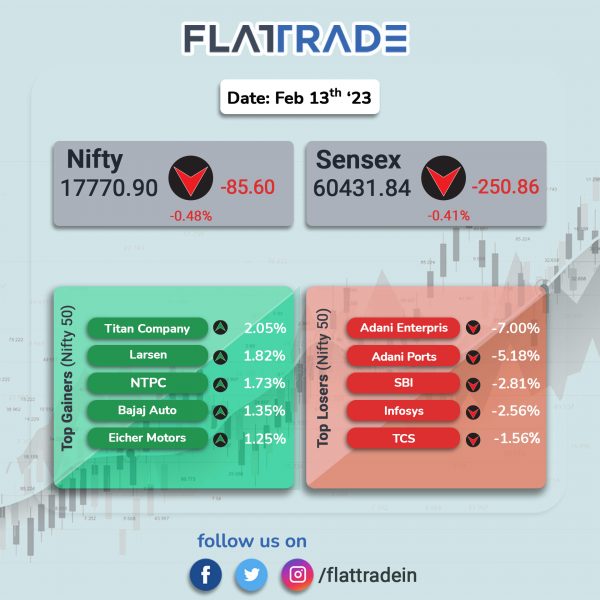

Benchmark stock indices fell as investors remained cautious ahead of the key inflation data in India and the US. Losses in IT and PSU Bank stocks weighed on the indices. The Sensex fell 0.41% and the Nifty was down 0.48%.

Broader markets underperformed headline indices. The Nifty Midcap 100 tanked 1.5% and the BSE Smallcap slumped 1.17%.

Top losers were PSU Bank [-2.52%], Media [-2.45%], IT [-1.88%], Realty [-1.68%] and Metal [-1.19%]. Except FMCG [0.04%] index, other indices among Nifty sectoral indices ended in the red.

Indian rupee fell 22 paise to 82.72 against the US dollar on Monday.

India’s foreign exchange reserves dropped by $1.494 billion to reach $575.267 billion as of February 3, RBI data showed. In the previous reporting week, the overall reserves had jumped by $3.03 billion to $576.76 billion. In October 2021, the country’s forex had reached an all-time high of $645 billion.

Direct Tax collections up to 10th February, 2023, showed that gross collections stood at Rs. 15.67 lakh crore which is 24.09% higher than the gross collections for the corresponding period of last year.

Stock in News Today

JSW Steel: The company reported a 15% rise in crude steel production at 18.91 lakh tonnes in January. The company’s crude steel production was at 16.46 lakh tonnes (LT) in January 2022. The production of its flat-rolled products increased by 14% to 14.24 LT over 12.47 LT in January 2022. Its output of long-rolled products also registered a growth of 14% YoY to 4.25 LT in January 2023. The overall capacity utilisation was higher at 99% in January 2023 from 96% in December 2022.

Vodafone Idea (VIL): The telcom company has started fresh talks with key lenders, including State Bank of India, Punjab National Bank and HDFC Bank, to refinance Rs 3,000-4,000 crore of loans, Economic Times reported citing bankers familiar with the matter. Refinancing of some debt will help free up cash for Vi, which urgently needs to pay substantial vendor dues – to tower companies like Indus Towers and network equipment makers such as Ericsson and Nokia.

Balkrishna Industries: Shares of fell 11.6% in intraday trading after the tyre firm’s consolidated net profit for the October-December quarter dropped 68% YoY to Rs108.38 crore from Rs 339 crore in the corresponding period last year. Its revenue from operations increased marginally by around 6% to Rs 2,165.57 crore in Q3FY23 as against Rs 2,045.81 crore in Q3FY22. EBITDA stood at Rs 314.26 crore, falling 44.84% from Rs 569.69 crore in the year-ago period.

Godrej Industries: The company’s net profit more than doubled Rs 314.6 in Q3FY23 as against Rs 144.4 in Q3FY22. Revenue was up 9.1% to Rs 3,842.6 crore in Q3FY23 as against Rs 3,514.6 crore in Q3FY22. EBITDA rose 53.9% YoY to Rs 373.2 crore in Q3FY23 as against Rs 242.5 crore in Q3FY22.

Fortis Healthcare: The company reported a 11% YoY rise in consolidated net profit to Rs 129.56 crore in Q3FY23 and a 6.4% YoY rise in revenue from operations of Rs 1559.88 crore in Q3FY23. Revenue from the Hospitals business rose by 13.3% YoY to Rs 1,267.4 crore, while net Diagnostics revenue declined by 11% YoY to Rs 292.4 crore in the quarter ended December 2022. EBITDA fell 1.9% to Rs 288.1 crore in Q3 FY23 from Rs 293.6 crore in Q3 FY22. Average revenue per occupied bed was Rs 2.02 crore, up 8.4% YoY and Average length of stay was 3.77 day, up 7.1% YoY in the quarter ended December 2022.

Coforge: The company announced its partnership with Denodo to enable banks and other financial organizations to engage in agile projects without affecting daily operations. Denodo is a leading data integration, management and delivery platform. Under the partnership Denodo will bring its logical data integration and data management approach, powered by data virtualization while Coforge will bring its design and implementation expertise at BFSI clients, enabling companies to overcome challenges like security, compliance, systemic risks, downtime and data migration quality.

Solara Active Pharma: The company has successfully completed EU GMP Inspection at its Cuddalore facility in Tamil Nadu. The inspection was carried out at Cuddalore facility from February 7-9, 2023 and the company’s quality systems followed were compliant to the EU GMP standards.

Grindwell Norton: The company reported a net profit of Rs 80.2 crore in Q3FY23, up 15.1% from Rs 70 crore in Q3FY22. Its revenue was up 20.3% at Rs 604 crore in the reported quarter as against Rs 502 crore in the year-ago period. EBITDA rose 32.6% to Rs 119 crore in Q3FY23 as against Rs 89.7 crore in the year-ago period.

IRFC: The company’s net profit was up 2.5% to Rs 1,633 crore in Q3FY23 as against Rs 1,594 crore in Q3FY22. Revenue rose 22% to Rs 6,218 crore in Q3FY23 as against Rs 5,096 crore in Q3FY22.

Morepen Lab: The company’s profit slumped 58.1% to Rs 9 crore in Q3FY23 as against Rs 21.5 crore in Q3FY22. Revenue fell 12.1% to Rs 348.5 crore in Q3FY23 as against Rs 396.5 crore in Q3FY22. EBITDA was down 36% to Rs 20.5 crore in Q3FY23 as against Rs 32.2 crore in Q3FY22.

Capacite Infra: The company’s profit jumped 50.3% to Rs 23 crore in Q3FY23 as against Rs 15.3 crore in Q3FY22. Revenue advanced 20% to Rs 443 crore in Q3FY23 as against Rs 370 crore in Q3FY22. EBITDA rose 41.5% to Rs 87.2 crore in Q3FY23 as against Rs 61.6 crore in Q3FY22.

Marksans Pharma: The company’s net profit was up 29.1% to Rs 63.4 crore in Q3FY23 as against Rs 49.1 crore in Q3FY22. Revenue increased 32.2% to Rs 480 crore in Q3FY23 compared with Rs 363 crore in Q3FY22. EBITDA rose 32% to Rs 77 crore in Q3FY23 as against Rs 58 crore in Q3FY22.

Borosil Renewables: The company’s net profit fell 78.5% to Rs 5.2 crore in Q3FY23 as against Rs 24.2 crore in Q2FY23. Revenue was up 45.6% to Rs 246 crore in the reported quarter as against Rs 169 crore in the preceding quarter. EBITDA dropped 54% QoQ to Rs 19 crore in the quarter under review.

Heidelberg Cement India: The company’s net profit fell 81.9% to Rs 5.5 crore in Q3FY23 as against Rs 30.4 crore in Q3FY22. Revenue slipped 0.8% to Rs 540.1 crore in Q3FY23 as against Rs 544.5 crore in Q3FY22. EBITDA was down 45.9% to Rs 37 crore in Q3FY23 as against Rs 68.4 crore in Q3FY22.

City Union Bank (CUB): Shares of the lender tanked 13.8% as the lender’s profitability took a hit on a sequential basis in the December quarter. The lender registered a net profit of Rs 217.83 crore for Q3FY23, down 21.2% QoQ from Rs 276.5 crore in Q2FY23. Its net interest income (NII) fell 2% sequentially to Rs 555.7 crore in the reported quarter from Rs 567.9 crore. Net interest margin (NIM) also contracted 21 basis points to 3.9%.

Southern Petrochemicals Industries Corporation Ltd (SPIC): The company reported a profit after tax for the Oct-Dec ’22 quarter at Rs 85.18 crore, the company said. It had registered a profit after tax at Rs 51.43 crore in the corresponding quarter of last year. The total income during the quarter under review went up to Rs 707.82 crore from Rs 497.78 crore registered in same period of last year.

National Aluminium Company Ltd (NALCO): The PSU posted a 69.1%decline in consolidated profit at Rs 256.32 crore for the quarter ended December 2022. The company had posted a consolidated profit of Rs 830.67 crore in the corresponding quarter of the previous fiscal. Its consolidated income dropped to Rs 3,356.30 crore from Rs 3,845.25 crore in the year-ago period. In a statement, the PSU said lower sales volume of alumina during the quarter, higher input costs coupled with global challenging business scenario and volatility have affected the profit margins despite the company registering robust growth in production.

Brigade Enterprises Ltd: The realty firm’s sales bookings rose by 48%% to Rs 1,009.7 crore in the third quarter of this fiscal on higher volumes and price realisation amid strong housing demand. The company sold residential and commercial properties worth Rs 684.2 crore in the year-ago period. In volume terms, its sales bookings rose 41 per cent to 15,33,000 square feet in the October-December period of 2022-23 fiscal from 10,90,000 square feet in the year-ago period.

Glenmark Pharma: The company’s net sales at Rs 3,463.86 crore in December 2022 up was 9.15% from Rs 3,173.41 crore in December 2021. Its net profit stood at Rs 290.76 crore in December 2022, up 31.03% from Rs 221.90 crore in December 2021. EBITDA was at Rs. 696.66 crore in December 2022, down 1.47% from Rs. 707.05 crore in December 2021.

Info Edge India: The company reported a net loss of Rs 116.5 crore in Q3FY23 as against a net profit of Rs 4,601.87 crore last year. The losses in the recent quarter mainly accrued as the company wrote off its investment in property tech start-up 4B Networks. It had invested Rs 276 crore in the start-up as of September 2022. During the quarter under review, the consolidated revenue rose about 40 per cent to Rs 589.51 crore from Rs 421.41 crore a year ago. “While we are seeing a slowdown in the IT hiring, the non IT hiring market continues to be strong,” said the company’s CEO Hitesh Oberoi.

Metropolis Healthcare: The diagnostic company’s consolidated net profit declined 12.8% YoY to Rs 35.80 crore in Q3FY23 and revenue from operations decreased 2.6% YoY to Rs 285.46 crore in Q3FY23. The company said that the PAT was impacted due to higher finance cost on account of Hi-Tech Acquisition & higher depreciation on account of Investments done to fuel the future growth engines. EBIDTA declined 4.6% to Rs 72.7 crore in the third quarter from Rs 76.2 crore posted in Q3FY22.

Delhivery: The logistics company’s consolidated net loss widened to Rs 195.65 crore in Q3FY23 as against a net loss of Rs 126.52 crore in Q3FY22. Its revenue from operations fell 9% to Rs 1,823 crore for the quarter under review as against Rs 1,995 crore in the last-year period. Revenue from contracts with customers fell by 8.6% YoY to Rs 1,823.84 crore during the quarter ended 31 December 2022. Revenue from services stood at Rs 1,822 crore in Q3 FY23, down 9% from Rs 1,995 crore in Q3 FY23. Revenue from Express Parcel services fell 1% YoY to Rs 1,200 crore in Q3 FY23.

Biocon: The company’s subsidiary, Biocon Biologics, announced that the USFDA has issued a Complete Response Letter (CRL) for the Biologics License Application (BLA) for Bevacizumab filed by the company’s partner Viatris (Mylan). The CRL informs the need for a satisfactory resolution of the observations made during the facility inspection conducted in August, 2022.

Natco Pharma: The drugmaker announced the submission of Abbreviated New Drug Application (ANDA) containing a paragraph IV certification with the USFDA for the generic version of Olaparib Tablets 100mg and 150mg. Olaparib is indicated primarily for certain forms of ovarian, breast, pancreatic and prostrate cancer. Olaparib Tablets are marketed in the US by AstraZeneca under brand Lynparza. NATCO has been named as defendant in a lawsuit filed in the US district court of New Jersey by AstraZeneca and Kudos Pharmaceuticals.

Oil India: The company’s standalone net profit surged 40.3% YoY to Rs 1,746.10 crore and revenue from operations jumped 43.9% YoY to Rs 5,376.16 crore in Q3FY23. The company reported highest ever profit after tax in Q3FY23 on strength of better pricing and higher output of crude oil and natural gas. EBITDA grew 32.28% to Rs 2,957.47 crore in Q3FY23 as against Rs 2,235.72 crore posted in Q3FY22.