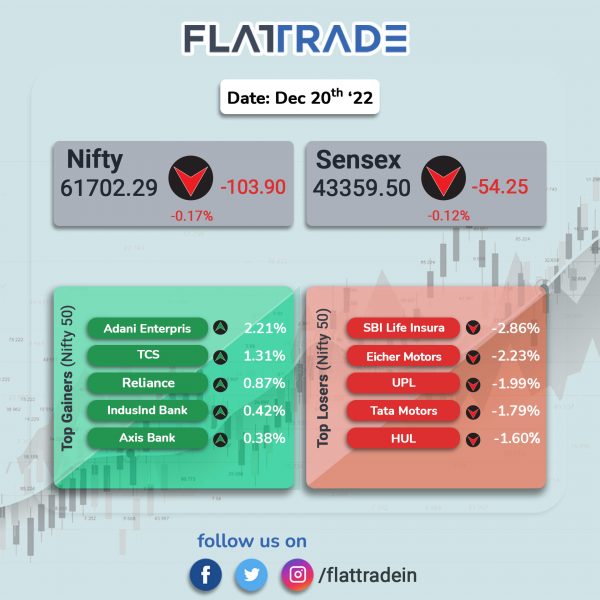

Benchmark equity indices fell as realty, auto and FMCG stocks declined. The Sensex was down 0.17% and the Nifty 50 index closed 0.19% lower.

In broader markets, Nifty Midcap lost 0.22% and the BSE Smallcap slipped 0.02%.

Top losers among Nifty sectoral indices were Realty [-1.21%], Media [-0.81%], Auto [-0.77%], FMCG [-0.62%] and PSU Bank [-0.35%]. Top gainers were Oil & Gas [0.24%] and IT [0.2%].

Indian rupee fell 5 paise to 82.76 against the US dollar on Tuesday.

Stock in News Today

IRCTC: The PSU has exercised the Oversubscription Option to sell an additional two crore shares amounting to 2.5% of the total issued and paid-up equity share capital of the company for the bid received on December15 and 16, according to its exchange filing. The company sold two crore equity shares of face value Rs 2, representing 2.5% of equity to retail and non-retail investors, on December 14. Shares of the company fell 0.4% on Tuesday.

NTPC: The state-owned enterprise added 100MW of capacity after commissioning first part out of the total 300MW Nokhra Solar PV Project at Bikaner, Rajasthan. With this, the standalone installed and commercial capacity of NTPC will be 58,209 MW, while group installed and commercial capacity of NTPC will be 70,824 MW.

Delhivery: The logistics company has acquired 100% shares in Pune-based supply chain software firm Algorhythm Tech for Rs 14.9 crore. The acquisition will be funded from its IPO proceeds and will be completed by January 31, 2023. Delhivery said Algorhythm’s software tools are relevant both as a value added service and to drive cost optimization in service delivery.

Balrampur Chini Mills: The company has commenced commercial production of rectified spirit / industrial alcohol for the additional capacity of 170 kilo litre per day (KLPD) at Balrmapur Unit. With the said addition, the total distillation capacity of the company now stands at 1,050 KLPD, the company said.

Axiscades Technologies: Shares of the company were locked in 5% upper circuit at Rs 317.90 after the company announced the renewal of contract with Airbus for providing engineering services. This contract renewal will entail niche engineering services on product development and plant engineering across fuselage & wings, covering different locations and divisions.

PSP Projects: Shares of the company rose 10% after ratings agency, CARE Ratings, reaffirmed ratings of bank facilities and instruments of the company to CARE A+ with a ‘stable’ outlook. The ratings assigned to the company was on the back of its healthy profitability, low leverage, healthy debt coverage indicators, strong liquidity position, experienced promoters, and increased thrust of government on infrastructure development.

Salasar Techno Engineering: The company has won two orders worth Rs 748.47 crore from Pashchimanchal Vidyut Vitran Nigam (PVVN). One of the orders entails building an electricity distribution circle in Hapur and Bulandshahar district worth Rs 403.85 crore and the other one is worth Rs 344.61 in the district of Meerut and Baghpat. The company said that the aforementioned order win will strengthen its existing orderbook and will be executed in next 24 months. Shares of the company surged over 8%.

Mahanagar Gas: The company has appointed Ashu Shinghal as the new Managing Director in place of Sanjib Datta, the incumbent Managing Director of the company. Earlier, Shinghal was the additional executive director of the company.

Capacite Infraprojects: The company said it has received a contract worth Rs 117.20 crore (excluding GST and Labour Cess) from DLF, for the construction of the proposed mall ‘DLF Avenue’ in Panji Goa. Shares of the firm rose 6.72 in intraday trade.

Intellect Design Arena: The company’s consumer banking arm, Intellect Global Consumer Banking (iGCB), announced that a new Ethiopian bank has chosen its product Intellect Digital Core (IDC) to power its banking. IDC has been recognized as the number one platform in Retail banking as per IBS Intelligence in 2022. Intellect Digital Core, the comprehensive core banking platform would implement core products like Savings and Deposits, Loans, Payments, Trade Finance, Treasury, Branch & Agent Banking, as well as Digital Channels and Wallet for the bank.