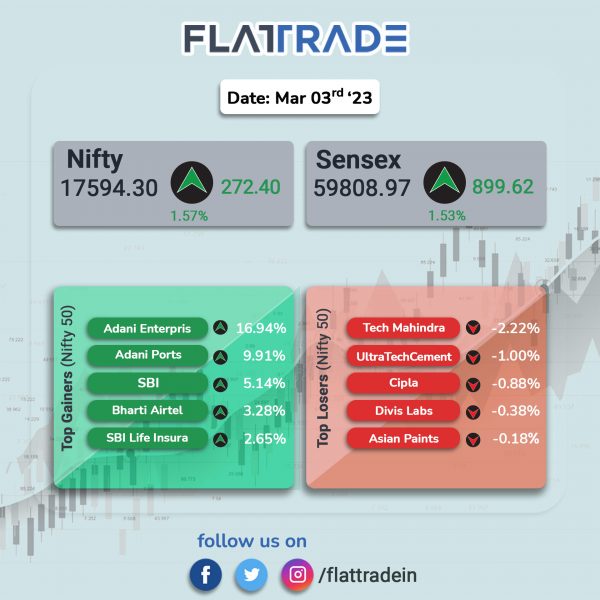

Benchmark stock indices soared, boosted by investor sentiments after Federal Reserve Bank of Atlanta President Raphael Bostic made dovish statements. In addition, the stock market firmed after GQG Partners announced it would iinvest about $2 billion in Adani Group. The Sensex surged 1.53% and the Nifty jumped 1.57%.

In broader markets Nifty Midcap 100 index gained 0.69% and the BSE Smallcap rose 0.68%.

Top gainers were PSU Bank [5.4%], Metal [3.55%], Bank [2.13%], Financial Services [1.77%] and Energy [1.68%]. All Nifty sectoral indices ended in the green.

Indian rupee rose 63 paise to 81.97 against the US dollar on Friday.

The seasonally adjusted S&P Global India Services PMI Business Activity Index rose to 59.4 in February from 57.2 in January. The reading is the highest level in 12 years and indicated a sharp expansion in output. The rise was due to favourable demand conditions and new business gains, the S&P survey said.

Stock in News Today

Reliance Industries (RIL): Mukesh Ambani, Chairman and Managing Director of the company, announced several new investment initiatives in Andhra Pradesh including 10 gigawatts of renewable solar energy in the state. The announcement was made during the Andhra Pradesh Global Investors Summit 2023 in Vishakhapatnam. Reliance has been among the first corporates to believe in the stupendous economic potential of Andhra Pradesh, Ambani added.

Adani Group: The conglomerate will hold fixed-income road shows this month in London, Dubai, and several cities in the United States, according to a document seen by Reuters. The management of the group including group Chief Financial Officer Jugeshinder Singh will attend the road shows which will run between March 7 to March 15, the document showed.

In other news, Adani Group will set up two new cement manufacturing plants, 15,000 MW of renewable power projects and a data centre in Andhra Pradesh as it looks to double down on its presence in the state, Karan Adani said on Friday. The conglomerate plans to double the capacity of the two sea ports it operates at Krishnapatnam and Gangavaram in Andhra Pradesh. Adani made the announcement during the Andhra Pradesh Global Investors Summit and the said investments will be on top of the Rs 20,000 crore already invested in Andhra Pradesh.

HDFC Bank: The lender in an exchange filing said that it has completed the issuance of $750,000,000 Senior Unsecured Reg S US$ bonds under the $ 3 Billion Medium Term Note Programme of the issuer, to overseas investors. The coupon rate is 5.686% and the bonds will be listed on the India International Exchange (IFSC) Limited (India INX) and the NSE IFSC Limited (NSE International Exchange).

Vedanta: The company is in initial talks with at least three banks including Barclays, JPMorgan and Standard Chartered for a loan up to one billion dollar, Bloomberg reported citing sources.

Alembic Pharmaceuticals: Shares the company declined 5% in intraday trade after the company’s board approved impairment charges of Rs 1,150 crore for three of its under-construction manufacturing plants in Gujarat. The company stated that the Covid-19 pandemic caused delays in the USFDA approval for its manufacturing facilities. As a result, the company is concerned that its estimates of cash generation from these facilities will need to be significantly revised downwards, partly due to price erosion in the US generics market and also due to rising global interest rates. Consequently, the Capital Work In Progress (CWIP) amount for these manufacturing facilities is now higher than the amount recoverable. However, share price rebounded from day’s low to close 0.11% lower compared to Thursday’s closing price.

Happiest Minds Technologies: The IT solutions provider announced that its board has approved the issuance of NCDs aggregating to Rs 125 crore on private placement basis in domestic market in three tranches. The funds raised will be utilized towards the general corporate purposes of the company. Happiest Minds will issue 12,500 unsecured, negotiable, redeemable, rated, listed NCDs aggregating to Rs 125 crore having tenure of three years from the date of allotment of each tranche.

Angel One: The broking company said its client base jumped 52.2% to 13.33 million in February 2023 as against 8.76 millions recorded in February 2022. Sequentially, the company’s client base rose by 3.4% from 12.89 million clients in January 2023. Angel’s overall average daily turnover (ADTO) was at Rs 17,57,000 crore in February 2023, up 3.2% MoM and up 97.8% YoY. The company’s ADTO from the F&O segment stood at Rs 17,25,500 crore in February 2023, up 3.2% MoM and up 99.7% YoY. Meanwhile, Cash segment was at Rs 2,700 crore, down 3.9% MoM and down 36.2% YoY. Commodity segment stood at Rs 18,800 crore, up 27.7% MoM and up 100.2% YoY in February 2023.

WPIL: Shares of the company hit an upper circuit of 10% after the company received four letter of acceptance (LoA) from Madhya Pradesh Jal Nigam Maryadit for execution of turnkey project worth Rs 1,225 crore. The turnkey project includes engineering, procurement, construction, testing, commissioning as well as 10 years Operation & Maintenance of Bebus Sunar 2 , Kutne Rajnagar, Lower Narmada and Mann Dam multi village schemes. The order will be completed in 24 months period.

Caplin Point Laboratories: The company’s subsidiary, Caplin Steriles (Caplin), has been granted final approval from the USFDA for its Abbreviated New Drug Application (ANDA) Rocuronium Bromide Injection, which is a a generic therapeutic equivalent version of (RLD), ZEMURON Injection, of Organon USA Inc. According to IQVIATM (IMS Health), Rocuronium Bromide Injection had US sales of about $53 million for the 12-month period ending September 2022.

Kiri Industries: The company said that the Singapore International Commercial Court confirmed $603.80 million as the final value of the company’s stake in DyStar. In a statement filed with the exchanges the company announced that the Singapore International Commercial Court (SICC) confirmed the final value of company’s 37.57% stake in DyStar Global Holdings (Singapore) (DyStar) as $603.80 million as against $481.60 million. The buyout order is to be executed now at the value of $603.80 million by Senda International Capital. Kiri Industries had filed a suit against Senda International Capital regarding its minority stake held in DyStar. Following the suit, the International court had directed Senda to buyout Kiri’s minority stake held in DyStar.

Karnataka Bank: The lender announced that it has appointed Abhishek Sankar Bagchi as chief financial officer (CFO) on contract basis. He was Chief Financial officer and Head Finance at NSDL Payments Bank since September 2017. The lender said that Muralidhar Krishna Rao has demitted the office of chief financial officer of Karnataka Bank on 1 March 2023 upon completion of his term.

Patel Engineering: In an exchange filing, the civil construction firm said that the company and its JV Partners have received letter of award for Rihand Micro Irrigation Project from Department of Water Resources, Madhya Pradesh. The project is expected to be completed within 36 months and the company holds 80% stake in the the JV.

Mastek: The IT company announced the appointment of Vijay Iyer as president of America to lead growth in the region. He will operate out of the US and he will be driving the entire Americas business P&L leveraging Mastek’s differentiated portfolio of offerings in Cloud, Enterprise IT and Digital Engineering and Experience. Prior to joining Mastek, Vijay was an executive at Persistent Systems working as Senior Vice President of their Digital Transformation Consulting and Large Deals Business.

Foseco India: The company said that based on the preliminary assessment, there was no assessed material impact on its operations due to a cyber security incident involving unauthorized access to its IT systems.