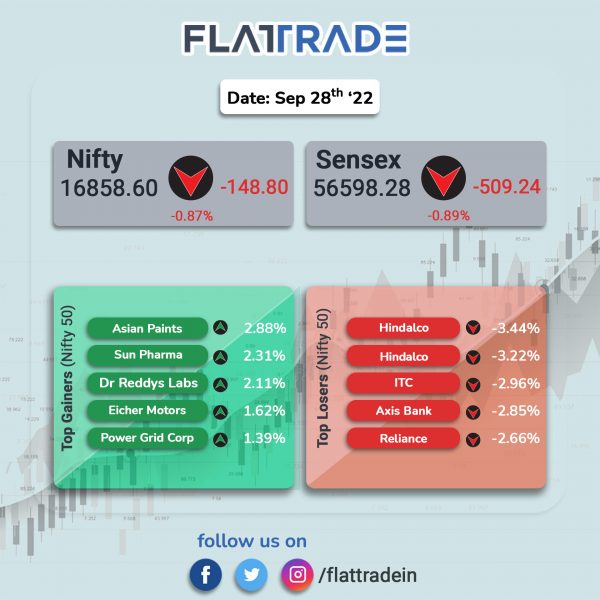

Benchmark stock indices closed nearly 1% lower, dragged by banking stocks and heavyweights like Reliance Industries and ITC. The Sensex fell 0.89% and the Nifty 50 index dropped 0.87%.

The Nifty Midcap 100 index was down 0.31% and the BSE Smallcap lost 0.43%.

Top Nifty sectoral index losers were PSU Bank [-2.07%], Metal [-1.94%], Bank [-1.56%], Energy [-1.56%] and Financial Services [-1.23%]. Top gainers were Pharma [0.85%] and IT [0.24%].

Indian rupee closed 36 paise to 81.94 against the US dollar on Wednesday compared with Tuesday’s close of 81.58 per dollar.

Stock in News Today

Larsen & Toubro (L&T): The company’s Buildings & Factories business division has secured an order to construct a new Medical College & Hospital at Golaghat, from the Assam Government on an Engineering, Procurement and Construction (EPC) basis. The total built up area will be 9.44 lakh Sq. ft. and the project is to be executed as per NMC norms within 36 months. The company classified the project as a significant project that would be wrth between Rs 1,000 crore and 2,500 crore.

The company also secured an order from a prestigious client to construct commercial space at Bengaluru with an approximate built-up area of 10 lakh square feet.

Adani Enterprises: The company said that it has raised Rs 100 crore by allotment of non-convertible debentures on private placement basis. The company allotted 1,000 rated, listed, secured, redeemable, principal protected market linked non-convertible debentures (MLD) of face value of Rs 10 lakh each aggregating up to Rs 100 crore on private placement basis. The company also said that these debentures will be listed on the wholesale debt market segment of BSE.

Tata Motors: The automaker has launched Tiago EV at a base price of Rs 8.49 lakh. The electric hatchback will have seven variants and the expensive variant is prices at Rs 11.79 lakh. The company is offering Tiago EV in two different battery packs — 19.2 kWh and 24 kWh battery packs. The 19.2 kWh battery will have a range of 250 km on a single full charge, while the larger battery will have a range of 315 km. Tata claims that the car can accelerate from 0 to 60 kmph in 5.7 seconds.

Vodafone Idea (VI) and Indus Towers: The cash-strapped Vodafone Idea has been warned of losing access to Indus Towers’ mobile towers from November if the telco fails to clear its dues, according to a report by Economic Times. The telcom operator has been asked by Indus Towers to clear its dues or lose access to towers, the Economic Times (ET) report said.

In the letter, Indus is believed to have told Vi to clear all past dues at the earliest, pay 80% of its current monthly dues immediately, and going forward, clear 100% of monthly dues on time, The company’s total tower dues exceed Rs 10,000 crore. Out of this, Rs 7,000 crore is owed to Indus Towers alone and Rs 3,000 crore is owed to American Tower Company (ATC).

Asian Paints: Shares of the company closed 2.88% higher as a fall in crude oil and raw material prices as well improved product mix will help drive EBITDA margin. The stock of the paint company also traded higher aided by hopes of higher demand ahead of the festive season.

JSW Energy: The company plans to raise 2.50 billion rupees ($30.60 million) through sale of bonds maturing in three years, Reuters reported citing three merchant bankers familiar with the matter.

The company will pay an annual coupon that is five basis points higher than one-year MCLR rate of State Bank of India and currently works out to be 7.75%, they said.

Hindustan Petroleum Corp (HPCL): HPCL-Mittal Energy will start up a bio-ethanol plant at its Bathinda refinery in northern India in 2023 as part of measures to reduce its carbon emissions, Reuters reported citing a company. HPCL-Mittal Energy is a joint venture between state-run Hindustan Petroleum Corp Ltd and Mittal Energy Investments. HPCL-Mittal Energy is in the process of constructing 100,000 tonnes per annum ethanol plant based on agricultural inputs like waste food, said Pravin Shirke, assistant general manager at HPCL-Mittal Energy.

Power Grid Corp: Shares of the company rose 1.2% after the public sector firm announced that its board approved the appointment of G. Ravisankar as chief financial officer (CFO) of the company with effect from September 26, 2022. He was previously working as director of finance with the company.

IFCI: The company’s board has approved preferential issue of equity share capital for the FY23 aggregating up to Rs 100 crore to the promoters i.e., Government of India. The issue is subject to approval from shareholders, stock exchanges and regulatory authorities. The government holds 64.86% stake in IFCI.

Godrej Properties: the company said that it has acquired a land parcel that is strategically located in the immediate vicinity of Indiranagar and is close to the Old Airport Road and within the Outer Ring Road limits. The land parcel is spread across approximately 7 acres and the project is estimated to have a developable potential of approximately 60 lakh square feet of saleable area. The 7 acres of land will be developed as a premium residential project comprising apartments of various configurations.

CreditAccess Grameen: The board of the micro-financier has approved the allotment of 600 senior, secured, rated, listed, redeemable, taxable, transferable, principal protected market linked non-convertible debentures, each having a face value of Rs 10 lakh aggregating up to Rs 60 crore on private placement basis.

Krsnaa Diagnostics: The company its plans to launch 600 diagnostics centers across India and will strengthen its footprint across Maharashtra, Himachal Pradesh, Punjab, West Bengal, and

Rajasthan. The centers will be equipped to offer specialized services in precision medicine, genetics, genomics, and molecular diagnostics, along with the routine investigations of biochemistry and serology, which are commonly used in routine diagnostics tests.

IDBI Bank: The bank’s board gave the approval for divestment of its stake in North Eastern Development Finance Corporation, according to its exchange filing.

LT Foods: In an exchange filing, the company said that the credit rating agency India Ratings and Research (Ind-Ra) has accorded “IND A1+ rating to the short-term bank facilities of the company. The rating ageny aslo opines the company has strong market position and distribution network, healthy geographical diversification and growing product diversification. Shares of the company rose 4.7% in intraday trade on Wednesday.