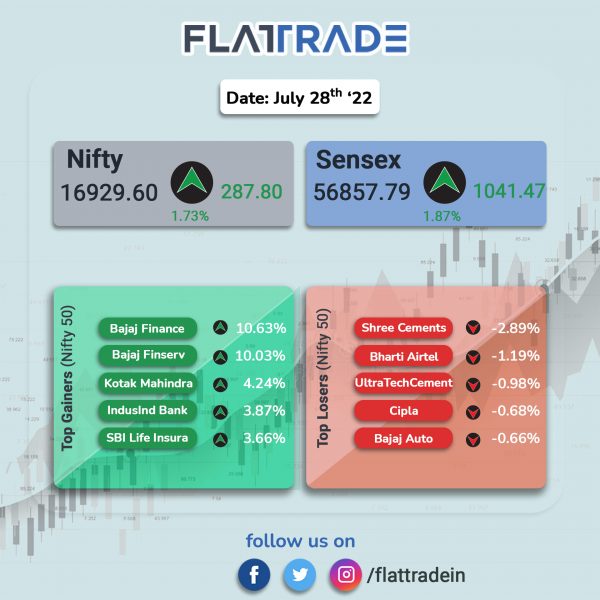

Major equity indices rose, helped by positive sentiments after the Fed Chair hinted at a possibility of slower pace of monetary tightening as well as gains in IT and banking stocks. The Sensex surged 1.87% and Nifty jumped 1.73%.

The US Federal Reserve Chairman Jerome Powell signalled that the pace of rate hike will slow down at some stage in the future and the US central bank would set policy meeting-by-meeting, even as Powell stressed on FOMC’s commitment to tame inflation.

Broader markets underperformed as Nifty Midcap 100 rose 0.84% and BSE Smallcap increased by 0.65%.

Top gainers among Nifty sectoral indices were IT [2.81%], Financial Services [2.41%], Realty [2.07%], Private Bank [1.86%], Metal [1.7%]. All Nifty sectoral indices closed in the green.

Indian rupee rose 14 paise to 79.76 against the US dollar on Thursday.

Stock in News Today

Bajaj Finserv: The company reported a 57% jump in net profit at Rs 1,309.4 crore in the first quarter ended June 2022, compared with a net profit of Rs 832.77 crore in the year-ago period. Its consolidated total income during the reported quarter rose 14% YoY to Rs 15,888.25 crore. Its consolidated assets under management (AUM) crossed an important milestone of Rs 2 lakh crore during the quarter and stood at Rs 2,04,018 crore.

Shree Cement: The cement maker’s standalone net income slumped 52% to Rs 315.55 crore in Q1FY23 as against Rs 661.72 crore in the corresponding quarter last year. Revenue climbed 22% to Rs 4,202.69 crore in Q1FY23 as against Rs 3,449.49 crore in Q1FY22. The company registered an EBITDA of Rs 818.82 crore in the reported quarter as against Rs 1,013.51 crore in the year-ago quarter.

SBI Cards & Payment Services: The company’s net income doubled to Rs 626.91 crore in Q1FY23 from Rs 304.61 crore in Q1FY22. Its revenue rose to Rs 3,100.30 crore in the reported quarter as against Rs 2,361.90 crore in the year-ago period. EBITDA rose two-fold to Rs 1,025.91 crore in Q1FY23 from Rs 582.91 crore in Q1FY22.

Nestle India: The company said its net profits for the quarter ended June 2022 stood at Rs 515.34 crore, down 4.31% from Rs 538.58 crore in the same quarter last year. Revenue from operations stood at Rs 4,036.57 crore compared with Rs 3,476.70 crore in the year-ago quarter. The company said that the growth was broad-based and primarily driven by pricing, healthy volume and mix evolution.

Nestle India announced the acquisition of pet food business Purina Petcare India for an estimated Rs 125.3 crore. Purina Petcare was launched in India in 2017 as a separate entity and the business transfer of Purina Petcare to Nestle India will happen from October 2022.

Dr Lal Pathlabs: The company’s consolidated revenue fell 17% to Rs 503 crore in Q1FY23 as against Rs 607 crore in Q1FY22. The net profit tanked 56% to Rs 58 crore in Q1FY23 compared with Rs 131 crore in the year-ago period. Its EBITDA fell 38% to Rs 118 crore in Q1FY23 from Rs 189 crore in the same period last fiscal.

Housing & Urban Development Corporation Ltd (HUDCO): The company’s board has approved the proposal to raise up to Rs 22,000 crore through bonds and debentures to finance affordable housing and urban infrastructure projects.

ONGC: The state-owned oil explorer and its partners will invest $6.2 billion (Rs 50,000 crore) in green energy projects to produce carbon-free hydrogen and green ammonia as part of their decarbonization drive, officials said. ONGC has signed a pact with Greenko, one of India’s largest renewable energy companies, to form a 50:50 joint venture for green energy projects.

The JV will set up 5.5-7 gigawatts (GW) of solar and wind power projects, and use electricity generated from such plants to split water in an electrolyzer to produce green hydrogen, which in turn would be used for manufacturing green ammonia, they said.

Mahindra & Mahindra Financial Services (MMFS): The company’s standalone net profit rose to Rs 222.92 crore in Q1FY23 as against a net loss of Rs 1528.76 crore in Q1FY22. Its standalone revenue increased modestly to Rs 2,486.31 crore from Rs 2,179.08 crore in the year-ago period. The company’s interest income stood at Rs 2,437.20 crore I Q1FY23 compared with Rs 2,139.54 crore in Q1FY22.