Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.02% lower at 17,942, signalling that Dalal Street was headed for a muted start on Tuesday.

Chinese shares were trading lower after Beijing released weak fourth-quarter economic data, although investors were hopeful of a strong Chinese economic rebound. The CSI 300 index fell 0.11% and the Hang Seng was down 0.23%. Japanese shares were trading higher with the Nikkei 225 index trading 1.23% higher and the Topix gaining 0.78%.

Indian rupee fell 29 paise to 81.61 against the US dollar on Monday.

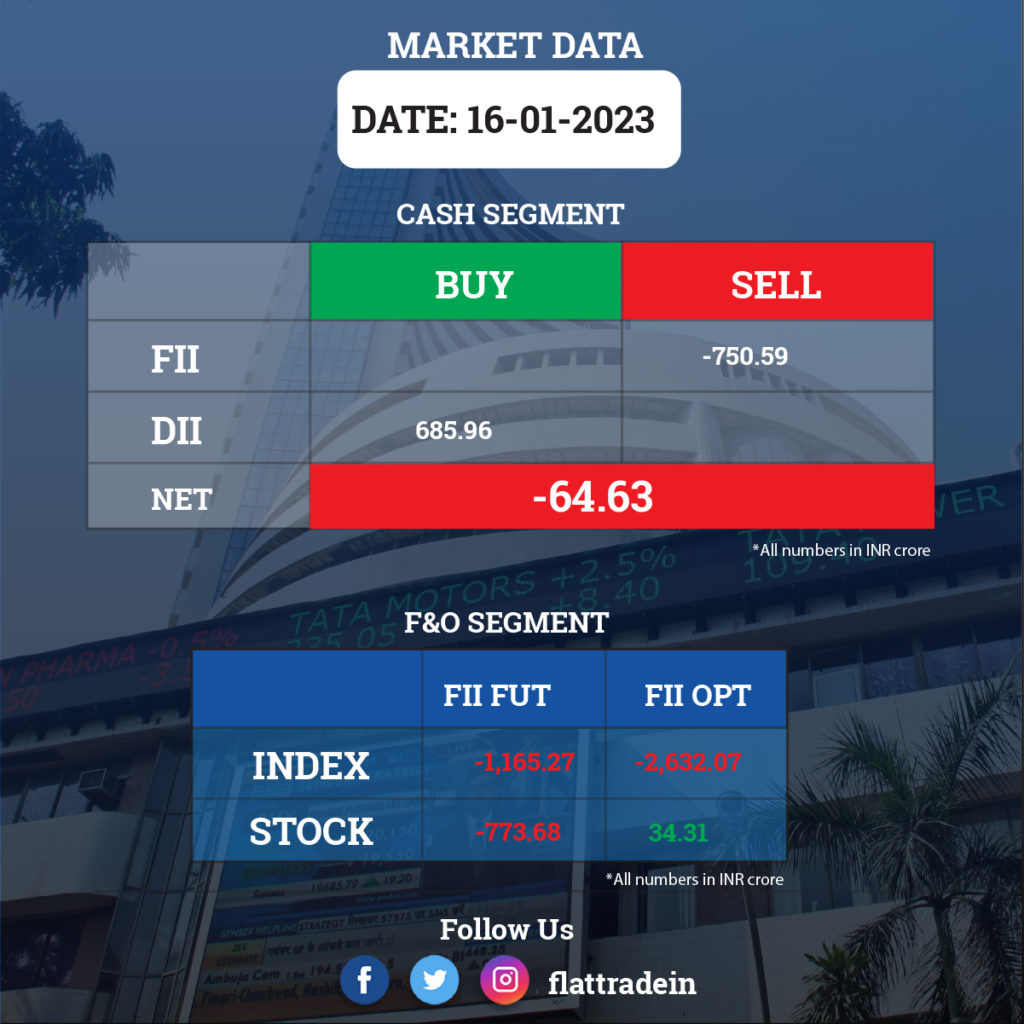

FII/DII Trading Data

Upcoming Results

ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, Bank of India, Delta Corp, Eris Lifesciences, Hathway Cable & Datacom, Mastek, Metro Brands, Network18 Media & Investments, TV18 Broadcast, Newgen Software Technologies, Shalby, Tata Investment Corporation, and Tata Metaliks will report their quarterly earnings on January 17.

Stocks in News Today

Adani Enterprises: The company has filed an offer letter with stock exchanges for a proposed Rs 20,000 crore follow-on public offer (FPO), Economic Times reported citing sources. The company is examining the possibility of launching the public issue in the last week of January, according to the sources.

Siemens Ltd: The company has received an order for 1,200 locomotives of 9,000 horsepower (HP) from Indian Railways. The company will design, manufacture, commission and test these locomotives. The company plans to deliver these locomotives over an eleven-year period, and the contract includes 35 years of full service maintenance. The locomotives will be assembled in the Indian Railways factory in Dahod, Gujarat, and the total contract value is Rs 26,000 crore.

Mahindra & Mahindra (M&M): The automaker aims to deliver 20,000 units of its electric SUV XUV400, which has been launched at an introductory price starting at Rs 15.99 lakh. M&M, which had unveiled the XUV400 in September 2022, said the vehicle would be launched in two variants across 34 cities in phase I.

NTPC: The company has signed an MoU with Government of Tripura to develop large sized renewable energy projects in Tripura.

IRB InvIT Fund: The company has recommenced toll collection at toll plazas of IRB Pathankot Amritsar Toll Road, one of its project SPVs (special purpose vehicle). The toll collection by the said SPV was temporarily suspended last month. The project SPV is eligible for compensation against the revenue loss under Force Majeure provisions of the Concession Agreement.

Angel One: The company has reported a total income of Rs 759.660 crore during the period ended December 31, 2022 as compared to Rs 605.250 crore during the period ended December 31, 2021. The company has posted net profit of Rs 227.982 crore for the quarter ended December 2022 as against a net profit of Rs 164.547 crore in the year-ago period. The company said its EPS stood at Rs 26.73 for the period ended December 31, 2022 as compared to Rs 19.54 for the period ended December 31, 2021.

Ashoka Buildcon: Ashoka Kandi Ramsanpalle Road, the special purpose vehicle (SPV) of the company, has received a provisional certificate for completion of 37.92 KMs out of total project highway length of 39.980 KMs in Telangana. The company informed the declaration of Novemer 19, 2022 as the commercial operational date for the said HAM project of NHAI under Bharatmala Pariyojna on hybrid annuity mode. After the declaration of commercial operational date, the SPV is eligible for receipt of annuity payments from NHAI for the operation period of 15 years at the interval of every 6 months from the date of achievement of commercial operational date.

Kesoram Industries: The company said its consolidated loss widened to Rs 48 crore for quarter ended December FY23, from a loss of Rs 32 crore in same period last year, due to higher input cost, power & fuel expenses and exceptional loss. Its consolidated revenue from operations increased 12.6% YoY to Rs 986 crore for the quarter.

Tinplate Company of India: The company has recorded a 62% year-on-year decline in profit at Rs 36.4 crore for quarter ended December FY23, due to lower top line and operating income. Revenue from operations for the quarter at Rs 959.9 crore fell by nearly 19% compared to year-ago period.

Phoenix Mills: The company’s wholly-owned subsidiary Phoenix Logistics and Industrial Parks has completed the acquisition of 100% equity in Janus Logistics and Industrial Parks as per Share Purchase Agreement. The acquisition cost is Rs 26.03 crore. Janus owns a land parcel admeasuring approximately 33 acres in Haryana.

Veritas (India): Investor Swan Energy has raised its stake in the company to 43.58%, up from 40.54% earlier. Swan has bought 3.04% stake in Veritas on January 13 via open market transactions. Promoter Niti Nitinkumar Didwania was the seller.