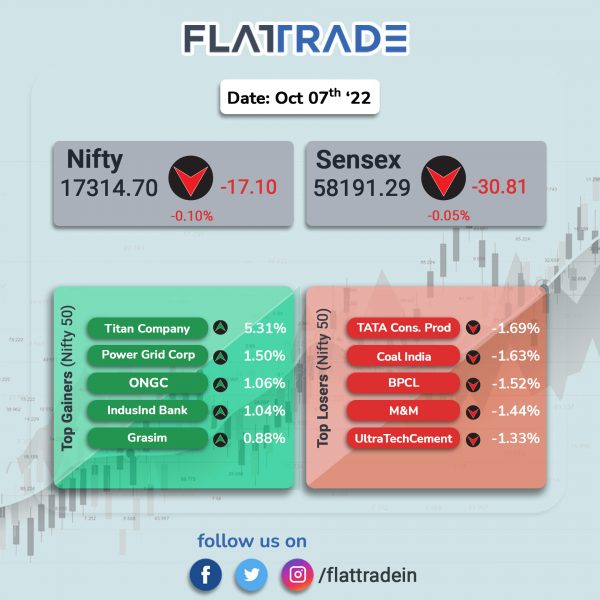

Domestic shares ended slightly lower weighed by Oil & Gas, IT and FMCG stocks. The Sensex slipped 0.05% and the Nifty 50 index fell 0.1%.

The Nifty Midcap 100 index lost 0.24% and the BSE Smallcap rose 0.3%.

Top losers among Nifty sectoral indices were Oil & Gas [-0.72%], IT [-0.7%], FMCG [-0.64%], Metal [-0.43%] and Pharma [-0.40%]. Top gainer were Media [0.38%] and Realty [0.32%].

Indian rupee fell 44 paise to 82.32 against the US dollar on Friday.

Stock in News Today

Hero MotoCorp: The two-wheeler maker launched its first electric scooter worldwide and the new Hero Vida V1 electric scooter will be offered in two variants — Vida V1 Plus and Vida V1 Pro. It would be first launched in New Delhi, Jaipur and Bengaluru. The deliveries of this electric scooter will start from the second week of December.

Vida V1 Pro, which is priced at Rs 1.45 lakhs, will have a top speed of 80 kmph, a range of 165 km and acceleration of 0 to 40 kmph in 3.2 seconds.

Meanwhile, Vida V1 Plus, which is priced at Rs 1.59 lakh, will have a top speed of 80 kmph, a rang of 143 km and acceleration of 0 to 40 kmph in 3.4 seconds.

Meanwhile, brokerage firm Jefferies upgraded the company’s stock to ‘buy’ from ‘hold’ and kept the target price at Rs 3,000 apiece. The brokerage firm cited that the Indian auto sector I recovering and likely to post a strong 17-19% volume CAGR for PVs, 2-Wheelers and trucks over FY22-25.

Biocon: The biotechnology company said that European medical regulator found one major ‘deficiency’ at its Bengaluru API plant. Biocon said the European Directorate for the Quality of Medicines and Healthcare conducted a good manufacturing practices inspection of its API plant in Bengaluru from September 12-14. The company also added that it will respond to the agency with appropriate corrective and preventive actions. Shares of Biocon fell more than 3% in intraday on Friday.

Adani Group: The group’s chairman Gautam Adani announced Rs 65,000 crore investment in Rajasthan over the next 5 to 7 years in setting up a mega 10,000 MW solar power capacity, expanding cement plant and upgrading Jaipur airport. Speaking at the Invest Rajasthan 2022 Summit here, he said the Adani group would also develop a network to supply piped natural gas and CNG to accelerate cleaner fuel availability to industrial, commercial, transport and domestic consumers, and set up new transmission projects to move the renewable power being generated.

Infosys Technologies: The IT company is in trouble again after an ex-employee levelled allegations of discrimination against the company while hiring in the US. A suit was filed by Infosys VP (Talent Acquisition) Jill Prejean in the US District Court Southern District of New York against Infosys, Infosys Senior VP and Head (Consulting) Mark Livingston and former partners Dan Albright and Jerry Kurtz. In her complaint, Prejaen alleged that the partners allegedly expressed reluctance to hire additional consultants of Indian origin, women with children at home and candidates over 50 years of age.

Maruti Suzuki: Global investment bank Goldman Sachs initiated coverage on the stock with a ‘buy’ recommendation, citing improving growth prospects.Goldman Sachs has given a 12-month target price of Rs 10,500 apiece on the stock. Goldman Sachs said that shares of India’s largest carmaker remained attractive as it saw the company entering a sweet spot in new model launches like Grand Vitara, Jimny, Baleno crossover.

BSE: The company said that market regulator, SEBI, has granted its in-principle approval to BSE for introducing Social Stock Exchange (SSE) as a separate segment on the BSE, according to its exchange filing.

Tata Steel: The steel major’s India business reported 2% rise in crude steel production to 4.81 million tons in Q2FY23 as compared with 4.73 million tons posted in Q2FY22. On quarterly basis, crude steel production declined 2.24% from 4.92 million tons in Q1FY23. The company said the decrease in steel production was mainly due to planned maintenance shutdown. Deliveries stood at 4.91 million tons, a growth of 7% YoY and 21% QoQ despite seasonal weakness due to monsoons.

SBI Cards and Payment Services: Shares of the company rose 1.8% in intraday after the company appointed Rashmi Mohanty as chief financial officer of the company with effect from October 21. Mohanty is currently the group chief financial officer and whole time director of Clix Capital.

Lupin: The drugmaker has announced that it has reached an agreement with global agencies such as Unitaid, The Aurum Institute, the Clinton Health Access Initiative to support Tuberculosis prevention treatment. The treatment will be rolled out in 138 countries, including many low and middle income countries. Lupin will introduce two new formulations, a fixed-dose combination of Rifapentine plus Isoniazid and Rifapentine 300 mg standalone tablets, at an affordable price.

Kalyan Jewllers: Shares of the company jumped 5.2% in intraday trade on Friday after the company registered consolidated revenue growth of approximately 20% in Q2FY23 as compared to the same period in the previous financial year, and approximately 50% in H1FY23 as compared to the same period in the previous financial year. The company said that it has been a positive quarter and has achieved robust momentum in footfalls and revenues across all its markets in India and Middle East.

RattanIndia Enterprises: Shares of the company rose over 10% intraday after the company announced that it will acquire 100% stake in electric motorcycle maker Revolt Motors. The company had earlier acquired a stake of 33.84% with an option to further increase the shareholding. With this acquisition, the company aims to build an ecosystem which is environment friendly, sustainable, and helps in speeding up the adoption of EVs in the country, the company said in an exchange filing.

Macrotech Developers: Brokerage firm Jefferies in its note raised its FY23 pre-sales estimate by 5% to Rs 12,000 crore after Macrotech Developers posted strong Q2 sales. It also noted that the new project signings and return of capital from UK investments was ahead of schedule. The company added four new projects during the quarter with 2.2 million square feet of saleable area and gross sales worth Rs 3,100 crore.

Venus Pipes: Centrum Broking initiated coverage of the company’s stock with a ‘buy’ recommendation and set a price target of Rs 764 per equity share. The broking firm said that the pipe manufacturer is an evolving growth story. The company had witnessed a sales CAGR of 48% and EBITDA CAGR of 61%, and it is in the process of increasing capacity to 33.6 ktpa .

Suzlon Energy: The company said that Sun Pharma’s Dilip Shangvi has conveyed his intention to fully participate in the Rs 1,200-crore rights issue of Suzlon along with subscribing for additional shares. Currently, Shangvi holds an approximate 23% stake in Suzlon.

Varroc Engineering: Shares of the company fell 9% in intraday after after the company announced a revised deal for its lighting business. The company said that it has completed the divestment of the 4-wheeler lighting business of the company in the Americas and Europe. The company said that it would now receive 520 million euros which is less than 600 million euros announced earlier. Post the deal closure, Varroc will still have debt worth Rs 1,300 crore on its books.