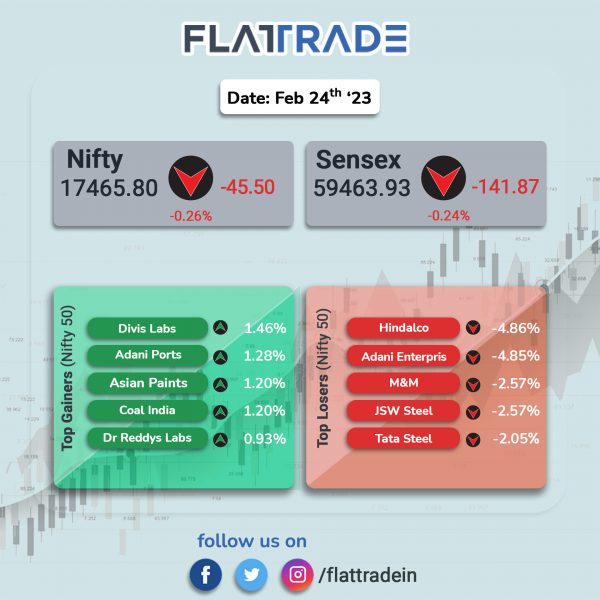

Dalal Street ended lower as investors were concerned over aggressive interest rate hikes by global central banks and slower economic growth. FIIs have also been on a selling spree and have remained net sellers in Indian equities year-to-date. The Sensex fell 0.24% and the Nifty 50 index was down 0.26%.

In broader markets, the Nifty Midcap 100 index dropped 0.21% and the BSE Smallcap slipped 0.15%.

Top losers were Metal [-3%], PSU Bank [-0.88%], Auto [-0.87%], Realty [-0.54%] and Media [-0.35%]. Top gainers were Oil & Gas [0.77%], Energy [0.66%] and Pharma [0.23%].

Indian rupee fell 2 paise to 82.75 against the US dollar on Friday.

Stock in News Today

Zee Entertainment Enterprises (ZEEL): The National Company Law Appellate Tribunal (NCLAT) has stayed the tribunal’s order admitting Zee Entertainment into insolvency. NCLAT has granted IndusInd Bank two weeks to file a reply. The matter will be heard next on Mar 29. Earlier, the Mumbai bench of the National Company Law Tribunal (NCLT) allowed the initiation of insolvency proceedings against the media company. “We respect the decision taken by the Hon’ble National Company Law Appellate Tribunal (NCLAT) and remain committed towards protecting the interests of all stakeholders. Our focus continues to be on the timely completion of the proposed merger,” said Punit Goenka, MD and CEO, Zee Entertainment Enterprises.

Maruti Suzuki India (MSI): The automaker announced that it will increase the ex-showroom prices of its Ignis cars, effective from 24 February 2022. The price change varies across models and ranges up to Rs 27,000 (ex-showroom – Delhi). Ignis is now being equipped with electronic stability program (ESP) and hill hold assist as standard feature across all the variants. It is also compliant with the upcoming E20 and real driving emission (RDE) norms.

Olectra Greentech: Shares of the company jumped 20% after the company announced that it has developed a Hydrogen bus with its technology partner, Reliance Industries. The development of a fully carbon-free alternative to traditional public transport is a significant step towards achieving India’s carbon-free hydrogen ambitions, and it could have a positive impact on the environment by reducing air pollution and emissions, the company said.

DLF: The realty major announced that the company has exercised the option to prepay the non-convertible debentures (NCDs) one year ahead of the schedule on annual interest reset date of 25 March 2023. The company had allotted of 5,000 rupee denominated NCDs of face value Rs 10 lakh each aggregating to Rs 500 crore on 25 March 2021 with a coupon rate of 8.25% for a period of three years. DLF said that it will redeem the outstanding principal amount along with the accrued annual interest on 24 March 2023.

KFin Technologies: The company will invest in Fintech Products and Solutions India (FPSIPL), a Technology Service Provider (TSP) having a wholly-owned subsidiary, FinSec AA Solutions Private , India’s first Account Aggregator (AA), licensed by Reserve Bank of India (RBI). The partnership will help the company to venture into TSP and AA business as it looks to diversify beyond its current offerings across asset classes in the financial services ecosystem.

SpiceJet: The carrier said its revenue from operations jumped 2.4% to Rs 2,316.8 crore as against Rs 2,262.6 crore in the year-ago period. Its net profit rose 160% to Rs 110.5 crore in the reported quarter as against Rs 42.5 crore in the corresponding quarter last fiscal. Its EBITDAR stood at Rs 89.83 crore in the reported quarter compared with Rs 250 crore in the year-ago period.

Delhivery: Tiger Global along with Internet Fund III, a venture capital fund managed by Tiger Global Management have offloaded 2.9% stake in Delhivery. The open market sale was conducted from the period starting June 2022 to February 2023. With this, Internet Fund III holds 2.55% stake in the company, while Tiger Global Investments Fund, which held 0.15% stake earlier, has no direct position in the company.

Housing & Urban Development Corporation (HUDCO): The company announced that rating agency Fitch has affirmed HUDCO’s Long-Term Foreign- and Local Currency Issuer Default Ratings at ‘BBB-’. The outlook is stable, reflecting the on the Indian sovereign rating (BBB-/Stable). The rating on HUDCO’s Rs 5000 crore medium-term note (MTN) programme has been affirmed at ‘BBB-’.

G R Infraprojects: The company has emerged as the highest bidder for a project Development, Operation and Maintenance of Multi Modal Logistics Park (MMLP) Indore near Pithampur, in Dhar District in Madhya Pradesh through Public Private Partnership on design, build, finance, operate and transfer (DBFOT) basis. The project cost is estimated at Rs 758.10 crore that includes two year construction period and 45 years of operations.

Gravita India: The company announced that its step-down subsidiary — Gravita Netherlands BV (GNBV) — has executed a Memorandum of Understanding (MOU) to establish a recycling plant in Oman. This will be Gravita’s first recycling facility in middle eastern market. GNBV will be holding 50% of equity with management control in the said project and remaining equity will be held by other partners based at Oman.

Blue Star: The air conditioner manufacturer said that Ashok M Advani, Chairman Emeritus & Promoter of the company, has announced a personal grant of Rs 100 crore over a period of five years to boost research & development activities. The purpose is to significantly accelerate, broaden and sustain investment in the technology and product development of its air conditioning and refrigeration products to meet the rapidly changing needs of the Indian and international markets.

Five-Star Business Finance: The NBFC announced that it has issued non convertible debentures (NCDs) aggregating to Rs 49 crore on private placement basis. The company has issued and allotted 4,900 rated, listed, senior, secured, redeemable, taxable, transferable NCDs with a face value & issue price of Rs 1 lakh each aggregating up to Rs 49 crore.

Prism Johnson: The company said in an exchange filing that that India Ratings and Research has revised its rating outlook on the long term debt instruments and other long term borrowings of the company to ‘Stable’ from ‘Positive’, while affirming the ratings at ‘IND A+’. There is no change in the ratings for non-fund based working capital limits and Unsecured short term loans.

Mazagon Dock Shipbuilders: The company announced that Dattaprasad Prabhakar Kholkar has been appointed as a non-official part-time independent director of the company for a period of three years effective from the date of DIN allotment or until further orders.

KSB: The company’s consolidated net profit surged 41.9% YoY to Rs 55.90 crore in the fourth quarter of calendar year 2022 and it registered a 18% YoY increase in net sales at Rs 524.60 crore in the reported quarter. For the full year, KSB’s consolidated net profit rose 22.3% to Rs 182.7 crore on 21.7% increase in net sales to Rs 1,822 crore in CY22 over CY21. The company’s board recommended dividend of Rs 15 per equity share for the year ended on 31 December 2022.

Kanoria Chemicals & Industries: The company plans to set up a new Formaldehyde plant with 300 TPD capacity at the existing manufacturing facility at GIDC, Ankleshwar, Gujarat. The upcoming Formaldehyde plant will be equipped with the latest Metal Oxide-based technology. This new capacity will cater to growing demand in various sectors such as engineering wood, textile, agrochemicals, pharmaceuticals, etc. in the region as well as the exports markets.

Strides Pharma Science: The company said that it has received establishment inspection report (EIR) from the USFDA for its Bangalore facility, indicating closure of the inspection. The US drug regulator had inspected the company’s Bangalore facility from 5 December 2022 to 9 December 2022 and issued form 483 with three observations. Based on the company’s response, the USFDA had classified the inspection as VAI (voluntary action indicated).