Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.14% higher at 18,054.50, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were trading higher with Japan’s Nikkei 225 index rising 0.52%, the Topix gaining 0.62% and China’s CSI 300 index advancing 0.82%.

Indian rupee rose 21 paise to 82.65 against the US dollar on Monday.

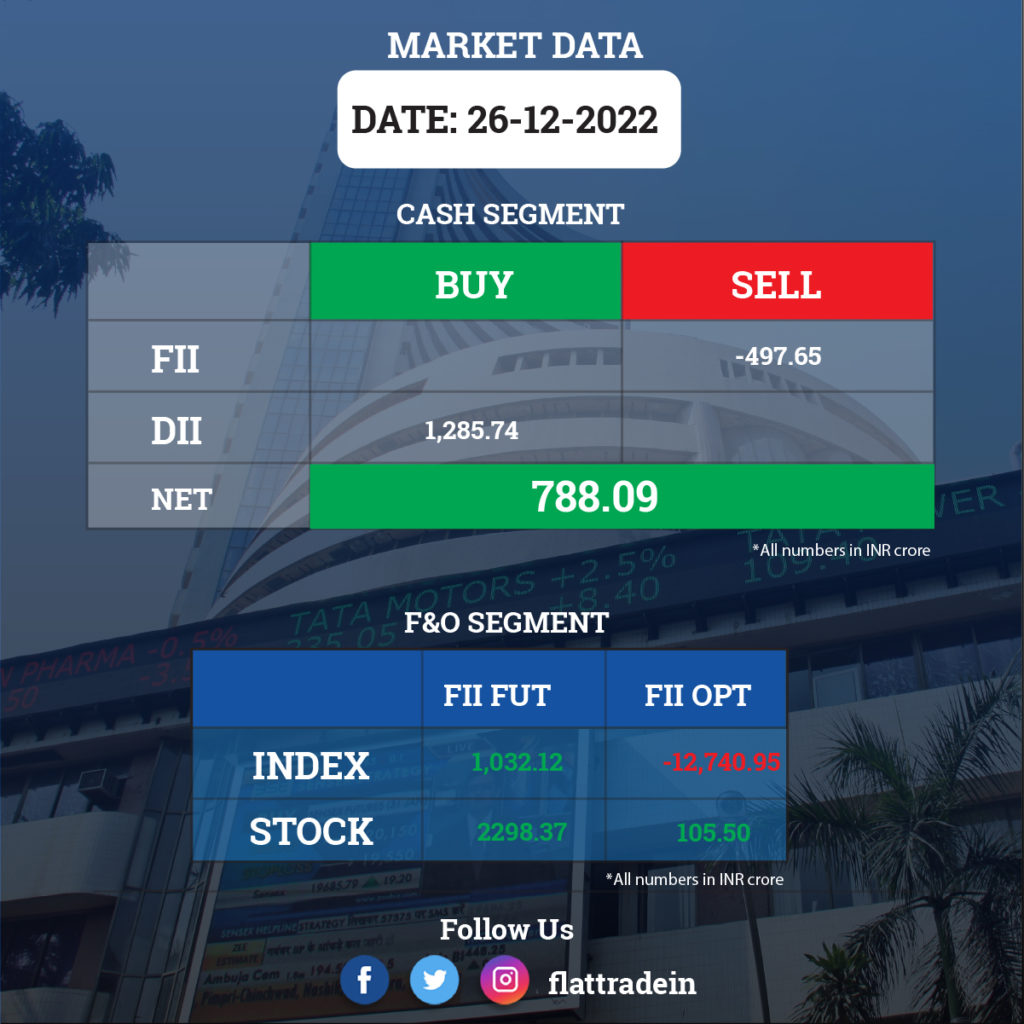

FII/DII Trading Data

Stocks in News Today

Reliance Jio: The telecom company announced that it has launched True 5G services in Andhra Pradesh. The 5G services were launched in Tirumala, Visakhapatnam, Vijayawada, and Guntur districts. State IT Minister Gudivada Amarnath said that 5G services will bring transformational benefits for the people. “Apart from their existing investment of Rs 26,000 crore, additionally Jio has invested over Rs 6,500 crore for deploying 5G network in Andhra Pradesh and this shows their immense commitment towards our state’s development,” the minister said. By December 2023, Jio True 5G services will be made available in every town, taluka, mandalam and village of Andhra Pradesh, he added.

NTPC: The state-owned company has signed a non-binding Memorandum of Understanding with Tecnimont, subsidiary of Italy-based Maire Tecnimont Group. Both the companies will evaluate and explore the possibility to develop commercial scale green methanol production facility at a NTPC project in India.

SpiceJet: Shareholders of the company approved the re-appointment of Ajay Singh as a director of the no-frills airline. At the annual general meeting, the shareholders also gave their nod for the adoption of audited financial statements for financial year ended March 31, 2022. Currently, Singh is the Chairman and Managing Director of the no-frills airline.

DLF: The Noida authority has issued a notice to the real estate company ordering it to pay Rs 235 crore within 15 days over a dispute related to the land where the real estate developer had built Mall of India.

Bank of Baroda: The lender has raised interest rates on retail term deposits by 15-65 basis points across various tenures. The revised rates are applicable on deposits below Rs 2 crore from Monday (December 27) and are in the range of 3.00-6.75%.

Filatex India: Shares of Filatex India will go ex-split in the ratio of 1:2 today. After the split, the stock’s new face value will be Re 1 per share compared with Rs 2 currently. Ahead of the stock split, the textile and apparels company’s shares traded over 6% higher at Rs 88.8 apiece on the NSE.

IndoWind Energy: The company’s board will meet on Tuesday to mull rights issue of shares. Sahres of the company closed more than 4% higher at Rs 14.10 apiece on the NSE.

Grindwell Norton: The abrasive manufacturer has commissioned its paper maker manufacturing plant in Bengaluru. The manufacturing unit presents a huge opportunity to introduce “Make in India” products that are innovative and have cutting edge technology. The company is part of France-based Saint-Gobain Group.

Time Technoplast: The company has received prestigious repeat order worth Rs 75 crore, from Adani Total Gas for supply of CNG cascades made from Type-IV composite cylinder. The delivery of these cascades will begin from January 2023.

Nureca: The company’s promoter Payal Goyal has sold 2.74% stake in the company via open market transactions during November 29 and December 22 this year. With this, Goyal’s stake in the company reduced to 29.83%, from 32.57% earlier.

GR Infraprojects: The company has received completion certificate for Expressway carriageway in Madhya Pradesh, from Authority’s Engineer and has declared the project fit for entry into commercial operation with effect from December 20. The said project on EPC mode under Bharatmala Pariyojana has been completed by the company, which had contract cost of Rs 991 crore.

Dev Information Technology: The Ahmedabad-based IT services & products company has sold 5.45% stake in Dev Accelerator (DevX), a managed co-working space business, at a valuation of Rs 104 crore. This secondary sale will bring down Dev IT’s shareholding in DevX from 41.26% to 35.81%.

Share India Securities: The company has received board approval for fund raising via rights issue to eligible equity shareholders, up to Rs 1,000 crore. It is going to appoint Corporate Professionals Capital as a lead Manager to the issue.