Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.09 per cent higher at 17,132.50, signalling that Dalal Street was headed for a positive start on Friday.

Japanese stocks were trading higher, taking their cue from a rally in tech stocks on Wall Street, and as markets focused on a possible slowdown in the pace of rate hikes. Nikkei 225 index was up 0.46% and Topix inched up0.02%. Meanwhile, Chinese stocks were down with Hang Seng dropping 1.37% and CSI 300 index falling 0.54%.

Indian rupee rose 14 paise to 79.76 against the US dollar on Thursday.

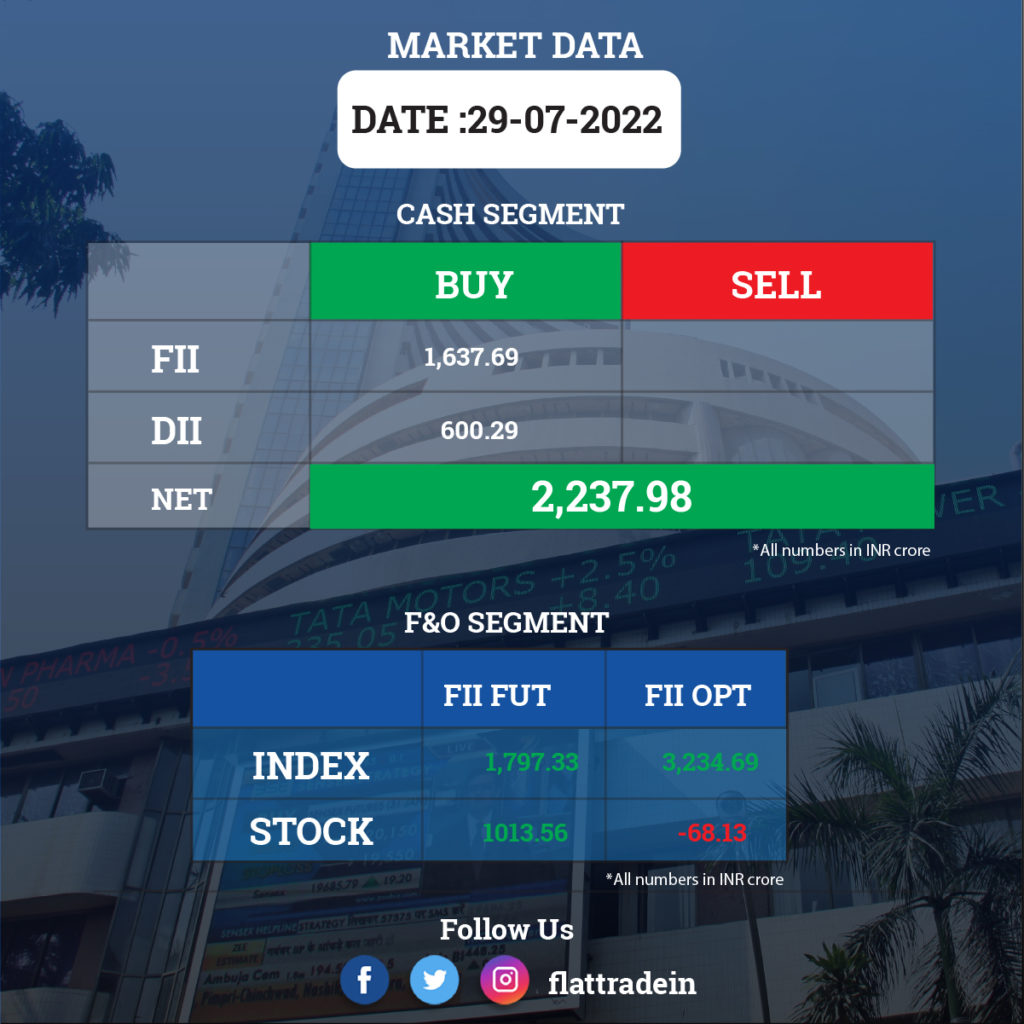

FII/DII Trading Data

Upcoming Results

HDFC, NTPC, Sun Pharma, Cipla, Indian Oil Corporation, Ashok Leyland, DLF, Emami, Exide Industries, Nazara Technologies, Piramal Enterprises, CARE Ratings, CarTrade Tech, Cholamandalam Investment, CreditAccess Grameen, Deepak Fertilisers, Easy Trip Planners, 3i Infotech, Great Eastern Shipping, GMR Infrastructure, Godrej Agrovet, Heritage Foods, JK Paper, Mahindra Logistics, Metro Brands, Rain Industries, Route Mobile, Strides Pharma Science, Star Health and Allied Insurance Company, Torrent Pharmaceuticals, VST Industries, and Zydus Wellness will report earnings fo the quarter ended June.

Stocks in News Today

Punjab National Bank (PNB): The state-owned lender reported a 70 per cent decline in standalone net profit to Rs 308.44 crore in the June quarter, mainly due to higher provisioning for bad loans and decline in interest income. It had posted a net profit of Rs 1,023.46 crore in the year-ago period. Total income in the first quarter of the current fiscal fell to Rs 21,294 crore, compared to Rs 22,515 crore in the year-ago period. Its interest income marginally slipped to Rs 18,757 crore from Rs 18,921 crore in the same quarter a year ago. The gross NPA declined to 11.2 per cent in the quarter ended June 2022 from 14.33 per cent in the same period a year ago.

TVS Motor Company: The company said its consolidated net profit stood at Rs 297 crore for the first quarter ended June 2022. It had reported a net loss of Rs 15 crore in the COVID-19 hit April-June quarter of the last fiscal. It reported a total income of Rs 7,348 crore in the first quarter of FY23 compared with a total income of Rs 4,692 crore a year ago. It noted that the overall two and three-wheeler sales, including exports, rose to 9.07 lakh units in the quarter ended June 2022 against 6.58 lakh units registered in the quarter ended June 2021.

Jubilant FoodWorks: The company reported a 63.01 per cent increase in its consolidated net profit at Rs 112.58 crore in Q1FY23. It had posted a consolidated net profit of Rs 69.06 crore in the same quarter of the previous fiscal. Its revenue from operations during the quarter stood at 40.51 per cent at Rs 1,255.09 crore as against Rs 893.18 crore in the year-ago period.

Vedanta Ltd: The company reported 6% YoY rise in net profit at Rs 5,592 crore for the quarter ending June 2022 and the consolidated revenue increased 36% YoY to Rs 38,251 crore. The company’s gross debt rose by Rs 8,031 crore in the first quarter of FY23 to Rs 61,140 crore.

SBI Life Insurance: The company’s net profit grew 18 per cent year-on-year to Rs 263 crore in Q1FY23 , aided by a healthy jump in gross written premium. In the corresponding period a year ago, it posted a net profit of Rs 223 crore. The annualised premium equivalent was up 80 per cent YoY to Rs 2,900 crore. The value of new business of the insurer rose 130 per cent to Rs 880 crore in Q1FY23, compared with Rs 380 crore in the corresponding period last fiscal.

Dr Reddy’s Laboratories: The company said its consolidated profit after tax was up by 108 per cent at Rs 1,187.6 crore for the quarter ended June 2022 as against Rs 570.8 crore in the same quarter a year ago. Revenue during the quarter under review were up by six per cent to Rs 5,215.4 crore compared to Rs 4,919.4 crore in the first quarter of FY22. The strong earnings were due to Suboxone settlement and also the brand divestments.

Shriram Transport Finance Company: The company has posted over four-fold rise in net profit to Rs 965.27 crore in Q1FY23 as against Rs 169.94 crore in Q1FY22. The company’s total income for the quarter under review saw a 10.7 per cent increase to Rs 5,149.26 crore, up from Rs 4,651.5 crore a year ago. The operating profit for the April-June quarter of the current financial year was up 26.15 per cent to Rs 2,112.04 crore, as against Rs 1,674.29 crore in Q1FY22.

PNB Housing Finance: The company’s net profit for Q1FY23 declined three per cent to Rs 235 crore year-on-year as net interest income dipped. Net Interest Income declined by 33 per cent YoY to Rs 370 crore on account of reduction in corporate book. Net Interest Margin (NIM) stood at 2.4 per cent in Q1FY23, down from 3.2 per cent a year ago in Q1FY22. Loan asset declined to Rs 56,301 crore during the reported quarter from Rs 60,438 crore in the year-ago period.

Chalet Hotels: The company posted a consolidated profit of Rs 28.5 crore for the quarter ended June 2022, as against a loss of Rs 41.66 crore in the year-ago period due to the second COVID wave. Revenue from operations soared 275.2 per cent YoY to Rs 253 crore during the quarter under review.

The company has received a contract from Delhi International Airport Limited (DIAL) to develop a hotel at the T3 Terminal of Indira Gandhi International Airport (IGIA). With this, Chalet will enter the north Indian market and the upcoming terminal hotel will be the company’s 9th hospitality property in the country and first in northern India. The hotel will have 350-400 rooms positioned in the 5-star deluxe space and the hotel is expected to be commissioned by FY26.

RITES Ltd: The company’s profit after tax grew 85.8 per cent YoY to Rs 145 crore in Q1FY23. Operating revenue, excluding other income, is up by 70.4 per cent at Rs 605 crore in Q1FY23 as against Rs 355 crore in Q1FY22. EBITDA stood at Rs 179 crore in Q1FY23 as against Rs 97 crore in Q1FY22, up by 84.5 per cent in the reported quarter.

Srei Equipment Finance: The company said its transactions auditor, BDO India LLP, has found fraudulent transactions worth Rs 2,133.74 crore under the erstwhile management during FY18 to FY21. The three entities involved in the fraudulent transactions are Shristi Group causing monetary impact of Rs 1,415.22 crore, Samsara Energy Ltd (Rs 284.71 crore) and Viom Infra Ventures, earlier Quippo Infrastructure Ltd, (Rs 433.81 crore).

IL&FS: The infrastructure financing and construction company has sold two power businesses for Rs 77.5 crore. The company will use the money to reduce debt as per a resolution framework approved by the National Company Appellate Law Tribunal.

SpiceJet : The company’s aircraft heading to Kandla in Gujarat safely aborted take off on the Mumbai airport’s runway on Thursday as the caution alert lit up, the airline said on Thursday. A senior official of the Directorate General of Civil Aviation (DGCA) called the incident as “routine”, adding that the regulator has started a probe into it.

Indus Towers: Bimal Dayal has resigned as Managing Director and CEO of the company. He has decided to pursue opportunities outside Indus Towers.