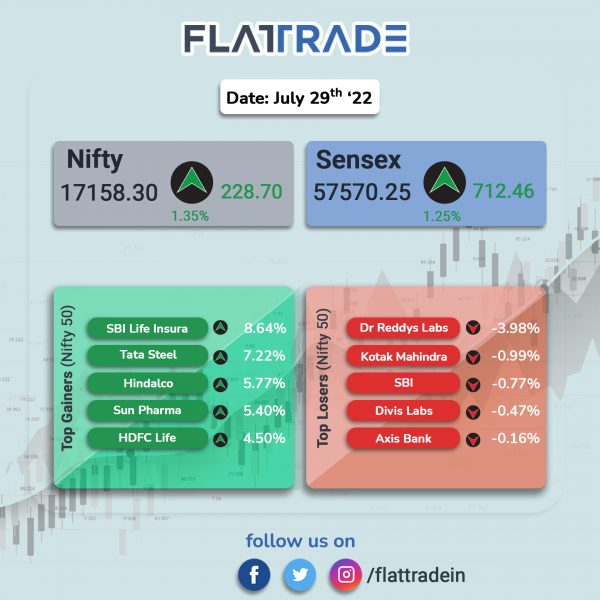

Benchmark indices ended higher as metal and IT shares rose, along with most index heavyweights gaining. The Sensex surged 1.25% and the Nifty jumped 1.35%.

Broader markets mirrored headline indices. The Nifty Midcap increased 1.42% and BSE Smallcap advanced 1.38%.

Top Nifty sectoral gainers were Metal [3.86%], Oil & Gas [2.18%], Energy [1.81%], IT [1.71%] and Media [1.42%]. Top loser was PSU Bank [-1.17%].

The Indian rupee rose by 50 paise to 79.25 against the US dollar on Friday.

Meanwhile, the US economy contracted for the second straight quarter from April to June, signalling a recession, the Bureau of Economic Analysis reported on Thursday. The world’s largest economy (also known as Gross domestic product) fell 0.9% at an annualized pace for the period, according to the advance estimate. The new number follows a 1.6% decline in the first quarter of calendar year 2022.

Further, economic growth in the euro zone economy rose in the second quarter of the year amid Russia continuing to reduce gas supplies. The 19-member bloc posted a gross domestic product (GDP) growth of 0.7% in the second quarter, according to Eurostat, Europe’s statistics office, beating expectations of 0.2% growth. It comes after a GDP rate of 0.5% in the first quarter.

Stock in News Today

Housing Finance Development Corporation (HDFC): The mortgage lender reported a standalone net profit of Rs 3,668.82 crore in Q1FY23, up 22.2 per cent from Rs 3,001 crore in Q1FY22. The rise was driven by higher interest and dividend income. Its assets under management (AUM) at the end of the June quarter stood at Rs 6.71 trillion, as against Rs 5.74 trillion at the end of Q1FY22. The net interest income (NII) stood at Rs 4,447 crore in Q1FY23, compared with Rs 4,147 crore in Q1FY22. The lender’s net interest margin came in at 3.4 per cent for the quarter under review.

Reliance Industries (RIL): The conglomerate, Softbank Group-backed Ola Electric and Indian jewellery maker Rajesh Exports signed final agreements to build battery cells under a $2.3 billion government incentive program, Reuters reported. The companies must set up their battery manufacturing facility within two years after which they will be eligible for incentives. These will be paid over a five-year period based on the sale of batteries manufactured in India, the government said in its statement.

Indian Oil Corporation (IOC): The state-owned oil refiner reported a consolidated net profit of Rs 882.96 crore for the quarter ended June 2022, a 85.62 per cent lower than Rs 6,140.63 crore profit reported in the same quarter last year. Consolidated Revenue from operations stood at Rs 2,55,381.62 crore, up 63.16 percent from Rs 1,56,519.19 crore in the year-ago quarter.

Sun Pharmaceutical Industries: The drugmaker has posted a 43 per cent YoY rise in net profits to Rs 2,061 crore in Q1FY23. Its net profit in the year-ago period was Rs 1,444 crore. The firm’s revenue rose 9.7 per cent to Rs 10,762 crores, up from Rs 9,719 crore in the year-ago quarter. The pharma has reported an EBITDA of Rs 28,84.4 crore, including other operating revenues, with the EBITDA margin at 26.8 per cent in the quarter under review.

Ashok Leyland: The commercial vehicle manufacturer posted a standalone profit of Rs 68 crore for the quarter ended June 2022, against a loss of Rs 282.3 crore in the corresponding period of the last fiscal during the second Covid wave that weighed on earnings. Revenue from operations for the June FY23 quarter increased sharply to Rs 7,223 crore, rising 145 per cent compared to Rs 2,951 crore in the same period last year.

Zydus Wellness: The company reported a 4.75 per cent rise in consolidated net profit to Rs 137.01 crore in the first quarter ended June 30, as against a consolidated profit after tax at Rs 130.8 crore in the same period last fiscal. Its consolidated total income during the quarter under review stood at Rs 698.71 crore in Q1FY23 as against Rs 599.97 crore in the year-ago period.

Glenmark Pharmaceuticals: The company said that its US arm has received final approval from the US health regulator FDA for its generic Norethindrone Acetate and Ethinyl Estradiol Capsules and Ferrous Fumarate birth control capsules. It is the generic version of Taytulla capsules of Allergan Pharmaceuticals International Ltd, it added.

Bandhan Bank: The lender has opened a currency chest in Deedargunj, Patna. The currency chest will help in cash management for the branches and ATMs in the city. The bank plans to open over 530 new bank branches across India in this fiscal.

GMM Pfaudler: The company’s net income rose to Rs 44.51 crore in Q1FY23 as against Rs 2.59 crore in the year-ago period. The company’s revenue increased to Rs 739.24 crore compared with Rs 551.58 crore. Its EBITDA came in at Rs 97.81 crore in Q1FY23 from Rs 35.94 crore in the same period last fiscal.

The manufactures of glass-lined reactors also approved the proposal for acquisition of Hydro Air Research Italia, based in Milan for 4.96 million Euro.

PNC Infratech: The company has inked an agreement for a HAM project with National Highways Authority of India (NHAI). The bid project cost is Rs 864 crore and it pertains to the upgradation of four-lane bypass in Hardoi district in Uttar Pradesh. The project length is 53.99 km.