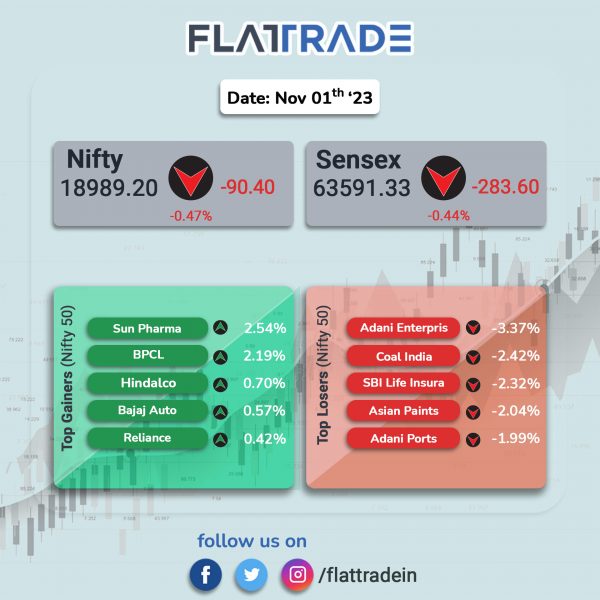

Equity benchmark indices extended losses as investors remained cautious ahead of the Federal Reserve’s monetary policy outcome. The Sensex fell 0.44% and the Nifty dropped 0.47%.

In broader markets, the Nifty Midcap 100 was down 0.26% and the BSE Smallcap ended 0.09% lower.

Top losers were Metal [-1.43%], IT [-0.78%], Auto [-0.51%], Private Bank [-0.47%], and FMCG [-0.34%]. Top gainers were Realty [1.55%], Media [0.88%], Pharma [0.35%], PSU Bank [0.32%], and Oil & Gas [0.22%].

The Indian rupee depreciated by 3 paise to 83.29 against the US dollar on Wednesday.

India’s manufacturing activity, measured by Manufacturing Purchasing Managers’ Index (PMI), fell to 55.5 in October 2023 from 57.5 in September 2023, according to credit rating agency S&P Global.

The gross GST revenue collected in October 2023 stood at Rs 1,72,003 crore out of which Rs 30,062 crore is CGST, Rs 38,171 crore is SGST, Rs 91,315 crore is IGST and Rs 12,456 crore is cess. The government has settled Rs 42,873 crore to CGST and Rs 36,614 crore to SGST from IGST.

Stock in News Today

Sun Pharmaceuticals: The drugmaker said that its net profit rose 5% YoY to Rs 2,375.51 crore and revenue from operations increased 11.32% YoY to Rs 12,192.41 crore in Q2FY24. In Q2FY24, Ebitda grew 7.5% YoY to Rs 3,179.4 crore, while Ebitda margin slipped to 26.1% from 27% for Q2FY23. India formulation sales accounted for about 32% of total consolidated sales. Meanwhile, US formulation sales stood at $430 million for Q2FY24, a growth of 4.2% YoY and accounted for about 30% of total consolidated sales for the quarter.

Maruti Suzuki India (MSI): The company reported its highest-ever monthly sales at 1,99,217 units in October, a 19% YoY growth from 1,67,520 units sold in October 2022. Its domestic sales in October was at 1,77,266 units, up 21% from 1,47,072 units in the year-ago period. MSI said its exports in October 2023 rose to 21,951 units from 20,448 units in the same month last year.

Hero MotoCorp: The two-wheeler manufacturer reported a 26% rise in its sales at 5,74,930 units in October from 454,582 units sold in th eyear-ago period. Out of the total, domestic sales were 559,766 units and total exports were 15,164 units. In the first 10 months of the year, the company reported a sale of 33 lakh vehicles.

Ambuja Cements: The company said its consolidated net profit rose multifold times to Rs 987.24 crore in Q2FY24 from Rs 51.30 crore recorded in Q2FY23. Revenue from operations grew by 4.1% YoY to Rs 7,423.95 crore in the quarter ended September 2023. Ebitda surged to Rs 1,302 crore in Q2FY24 from Rs 327 crore in Q2FY23. Ebitda margin improved to 17.5% in Q2FY24 as compared to 4.6% recorded in the year-ago period. The company’s sales volume stood at 13.1 million tons during the quarter, up 2.34% YoY from 12.8 million tons reported in the same period a year ago.

REC: The state-rum company said that its net profit rose 38% YoY at Rs 3773 crore in Q2FY24 as against Rs 2728 crore in Q2FY23. Total income more than doubled to Rs 4188 crore in Q2FY24 from Rs 1915 crore in Q2FY23. Interest income increase to Rs 11,213 crore in Q2FY24 from Rs 9,534 crore in Q2FY23. Disbursements surged 133% to Rs 41,598 crore in Q2FY24 from Rs 17,827 crore in Q2FY23. The company’s board has approved an interim dividend of Rs 3.50 per share.

Indraprastha Gas Limited (IGL): The company reported a consolidated net profit of Rs 552.67 crore in Q2FY24, a jump of 29.47% from Rs 426.84 crore in the same quarter last year. The revenue from operations for Q2FY24 stood at Rs 3,822.53 crore compared to Rs 3,922.02 crore in Q2FY23, registering a fall of 2.53%. The company announced an interim dividend of Rs 4 per share.

Tata Motors: The auto major’s domestic and international sales for October 2023 stood at 82,954 vehicles, up 5.9% compared to 78,335 units sold in October 2022. The company’s total domestic sales grew by 6% to 80,825 units in October 2023 from 76,537 units sold in the same period last year. Total commercial sales rose 4% YoY to 34,317 units sold in October 2023.

Bajaj Auto: The company announced total sales of 4,71,188 units in October 2023, a 19% YoY rise from 3,95,238 units sold in October 2022. In two-wheeler segment it sold 2,78,486 units in October 2023, up 35% from 2,06,131 units sold in October 2022. Exports fell by 7 percent to 1,41,570 units from 1,52,321 units YoY.

Adani Ports and SEZ: The company’s wholly owned subsidiary, Adani Logistics, subscribed to a 50% stake in Veracity Supply Chain Private, which was incorporated on Oct. 31, 2023. VSCPL was incorporated to provide last-mile connectivity to customers from ICDs powered by a digital transport management system. The cost of acquisition stood at Rs 5 lakhs.

Adani Wilmar: The company reported a consolidated net loss of Rs 131 crore in Q2FY24 as compared with net profit of Rs 49 crore in Q2 FY23. The decline in net profit was due to losses in the edible oil segment. Revenue from operations dropped 13% to Rs 12,267 crore in Q2FY24 from Rs 14,150 crore in Q2FY23. Ebitda stood at Rs 144 crore, registering a de-growth of 43% YoY. Its volume grew 11% YoY in Q2FY24, supported by gradual improvement in consumer demand, lower edible oil prices, and efficient supply chain.

RattanIndia Enterprises: Shares of the company zoomed 10.5% in intraday trade after the company received DGCA’s certification for its drone product. The company announced that its step-down subsidiary, Throttle Aerospace Systems (TAS), received type-certification for its drone product, DOPO, from the Directorate General of Civil Aviation (DGCA). DOPO is a multipurpose drone, and with this type of certification, it can be deployed across multiple industries like survey, mapping, inspection, agriculture, surveillance, and disaster management.

Marksans Pharma: Shares of the company jumped over 6% after the company announced the successful inspection of its newly-acquired facility in Goa by the German health authorities. The company in a stock exchange filing stated that the German authorities did not find any critical or major observations. However, the authorities highlighted a few minor points, which Marksans Pharma said it is committed to implementing immediately.

Mahindra & Mahindra Financial Services: The NBFC announced a strategic co-lending partnership with State Bank of India (SBI), India’s largest public sector bank. The co-lending model is designed to harness the distribution strength of NBFC and the cost-efficient capital of banks, ensuring wider outreach and better interest rates for customers, the company said in a press release.

Bank of Baroda: The public sector lender said that Akhil Handa, who was heading the digital lending business, has resigned from his duties. The lender said that Kadgatoor Sheetal Venkatesmurt will take over the charge along with her existing responsibilities as the head of digital channels and operations.

Power Mech: The company has bagged an order worth Rs 355 crore from Bharat Heavy Electricals (BHEL). The order entails erection, commissioning and trial at the BHEL client’s stores or storage yard, transportation to the site and handing over of the boiler and its auxiliaries, power cycle piping, and steam turbine generators of units 1 and 2 at 2×660 MW NTPC, Talcher, Odisha.

Nuvoco Vistas: The company’s consolidated net revenue was up 7.2% at Rs 2,573 crore in Q2FY24 as against Rs 2,401 crore in Q2FY23. Its consolidated Ebitda was up 71.8% to Rs 330 crore in Q2FY24 as against Rs 192 crore in Q2FY23. Consolidated net profit stood at Rs 1.5 crore in Q2FY24 as against a reported loss of Rs 130.4 crore in Q2FY23.

Jindal Steel and Power: The company’s consolidated revenue fell 9.4% to Rs 12,250.2 crore in Q2FY24 from Rs 13,521.4 crore in Q2FY23. Its consolidated Ebitda was up 18.35% at Rs 2,285.7 crore in Q2FY24 as against Rs 1,931.4 crore in Q2FY23. The company’s net profit rose multifold times to Rs 1,390.1 crore in Q2FY24 from Rs 219.3 crore in Q2FY23.

Max Financial Services: The company’s revenue from operations stood at Rs 10,164.62 crore in Q2FY24, up 9.11% from Rs 9,316.09 crore in Q2FY23. The company’s net profit at Rs 147.89 crore in Q2FY24, up 188.34% from Rs 51.29 crore in Q2FY23. Its Ebitda stood at Rs 168.38 crore in Q2FY24, up 99.34% from Rs 84.47 crore in Q2FY23. The company’s EPS increased to Rs 4.29 in the quarter ended September 2023 from Rs 1.49 in the quarter ended September 2022.

Gravita India: The company’s consolidated revenue was up 22.5% YoY to Rs 836 crore in Q2FY24 from Rs 683 crore in Q2FY23. Consolidated Ebitda rose 23.7% at Rs 72.6 crore in Q2FY24 from Rs 58.7 crore in Q2FY23. Consolidated net profit jumped 30.8% to Rs 58.8 crore in Q2FY24 from Rs 45 crore in Q2FY23.

Aster DM Healthcare: The company’s wholly owned subsidiary, Aster DM Healthcare (Trivandrum), launched a 506-bed multispecialty hospital at Whitefield, Bengaluru, on October 31. The new hospital will offer Aster’s Centres of Excellence in Oncology, Cardiac Sciences, Neurosciences, Astroenterology, Women and Child Care, among other medical services.

Oberoi Realty: The company’s wholly owned subsidiary, Sight Realty, has executed a share purchase agreement and divested its entire 33% stake in JV Metropark Infratech and Realty Developments for a consideration of Rs 55.19 lakh. The buyer, Dipak Sharma, is an existing shareholder of the JV.

Birlasoft: The mid-tier IT firm reported a 5.5% sequential rise in net profit at Rs 145.1 crore, while profits rose by 26.1% YoY. Revenue from operations stood at Rs 1309.9 crore, a 3.7% QoQ rise and 9.9% YoY basis. Ebitda margin expanded 52 bps QoQ basis to 15.8% and 111 bps on YoY basis. The company has approved an interim dividend of Rs 2.5 per share with a face value of Rs 2 each for FY24. The company also appointed Satyavati Berera as an independent director, not liable to retire by rotation. The appointment is for a period of five years, effective Oct. 31, 2023.

Inox Wind Energy (IWEL): The company said it has successfully raised Rs 800 crore through sale of equity shares of Inox Wind (IWL) via block deals on the stock exchanges. The transaction witnessed strong participation from long-only domestic and foreign institutional investors. The funds raised by IWEL will be infused into IWL and utilized for the repayment of IWL’s external debt, marking a significant step towards achieving a net-debt free status.

Tata Consumer Products: The company’s board approved the amalgamation of three subsidiaries–NourishCo Beverages, Tata SmartFoodz, and Tata Consumer Soulfull with itself. L. Krishnakumar, the Executive Director and Group CFO, resigned effective the close of business hours on October 31. Navaneel Kar, President and Head of India Sales, submits his resignation w.e.f. November 17. Senior CP of Strategy and M&A Punit Gupta will assume the role of Head of Sales India.

ITC: The company has acquired 2,286 equity shares of Rs 10 each of Delectable Technologies Private Limited. With this acquisition, the company’s shareholding in Delectable aggregated to 39.32% of its share capital on a fully diluted basis.

India Cements: The company’s consolidated net loss in the quarter ended September 30 stood at Rs 85.54 crore, as compared to Rs 121.1 crore in the same quarter last year. The revenue from operations for Q2FY24 stood at Rs 1,264.39 crore, compared to Rs 1,327.06 crore in the year-ago period. The total income for Q2FY24 fell 4.9% to Rs 1,272.41 crore compared to Rs 1,337.70 crore in the year-ago period.

Gujarat Ambuja: The company reported a consolidated revenue of Rs 1116 crore, up 3.5% from Rs 1078 crore in Q2FY23. Consolidated Ebitda rose 10.2% to Rs 103.3 crore in Q2FY24 from Rs 93.7 crore in Q2FY23. Consolidated net profit rose 29.1% to Rs 82.8 crore in Q2FY24 from Rs 64.1 crore in Q2FY23.

Jubilant Ingrevia: The company’s consolidated revenue declined 21.8% to Rs 1020 crore in Q2FY24 from Rs 1304 crore in Q2FY23. Consolidated Ebitda was down 23% at Rs 118 crore as against Rs 153 crore in Q2FY23. Consolidated net profit dropped 31.8% to Rs 58 crore in Q2FY24 from Rs 84 crore in Q2FY23.

Blue Jet Healthcare: The company had a strong stock market debut. Shares of the company got listed at Rs 380 apiece on NSE as against an issue price of Rs 346. The shares hit a high of Rs 417.95 and closed at Rs 413.4 per share.