ended 31 March 2023 over the financial year ended 31 March 2022.

Balkrishna Industries (BKT): The company’s standalone net profit declined 31.6% to Rs 255.55 crore in Q4FY23 as compared with Rs 373.69 crore in Q4FY22. Net sales fell 2.4% YoY to Rs 2,317.63 crore in Q4FY23. Ebitda fell 14% to Rs 494 crore in Q4FY23 from Rs 576 crore in Q4FY22. Meanwhile, the board declared final dividend of Rs 4 per equity share for FY23, subject to approval of the shareholders. The company’s standalone net profit declined 23.5% to Rs 1,078.71 crore in FY23 as compared with Rs 1,410.69 crore in FY22. Net sales increased 18.7% year on year to Rs 9,810.52 crore in FY23 over FY22. Shares fell 7.64% on Monday.

Aurobindo Pharma: The drugmaker reported 12.2% decline in consolidated net profit to Rs 505.91 crore in Q4FY23 as against Rs 576.14 crore reported in Q4FY22. Revenue from operations rose 11.4% YoY to Rs 6,472.96 crore in the quarter ended March 2023. Ebitda (before forex and other income) increased by 2.9% YoY to Rs 1,002.2 crore in the quarter under review. On full year basis, the company’s net profit slumped 27.2% to Rs 1,927.65 despite 5.4% rise in revenue from operations to Rs 24,617.13 crore in FY23 over FY22.

JK Cement: The company’s consolidated net profit tumbled 44.2% to Rs 112.27 crore in Q4FY23 from Rs 201.13 crore recorded in Q4FY22. Revenue from operations grew by 18.1% YoY to Rs 2,777.88 crore in the quarter ended March 2023. The company’s operating margin reduced to 12.60% in Q4FY23 as against 16.09% reported in Q4FY22. Net profit margin slipped to 3.91% in Q4 FY23 as compared to 8.10% registered in Q4 FY22. Meanwhile, the firm’s board has recommended a dividend of Rs 15 per equity share for FY23, subject to approval of the shareholders at the AGM. On full year basis, the company’s consolidated net profit declined 38% to Rs 426.33 crore despite of 21.6% rise in revenue to Rs 9,720.20 crore in FY23 over FY22.

Barbeque-Nation Hospitality: The company reported a consolidated net loss of Rs 11.82 crore in Q4FY23 as compared with a net loss Rs 0.06 crore in Q4FY22. Net sales rose 11.6% YoY to Rs 280.23 crore in Q4FY23. Ebitda stood at Rs 421 crore in Q4FY23, declining 16.5% as compared with Rs 504 crore posted in corresponding quarter last year. On full year basis, the company reported consolidated net profit of Rs 17.02 crore in FY23 as compared to net loss of Rs 25.60 crore in FY22. Net sales jumped 43.4% year on year to Rs 1,233.76 crore in FY23.

During the year, the company added 39 new restaurants resulting in total count of 216. Meanwhile, the board approved further acquisition of 275 equity shares constituting 4.21% paid-up share capital, having face value of Rs 100 each, of Red Apple Kitchen Consultancy (Red Apple), subsidiary of the company, from the existing shareholders of Red Apple for total consideration of Rs 10,06,16,175.

Power Finance Corporation (PFC): The company’s consolidated net profit jumped 45.9% to Rs 4,676.71 crore in Q4FY23 from Rs 3,205.88 crore posted in Q4FY22. The company’s consolidated net profit rose 13.4% YoY to Rs 15,889.33 crore in the year ended March 2023. Total income rose marginally to Rs 77,625.20 crore in FY23 as compared with Rs 76,344.92 crore in FY22. Meanwhile, the board recommended a final dividend of Rs 4.50 per equity share, subject to shareholder’s approval. The record date date for the same is fixed on 16 June 2023.

Ahluwalia Contracts (India): The company’s consolidated net profit soared 70.4% to Rs 72.16 crore on 18.1% jump in revenue from operations to Rs 863.05 crore in Q4FY23 over Q4FY22. For full year, the company’s consolidated net profit rose 25% to Rs 193.98 crore on 5.4% increase in revenue to Rs 2,838.39 crore in FY23 over FY22. Meanwhile, the firm’s board has recommended a final dividend of Re 0.40 paisa per share for FY23, subject to the approval of members at the ensuing 44th AGM.

Engineers India: The company’s consolidated net profit surged 140.3% to Rs 190.18 crore in Q4FY23 as compared with Rs 79.13 crore in Q4FY22. Net sales rose 7.6% YoY to Rs 880.10 crore in Q4FY23. On full year basis, the company’s consolidated net profit surged 148.2% to Rs 346.27 crore in FY23 as compared with Rs 139.52 crore in FY22. Net sales jumped 14.3% year on year to Rs 3330.14 crore in FY23 over FY22. Meanwhile, the board has recommended a final dividend of Rs 1 per equity share for financial year 2022-23, subject to approval of shareholders.

SML Isuzu: The company’s consolidated revenue was up 70% YoY at Rs 583.22 crore in Q4FY23 as against Rs 342.35 crore in Q4FY22. Ebitda stood at Rs 43.25 crore in Q4FY23 as against Rs 2.42 crore in Q4FY22. Consolidated net profit was at Rs 26.79 crore in Q4FY23 as against a net loss of Rs 11.42 crore in Q4FY22.

Bajaj Hindusthan Sugar: The company’s consolidated net profit zoomed 119.21% to Rs 130.91 crore in Q4FY23 as against Rs 59.72 crore posted in Q4FY22. Revenue from operations stood at Rs 2053.87 crore in Q4FY23, registering a growth of 26.65% from Rs 1621.67 crore in the year-ago period. On an annual basis, the firm’s consolidated net loss narrowed to Rs 134.73 crore in FY23 as compared to Rs 267.54 crore posted in FY22. Revenue rose 13.67% year on year to Rs 6338.03 crore in FY23.

Suprajit Engineering: The company’s net profit declined 15.69% to Rs 41 crore in Q4FY23 as compared with Rs 48.63 crore in Q4FY22. Revenue from operations jumped 38.17% to Rs 699 crore in Q4FY23 as against Rs 505.91 crore posted in corresponding quarter last year. On full year basis, the company’s consolidated net profit declined 12.12% to Rs 152.10 crore despite of 49.55% jump in revenue from operations to Rs 2,752.35 crore in FY23 over FY22. Meanwhile, the board recommended a final dividend of Rs 1.25 per equity share for financial year 2022-23.

Greenlam Industries: The company’s consolidated net profit surged 80.6% to Rs 46.16 crore in Q4FY23 from Rs 25.56 crore reported in Q4FY22. Revenue from operations rose 15.2% YoY to Rs 533.81 crore year on year in the quarter ended March 2023. Ebidta in Q4FY23 was at Rs 74.1 crore, up 49.4% from Rs 49.6 crore in Q4FY22. On full year basis, the company’s consolidated net profit jumped 41.5% to Rs 128.42 crore on 18.9% increase in revenue to Rs 2,025.96 crore in FY23 over FY22. The company’s board has recommended a final dividend of Rs 1.50 per equity share for FY23 and the dividend will be paid within 10 days of its approval by the shareholders at ensuing AGM.

NIIT: The company’s revenue was down 35.56% QoQ at Rs 60.05 crore in Q4FY23 as against Rs 93.18 crore in the preceding quarter. EBIT loss stood at Rs 14.82 crore in Q4FY23 as aginst EBIT of Rs 2.7 crore in Q3Fy23. Net loss stood at Rs 9.37 crore in Q4FY23 as against a net profit of Rs 14.29 crore in the previous quarter.

PG Electroplast: The company gas signed a Memorandum of Understanding with Jaina Group to form a joint venture. The joint venture company will initially manufacture Google-certified LED TVs and then other products in the future. The joint venture will be equally owned by PG Electroplast and Jaina Group, with each owning 50% stake.

Nucleus Software Exports: The company’s consolidated revenues was up 34.73% at Rs 206.2 crore in Q4FY23 from Rs 153.04 crore in Q4FY22. Ebitda was up 232.28% YoY at Rs 82.74 crore in Q4FY23 as against Rs 24.9 crore in the year-ago period. Its consolidated net profit was up 269.87% at Rs 67.65 crore as againt Rs 18.29 crore in the year-ago period.