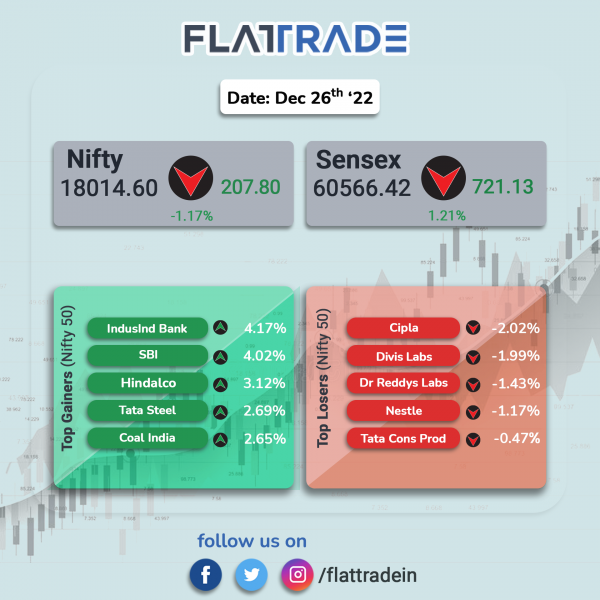

Dalal Street ended high on broad-based buying as well as boosted by gains in banks, realty and energy stocks. The Sensex jumped 1.2% and the the Nifty 50 index soared 1.17%.

In broader markets, Nifty Midcap 100 index surged 2.72% and the BSE Smallcap rose 3.13%.

Top gainers among Nifty sectoral indices were PSU Bank [7.29%], Media [2.85%], Pvt Bank [2.44%], Realty [2.43%] and Bank [2.31%]. Nifty Pharma was down 0.84%.

Indian rupee rose 21 paise to 82.65 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The company’s arm, L&T Construction, has secured significant contracts for its water & effluent treatment business. As per L&T’s classification, the value of the said contract lies between Rs 1,000 crore and Rs 2,500 crore. The order has been secured from from the Tumakuru Industrial Township (TITL) under the Chennai Bengaluru Industrial Corridor (CBIC). The order from TITL is to design, construct, test, commission, operate & maintain infrastructure works at the Tumakuru Node, Karnataka on an EPC basis. It has also won repeat orders from the Tamil Nadu Water Supply and Drainage Board (TWAD Board), Government of Tamil Nadu, funded by the Asian Development Bank (ADB).

Computer Age Management Services (CAMS): The company announced its collaboration with IIT Madras to launch CAMS IIT-M Fintech Innovation Lab (CIFIL), to accelerate financial technology related innovations. The Fintech Innovation Lab at IIT-M will develop research-based decision support systems to financial market players using fintech.

HDFC: The mortgage lender received a $400 million loan from International Finance Corporation to bridge the urban housing gap and promoter green housing in India.

Adani Ports: The company announced that The Adani Harbour Services (TAHSL), wholly-owned subsidiary (WOS) of the company has incorporated a WOS in the name of The Adani Harbour International DMCC. The new company is for the purpose of carrying out the activities relating to barges & tugs charter, marine tours operation, sea freight and ship charter.

Easy Trip Planners: Shares of the company surged nearly 20% after the introduction of EMTFAMILY – an invite only, special programme for its elite shareholders. Under this programme, EaseMyTrip’s shareholders will be enrolled into a ‘Refer Now & Earn Forever’ programme. Referrer will get exciting cash-backs on flights, hotels, holidays, buses and train bookings for a period of one year by referring a new user to book from EaseMyTrip website or mobile application. Shareholders can use the Coupon Code: EMTFAMILY and mention their PAN details to avail exclusive benefits.

Godrej Properties: The realty major announced that it has expanded its residential portfolio in National Capital Region (NCR) through the purchase of 62 acres of land in Kurukshetra, Haryana. The project is expected to offer approximately 1.4 million square feet of plotted residential development, offering attractive plot sizes along with lifestyle amenities. The site is strategically located with access to National Highway 44 (NH44).

Union Bank of India: The lender said that it has allotted unsecured, subordinated, non-convertible, perpetual, taxable, fully paid-up Basel-III Compliant Additional Tier-1 Bonds in the nature of debentures eligible for inclusion in Tier 1 capital (bonds) series aggregating to Rs 663 crore.

Central Bank of India: Shares of the company was locked in 5% upper circuit after the company said that its board has approved fundraising through issuance of non-convertible Base III compliant Tier II bonds up to Rs 1,500 crore. The fundraising will have a base size of Rs 500 crore and a green shoe option up to Rs 1,000 crore during the FY23. The company said that the issue is subject to market conditions and necessary approvals.

United Breweries: The NCLAT upheld the CCI order imposing Rs 751.8 crore fine on the company over charges of price co-ordination in beer market in India.

GTPL Hathway: The company announced launch of GTPL Genie+ for all its customers. GTPL Genie+ is an OTT apps aggregation product, which offers subscriptions to a wide choice of OTT applications in convenient packs and with easy to use monthly, quarterly, half]yearly and yearly tenures to suit every budget and consumer choice. The apps subscribed through GTPL Genie+ can be viewed on any device and any broadband connection.

GPT Infraprojects: The company shares were locked in 20% upper circuit at Rs 53.20 after the company said that its subsidiary, RMS GPT Ghana, has bagged an order valued at Rs 123 crore. The order entails manufacture and supply of 130,000 sets standard gauge pre stressed railway concrete sleepers. The value of the contract is 13.936 million euro which is approximately Rs 123 crore.

Dharmaj Crop Guard: The company shares jumped after the company said it has launched a new insecticide product ‘Regiment’ in the domestic market on 22 December 2022. Dharmaj Crop Guard is an agrochemical company engaged in the business of manufacturing, distributing, and marketing of a wide range of agro chemical formulations to B2C and B2B customers.

Power Mech Projects (PMPL): The civil construction company announced that it has received three separate orders aggregating to Rs 1,034.13 crore. PMPL bagged a service order worth Rs 608 crore from Adani Group. Another order is worth Rs 306.60 crore for setting up of Wagon Repair Workshop at Kazipet, Telangana, on EPC mode. Further, the firm secured an order worth Rs 119.53 crore for providing technical expert, rotary technicians & operation and maintenance services.

SBC Exports: The company said that it secured a work order from a civic body in New Delhi for providing office support, project management support and rollout services. The order was awarded by the Department of Consumer Affairs through NICSI, New Delhi. SBC Exports will provide office support, project management support and rollout services. The aggregate purchase order cost of the said work order is Rs 90.20 lakh.

Welspun: The company announced the commissioning of its coke oven plant in Anjar, Gujarat through Welspun Metallics, a wholly owned subsidiary of the company. Te facility has a production capacity of approximately 210,000 million tonne (MT) per annum of coke which will primarily be used in the blast furnace for manufacturing of hot metal.

Inox Green Energy Services: The company will acquire a majority stake in a renowned Independent O&M Wind Service Provider (Target Company) with a 230+MW fleet that operates majorly in South India, according to its exchange filing. The acquisition is part of the company’s strategy to grow its fleet through the inorganic route. The inorganic route provides a large growth opportunity for the company to grow its business rapidly as a large part of the operating fleet in India is currently being managed by the unorganized sector.

Alembic Pharmaceuticals: The company has received final approval from the USFDA for its ANDA, Fulvestrant Injection. Fulvestrant Injection, 250 mg/5 mL, has an estimated market size of US$71 million (approx Rs 588 crore) for twelve months ending September 2022. Fulvestrant Injection is an estrogen receptor antagonist for the treatment of breast cancer, according to its excahnge filing.

Aurionpro Solution: The company’s US subsidiary, AurionPro Fintech Inc., secured orders worth $18 million (Rs 150 crore) from a US-based company offering merchant payment services in the insurance financing segment. This order entails expansion of the client platform, AWS infrastructure support and extended services that will facilitate ongoing support, maintenance and enhancements.