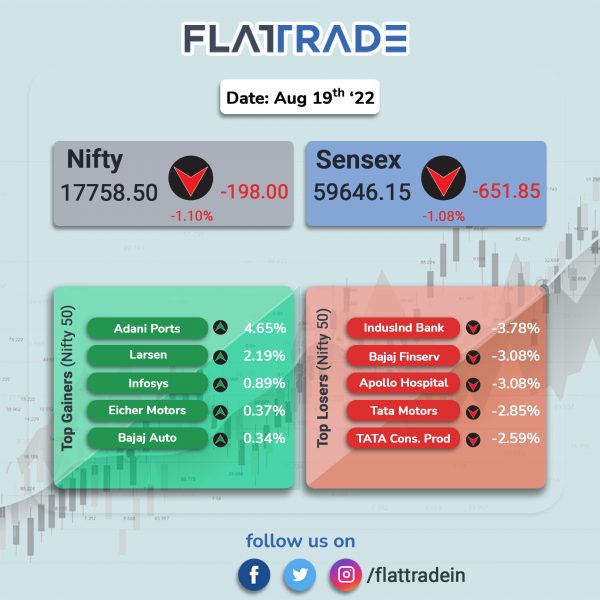

Benchmark indices fell more than 1% as investors were worried over growth prospects. The Sensex fell 1.08% and the Nifty 50 index lost 1.1%.

Meanwhile, the Nifty Midcap 100 slumped 1.45% and BSE SmallCap was down by 0.93%.

Top Nifty sectoral losers were PSU Bank [-2.66%], Realty [-1.95%], Private Bank [-1.84%], Bank [-1.69%] and Financial Services [-1.58%]. All indices closed in the red, except IT, which inched up 0.06%.

The Indian rupee fell 10 paise to 79.78 against the US dollar on Friday.

Stock in News Today

Adani Ports & SEZ : Shares of the company rose 4.6% after the Indian government introduced the draft Indian Ports Bill, 2022, to consolidate and amend the laws relating to ports in India. The bill has been issued for stakeholder consultation, the Ministry of Ports, Shipping and Waterways said. The ministry intends to receive feedback and suggestions on the draft IP Bill 2022 from all the stakeholders and the bill document can be accessed from the websites of the MoPSW and Sagarmala.

Tata Chemicals: Shares of the company jumped to an all-time high after the company gave a strong business outlook. The share price of Tata Chemicals has appreciated by 38 per cent in the lsat one month after the company reported better-than-expected earnings for the quarter ended June 2022 (Q1FY23). However, the share price retreated to close 0.53% higher from Thursday’s closing price.

Indian Railway Catering and Tourism Corporation (IRCTC): Shares of the company has jumped nearly 12% in the past two days after the company announced plans to monetise its passenger data bank. IRCTC is looking to monetise its bank of passenger data while conducting business with private and government companies. The company aims to raise up to Rs 1,000 crore through this exercise. The company has just floated a tender to appoint a consultant to look for possible alternatives to monetise its data.

PVR, Inox: The Consumer Unity and Trust Society (CUTS), a public policy research and advocacy group, has filed an information with the Competition Commission of India (CCI), urging it to investigate possible anti-competitive effects of the proposed merger agreement between multiplex chains Inox Leisure and PVR. CUTS alleged that the deal would have anti-competitive effects on the film exhibition industry. Shares of both the companies tanked more than 5% on Friday.

CEAT: The tyre maker plans to expand its sales network in places with population of 5,000-10,000 through its FMCG style of distribution. With this business strategy , the company plans to double outlets to 1 lakh in two to three years, company COO Arnab Banerjee said. He noted that the market has more or less “saturated” penetration in places with 25,000 population in the country and there is a need to go to even lesser populated areas for its two-wheeler tyres.

Jubilant Foodworks: The company has accelerated its pace of network expansion in the country and is bullish about its medium-term market potential in India. The company’s present assessment of the medium-term market potential in India is 3,000 stores, according to the company’s latest annual report. During FY22, Jubilant Foodworks has crossed the 1,500th Domino’s store milestone in India.

Havells India: Shares of the company fell nearly 2% after the company informed the excahnged about a fire incident at its Neemrana plant in Rajasthan. The company estimated the book value of assets affected due to the incident at around Rs 150 crore and said that the amount is fully insured. It also added that there was no human loss/injury.

Sun Pharmaceutical Industries: The US health regulator, FDA, has flagged quality control and procedural lapses at the Mohali facility of the pharma firm. The US FDA has issued Form 483, with six observations. Sun Pharma said in an exchange filing that it is preparing to respond to the observations.