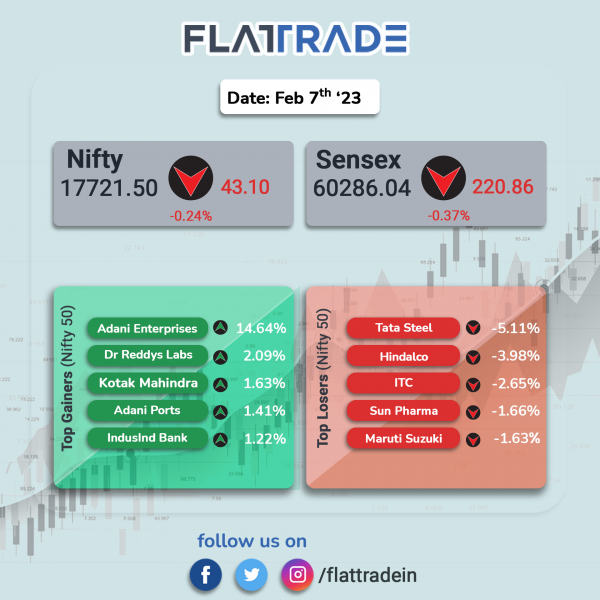

Dalal Street ended lower in a choppy session as losses in FMCG and auto stocks weighed ahead of the RBI’s monetary policy decision tomorrow. The Sensex fell 0.37% and the Nifty dropped 0.24%.

In broader markets, Nifty Midcap 100 slipped 0.02% and the BSE Smallcap fell 0.16%.

Top losers were Nifty FMCG [-1.16%], Auto [-1%], Media [-0.51%], Energy [-0.41%] and IT [-0.33%]. Top gainers were Realty [0.88%], Bank [0.28%] and Private Bank [0.19%].

Indian rupee rose 3 paise to 82.7 against the US dollar on Tuesday.

Stock in News Today

Adani Ports: The company’s revenue rose 18% YoY to Rs 4,786.2 crore in Q3FY23 as against Rs 4,072 crore in Q3FY22. Its net profit fell 16% to Rs 1,315.5 crore in Q3FY23 as against Rs 1,567 crore in Q3FY22. EBITDA rose marginally by 4% to Rs 2,707.5 crore in the reported quarter from Rs 2,591.8 crore in the same period last year.

Oil and Natural Gas Corporation (ONGC): The largest oil and gas producer will this year reverse years of decline in production and gradually raise output thereafter, as it invests billions of dollars to produce from newer discoveries, its chairman Arun Kumar Singh said. ONGC in fiscal 2021-22 produced 21.707 million tonne of crude oil, which is refined to produce petroleum products like petrol and diesel, and 21.68 billion cubic metre (bcm) of natural gas, which is used to produce electricity, manufacture fertiliser and as CNG in automobiles.

In other news, India’s state-run company will explore investing in gas assets in Argentina, its chairman Arun Kumar Singh said on Tuesday. The company also signed a memorandum of understanding with Argentina’s state oil company YPF for hydrocarbon cooperation.

Aditya Birla Fashion: The company said its consolidated revenue was up 20% at Rs 3589 crore in Q3FY23 as against Rs 2987 crore in Q3FY22. Its net profit plunged 94% to Rs 11.21 crore in the reported quarter as against Rs 196.8 crore in the year-ago period. EBITDA fell 25% to Rs 435.63 crore in the reported quarter compared with Rs 582.11 crore in the corresponding quarter last year.

Hindalco Industries: Shares of the company declined nearly 4% after lower-than-expected Novelis Q3 earnings. Novelis’ net income attributable to common shareholder was $12 million, down 95% YoY. Net income from continuing operations excluding special items was $96 million, down 60% YoY. Adjusted EBITDA fell 33% YoY to $341 million due to cost challenges. Hindalco is the parent organisation of Novelis.

PVR: The theatre operator said it has fixed February 17 as the record date for determining INOX holders that will get the company’s shares as part of the merger.

Canara Bank: The state-owned lender said the Union Government has appointed K Satyanarayana Raju as its Managing Director and CEO, with immediate effect. He will be replacing L V Prabhakar who demitted office on December 31, 2022.

One97 Communications (Paytm): Shares of the company zoomed 20% in intraday trade on the BSE to hit over three-month high of Rs 669.60 apiece. The rise is due to improved financial performance of the company in Q3FY23.

IRB Infrastructure Developers: The company has fixed 22 February 2023 as record date for the purpose of sub-division /split of every one equity share having face value of Rs 10 each, fully paid-up into 10 equity shares having face value of Rs 1 each fully paid-up.

Shree Global Tradefin: The company’s consolidated net profit rose multi-fold times to Rs 13.86 crore in the quarter ended December 2022 as against Rs 3.08 crore during the same quarter last fiscal. Consolidated revenue rose 202.80% to Rs 58.41 crore in the quarter ended December 2022 as against Rs 19.29 crore during the corresponding quarter last fiscal.

OnMobile Global: The company’s consolidated net profit declined 53.44% to Rs 4.06 crore in the quarter ended December 2022 as against Rs 8.72 crore during the quarter ended December 2021. Consolidated revenue decline 1.72% to Rs 130.89 crore in the quarter ended December 2022 as against Rs 133.18 crore during the quarter ended December 2021.

Century Plyboards: The company’s consolidated total income stood at Rs 889 crore in Q3FY23 as against Rs 860.71 crore in the year-ago period. Its net profit stood fell to Rs 82.23 core during the quarter under review from Rs 94.09 crore in the corresponding quarter last fiscal.

Power Mech Projects: The company posted over 54% YoY rise in its consolidated net profit at Rs 50.61 crore in December 2022 quarter. The consolidated net profit of the company was Rs 32.75 crore in the quarter ended on December 2021. Total income also rose to Rs 912.05 crore in the quarter from Rs 649.97 crore in the same period a year ago.