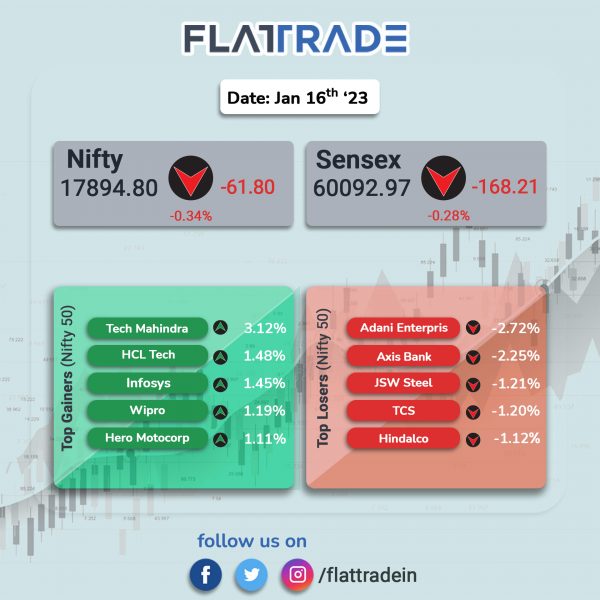

Benchmark equity indices fell, weighed by losses in metal, financial services and auto stocks. The Sensex dropped 0.28% and the Nifty declined 0.34%.

In broader markets, Nifty Midcap 100 index was down 0.24% and the BSE Smallcap index slipped 0.10%.

Top losers were Nifty Media [-1.36%], Metal [-1.32%], Financial Services [-0.75%], Auto [-0.65%] and Private Bank [-0.53%]. Top gainers were PSU Bank [1.57%], IT [1.14%] and Energy [0.64%].

Indian rupee fell 29 paise to 81.61 against the US dollar on Monday.

Stock in News Today

Tata Consultancy Services (TCS): The IT services company said that Scotwest Credit Union in the UK has enhanced its customer experience with TCS Customer Intelligence & Insights (CI&I), an AI-driven analytics software. It selected TCS to strengthen its loan portfolio, help preempt early repayments, reduce loss of interest income, improve customer retention and lifetime value.

Larsen and Toubro (L&T): The company said that L&T Construction’s Buildings & Factories (B&F) Fast Business has secured a significant repeat order from commercial developer to construct two towers with commercial office space in Hyderabad. According to L&T’s classification, the value of the contracts is between Rs 1,000 crore and Rs 2,500 crore. The company will construct two towers with commercial office space with approximate built-up areas of 28.91 lakh sq. ft and 28.53 lakh sq. ft respectively. The scope of project includes civil work for the composite structure including Mechanical, electrical and plumbing (MEP), finishes & fade to construct the towers in 6B+G+22 floors and 6B+G+41 floors configurations. The project is scheduled to be completed in 18 months.

Federal Bank: The company reported its standalone net profit at Rs 803.6 crore during Q3FY23, up 54% from Rs 521.7 crore in the same quarter in the previous fiscal. Its operating profit stood at Rs 1274.21crore in the reported quarter, a growth of 39% from the year-ago quarter. The lender’s net interest income (NII) rose 27% to Rs 1,956 crore as compared to Rs 1,539 crore year-on-year. Federal Bank’s net interest margin rose to 3.49% during the December 2022 quarter, higher by 22 basis points YoY and 19 bps QoQ. Its gross non-performing assets (NPAs) stood at 2.43% from 2.46% quarter-on-quarter (QoQ) whereas net NPAs came down to 0.73% from 0.78% in the previous quarter ended September 2022.

Maruti Suzuki: The automaker announced that it has increases prices across models with effect from January 16. The increase across models stands at around 1.1% and it is indicative figure which is calculated using Ex Showroom prices of models in Delhi.

Bank of Maharashtra (BoM): The company reported a two-fold jump in its standalone profit after tax (PAT) at Rs 775 crore in the quarter ended December 2022 due improved asset quality. The bank had posted a net profit of Rs 325 crore in the same quarter a year ago. The bank’s total income increased to Rs 4,770 crore in the reported quarter from Rs 3,893 crore in the year-ago period. Its gross NPAs (Non-Performing Assets) declined to 2.94%, as compared to 4.73% per cent at the end of third quarter of previous fiscal. At the same time, net NPAs eased to 0.47%, as against 1.24 per cent in the same period a year ago. The capital adequacy ratio rose to 17.53 per cent in the December quarter as against 14.85%.

RateGain Travel Technologies: The company announced that SKY express has selected AirGain for accurate and realtime competitive pricing insights as it looks to expand it’s footprint across Europe. The fastest growing airline in Greece and one of the most dynamic in Europe aims to continue to lead the development in the aviation sector locally and accelerate its international growth with accurate pricing insights that help in being more competitive in real-time.

Delhivery: Shares of logistics company rose 3.4% after Macquarie initiated coverage on the stock, citing a strong position in the logistics sector. The brokerage initiated coverage on the stock with an ‘outperform’ and a price target of Rs 440, with a “clear path to 100% in three years”.

Karnataka Bank: The bank said it has appointed Sekhar Rao as the Additional Director to take up the role of Executive Director for a period of three years. The appointment is subject to the shareholders’ approval at the next Annual General Meeting or within a period of three months from the date of taking charge, according to its exchange filing. Rao has more than 29 years of overall work experience and 19 years in BFSI sector.

GPT Infraprojects: The company has secured a project worth Rs 216 crore from Maharashtra Rail Infrastructure Development Corporation Ltd. The project entails construction of proposed extensions of Ghatkopar cable-stayed road over-bridge, connecting LBS Road junction and Eastern Expressway junction in Mumbai.

Viacom18: The company has won the media rights for the Women’s IPL for Rs 951 crore for five years from 2023 to 2027. This translates to a per match value of Rs 7.09 crore.

Century Textiles and Industries: The company’s said that its board has approved raising up to Rs 400 crore in one or more tranches through non convertible debentures (NCDs) on private placement basis. The fundraising is subject to shareholders and regulatory approvals as may be necessary under applicable laws.

Lupin: The company said that it has received tentative approval from the USFDA for its Abbreviated New Drug Application (ANDA), Dolutegravir and Rilpivirine Tablets. Dolutegravir and Rilpivirine tablets had an estimated annual sales of $666 million in the US, according to IQVIA MAT September 2022 data.

Granules India: The pharmaceutical company said that its Gagillapur facility located at Hyderabad has completed the USFDA’s pre-approval inspection (PAI) with three observations. The pre-approval inspection was conducted from 9 January 2023 to 13 January 2023. The drug maker said that it will respond to these observations within the stipulated time period.

Ksolves India: The company’s net profit rose 53.73% to Rs 6.18 crore in the quarter ended December 2022 as against Rs 4.02 crore during the quarter ended December 2021. Sales rose 68.44% to Rs 20.55 crore in the quarter ended December 2022 as against Rs 12.20 crore during the quarter ended December 2021.