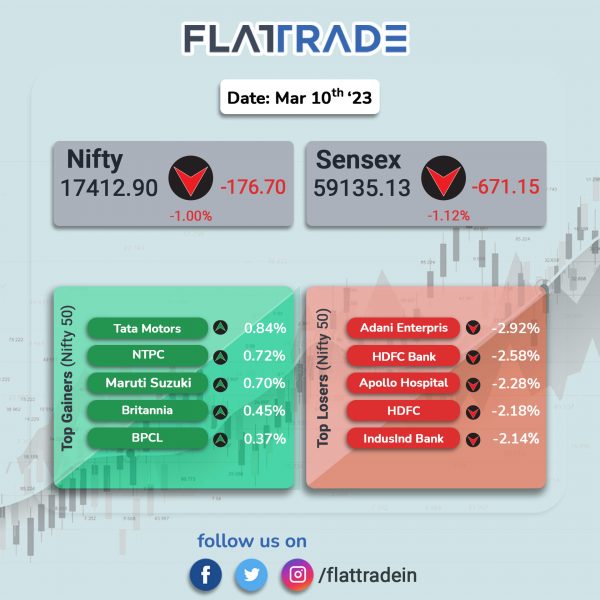

Benchmark equity indices tanked as investor sentiments were dampened due to concerns over the health of the US banking sector and its impact on other markets. The Sensex tumbled 1.12% and the Nifty slumped 1%.

In broader markets, the Nifty Midcap 100 index was down 0.75% and the BSE Smallcap fell 0.59%.

Top losers were Nifty PSU Bank [-2.19%], Bank [-1.87%], Private Bank [-1.84%], Financial Services [-1.8%] and Realty [-1.03%]. Top gainer was FMCG [0.16%] and Energy index inched up 0.06%. All other Nifty sectoral indices closed in the red.

Indian rupee fell 6 paise to 82.04 against the US dollar on Friday.

Stock in News Today

Tata Motors: Shares of the company rose over 1% in intraday trade on NSE after the auto major said that its subsidiary, Tata Technologies, filed a draft red herring prospectus with market regulator Securities and Exchange Board of India (Sebi) for an initial public offering. It is planning an initial public offering by way of an offer for sale of up to 9,57,08,984 equity shares for cash, representing approximately 23.60% of its paid-up share capital.

Hindustan Unilever Limited (HUL): The FMCG company has appointed Rohit Jawa as MD and CEO and he will succeed Sanjiv Mehta with effect from June 27. Rohit Jawa, currently the chief of transformation at Unilever, will serve as whole-time director from April 1 to June 26, 2023 at HUL. The company Company also appointed Ranjay Gulati is as an Independent Director for five years effective from April 1, 2023.

Equitas Small Finance Bank: Shares of the company tumbled 12.16% in intraday trade on NSE after listing of fresh 78.95 crore shares pursuant to the amalgamation of Equitas Holdings with the bank. Further, 93,39,43,363 equity shares of the bank held by Equitas Holdings (erstwhile promoter) stand extinguished with effect from 3 March 2023.

Spandana Sphoorty Financial: The company said that its board has considered and approved non convertible debentures (NCDs) worth Rs 125 crore on private placement basis. The senior, secured, rated, listed, redeemable, NCDs will be allotted on 17 March 2023. The tenure of the instruments is 24 months. The NCDs have a rate of interest of 10.50% per annum and the date of maturity of the instrument is on 17 March 2025. The NCDs will be listed on National Stock Exchange of India.

Jubilant FoodWorks: The QSR (quick service restaurant) chain operator announced that Sameer Batra has joined as president and chief business officer (CBO) of Domino’s India effective from 9 March 2023. In this role, he will be responsible for steering Domino’s Pizza India to its next phase of growth pivoted upon best-in-class customer experience, operational excellence, same store growth and store expansion, said the company.

KNR Constructions: The company has received Letter of Award for construction of access controlled four laning with paved shoulder from Mysore to Kushalnagara section of NH-275 near SH-86 Ramanathapura – Terakanambi Road/KR junction in Hunsur and at Yalachahalli near SH-117 Yelawala – KR Nagara Road junction on Hybrid Annuity Mode under NH(O) in Karnataka. The project cost is Rs 650 crore. The construction period is 24 months and mode of construction is hybrid annuity, with an operational timeline of 15 years.

Lumax Auto Technologies: The company has announced that the National Company Law Tribunal, New Delhi Bench, has sanctioned the Scheme of Arrangement for Amalgamation of Lumax Mettalics (wholly-owned subsidiary) with Lumax Auto Technologies.

Welspun Corp: The company announced that Welspun DI Pipes, a wholly-owned subsidiary of the company, has received the Kitemark certificate by BSI UK for size range of 100 to 1,000 DN against EN 545 and ISO 2531 standards. These are the international standards for Ductile Iron pipes used for transportation of potable water.

Thermax: The company said that it has signed a memorandum of understanding (MoU) with Fortescue Future Industries (FFI) to explore green hydrogen projects, including new manufacturing facilities in India. According to the MoU, Thermax and FFI will explore opportunities to jointly develop fully integrated green hydrogen projects for commercial and industrial customers in India. The company said that the performance linked incentive (PLI) scheme, under India’s National Green Hydrogen Mission, could be leveraged for setting up any new manufacturing capacity. In addition to meeting the domestic requirements, electrolysers and subsystems could potentially be used for export internationally.

Ajanta Pharma: The company has fixed 24 March 2023 as record date to determine the entitlement and names of equity shareholders, who shall be entitled to participate in the proposed buyback offer of up to 22,10,500 equity shares of the company at Rs 1,425 per equity share.

IFL Enterprises: The company announced that its board has approved 10-for-1 stock split and 1:4 issue of bonus shares. The firm’s board has approved sub-division of one equity share having face value of Rs 10 each into 10 equity shares having face value of Re 1 each, subject to the approval of shareholders and other regulatory approvals as may be required. The record date for the sub-division of equity shares shall be decided by the board and will be intimated to the exchanges, said the company.

Marksans Pharma: The drugmaker announced that it has received final approval from the USFDA for its abbreviated new drug application (ANDA) of Famotidine tablets for over the counter (OTC) use The approved ANDA is bioequivalent to the reference listed drug (RLD), Pepcid AC tablets, a registered trademark of Johnson & Johnson Consumer Inc, which has sales of over $200 million in the US market. The said tablets are acid reducers which used to treat conditions where reduction of stomach acid is needed, such as acid indigestion, occasional heartburn, or sour stomach from eating or drinking certain foods or beverages.