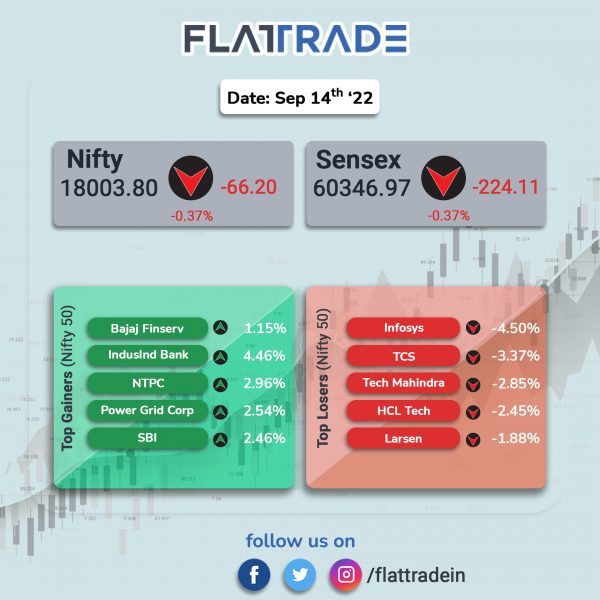

Benchmark indices opened gap-down by over 1% and rebounded from day’s lows to end modestly lower. Heavy losses in IT stocks offset gains in metals and banking stocks. The Sensex fell 0.37% and the Nifty 50 index was down 0.37%.

The Nifty MidCap 100 index lost 0.33% and BSE SmallCap inched down 0.01%.

Top Nifty sectoral index losers were IT [-3.36%], Oil & Gas [-0.87%], Realty [-0.69%], Pharma [-0.5%], Energy [-0.33%]. Top gainers were PSU Bank [1.74%], Metal [1.58%], Pvt Bank [1.5%], Bank [1.3%] and Media [0.87%].

The Indian rupee depreciated 29 paise to 79.44 against the US dollar on Wednesday.

WPI-based inflation eased to 12.41% in August 2022 compared to 13.9% in July 2022. It fell by 0.5% month-on-month compared to a fall of 1% in July.

Stock in News Today

Vedanta Ltd: The company will create a hub to manufacture Apple’s iPhones and TV equipment, along with possibly diving into the electric vehicle sector, Chairman Anil Agarwal said in an interview with CNBC TV18, according to a Reuters report. He added that this would be “kind of forward integration for the Gujarat JV plant”.

State Bank of India (SBI): The country’s largest lender has crossed a market capitalisation of Rs 5 lakh crore. It is the third bank to cross the mark, after the top two private sector banks – ICICI Bank and HDFC Bank. Shares of the bank rose 2.46% to close at Rs 571.75 per share.

Ambuja Cements: Shares of the company rose over 7% after the company announced that it will consider a proposal for raising of funds by way of issue of equity shares or any other means. The company’s board is scheduled to be held on September 16 to consider and evaluate proposal for raising of funds.

RattanIndia Enterprises: The company announced the launch of ‘Defender’ by its company Throttle Aerospace Systems. Defender is an indigenously developed tracking and capturing system for rogue drones. Defender is loaded with 13 AI features to neutralize the rogue drones.

Tata Power: The company’s subsidiary, Tata Power Solar Systems (TPSSL), has received a ‘Letter of Award’ (LoA) of Rs 596 crore for setting up a 125 MWp floating solar project from NHDC. NHDC had invited bids earlier for the project at the Omkareshwar reservoir in the Khandwa district of Madhya Pradesh.

Fertiliser manufacturers: Shares of some fertiliser producers fell after Union Chemicals & Fertilisers Minister Mansukh Mandaviya said that the government will not allow fertiliser firms to raise prices of crop nutrients and non-urea products during the winter season. Some of the companies that were affected by his comments were Gujarat State Fertilizers & Chemicals [-2.7%], Khaitan Chemicals [-2.1%], Chambal Fertilisers & Chemicals [-1.71%], Mangalore Chemicals [-1.6%], Nagarjuna Fertilizers [-1.5%], Coromandel International [-1.7%] and National Fertilizers [-1.04%], Fertilizers & Chemicals Travancore [-1.03%].

Shriram City Union Finance: The company has approved the issue of Secured Rated Listed Redeemable Principal Protected Market Linked Non-Convertible Debentures (PP-MLDs) of face value of Rs 10,00,000 each for an amount of Rs 200 crore (Base Issue size) with green shoe option up to Rs 200 crore aggregating up to 4000 NCDs amounting to Rs 400 crore as one or more issuances, in one or more tranches either as fully paid up or partly paid-up on private placement basis.

CMS Info Systems: The company has announced that the board of directors have now extended the tenure of Rajiv Kaul as Executive Vice Chairman on the existing terms for a further period from 16 September 2022 to 31 March 2023.