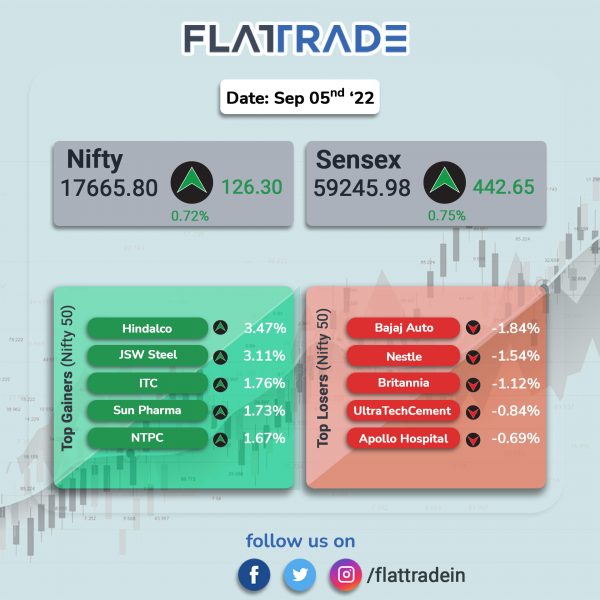

Dalal Street rallied, led by gains in metal, banking and realty stocks as well as on the back of the country’s economic growth prospects. The Sensex jumped 0.75% and the Nifty 50 index climbed 0.72%.

Broader markets also rose with the Nifty Midcap 100 index rising 0.38% and the BSE SmallCap gaining 0.89%.

Top Nifty sectoral gainers were Media [2.75%], Metal [1.67%], Private Bank [1.12%], Bank [0.98%], PSU Bank [0.95%] and Realty [0.89%]. All sectoral indices closed in the green.

The Indian rupee fell 4 paise to 79.84 against the US dollar on Monday.

The S&P Global India Services PMI Business Activity Index stood at 57.2 in August 2022 compared with 55.5 in July 2022. The Composite PMI Output Index stood at 58.2 in August against 56.6 in the prior month. A reading above 50 indicates the sector is expanding.

India’s forex reserves have fallen by $3.007 billion to $561.046 billion for the week ended August 26, the Reserve Bank of India (RBI) data showed. The country’s forex reserves have declined sharply in recent months as the RBI intervened in the currency markets to minimize the fall in value of the rupee.

Stock in News Today

Reliance Industrial Ltd (RIL): The company’s fourth investment cycle of an estimated $50 billion over the next three years could boost the firm earnings, a report by investment firm Morgan Stanley said. “The investments in new energy and retail expansion to take market share from unorganized sector, and repurposing of existing energy business gives RIL a long runway to deliver earnings growth consistently even beyond the next three years,” it said.

Meanwhile, the company’ subsidiary, Reliance Retail Ventures Ltd (RRVL), has acquired a controlling stake in make-up and personal care brand Insight Cosmetics, Livemint reported citing two sources. The deal was valued at $10-15 million, one of the people said, requesting anonymity.

Federal Bank and Kotak Mahindra Bank: The bank in an exchange filing clarified that the news report of a merger between Federal Bank and Kotak Mahindra Bank is speculative in nature. Earlier, CNBC Awaaz reported that the top management of both banks has likely met for a potential deal. Shares of Federal Bank closed 3.35% higher.

Larsen & Toubro (L&T) and Hindustan Aeronautics Ltd (HAL): The HAL-led consortium with L&T has won a Rs 860 crore deal from NewSpace India Limited to build five rockets. The contract is for manufacturing five PSLV rockets, the versatile workhorse launch vehicle of India, according to PTI news report.

Yes Bank: The lender may acquire The Ritz Carlton hotel in Bengaluru, developed by NEL Holdings South Ltd (formerly Nitesh Estates), on account of non-payment of Rs 300 crore in loans by NEL, Livemint reported. The bank is likely to sell the property or seek a suitor when it petitions the National Company Law Tribunal, the news report said citing two executives familiar with the matter.

Dixon Technologies: The company has received sub licensing rights relating to Android & Google TV and the new partnership will enable the company to offer a cost effective,

consistent, high quality & out of box experience to its existing customers, it said in an exchange filing. The company also expects the new partnership will further strengthen the company’s market leadership in the LED TV category.

SpiceJet: The budget carrier said it has received an extension of up to three months for conducting its annual general meeting for the financial year ended March 2022. The Annual General Meeting (AGM) for FY22 will be held on or before the end of December 2022.

Aurionpro Solutions: The company’s subsidiary, Aurionpro Fintech, has announced the acquisition of Real Patient Solutions Inc. d.b.a. Hello Patients Solutions Inc, a startup registered in the State of Delaware, USA. With this acquisition, the company expects a new line of recurring revenue stream, inclusive of SaaS and processing revenue.

Wockhardt: The pharma company has received reaffirmation in credit ratings from CARE Ratings. The ratings were given after factoring in the tie-up with various global partners for supply of vaccines and respiratory antibiotic, diversified product portfolio spread across multiple therapeutic segments. The rating agency also noted that the company has seen improvement in total operating income and operating margins in FY22 as well as successfully raised funds through rights issue and NCD issue.

Trident: The textile manufacturer has announced that Abhinav Gupta has resigned from the chief financial officer (CFO) and key managerial personnel position, citing personal reasons. Gupta was relieved from his services with effect from 3 September 2022 post working hours. Avneesh Barua, who is working in the finance and accounts function of the company, shall be acting as an interim CFO of the company, according to the company’ statement.

KPI Green Energy: The company plans to add a hybrid power project in the company’s own power generating asset portfolio. The company is developing a hybrid power project of 16.10 MW at Bhungar site in Mahuva, at Bhavnagar, Gujarat under the Gujarat hybrid power policy 2018. The project has achieved financial closure of Rs 132 crore from State Bank of India.

Petronet LNG: The company plans to invest Rs 40,000 crore in the next five years to expand its import infrastructure and also foray into new business such as petrochemicals to improve profitability to Rs 10,000 crore, according to the firm’s latest annual report.

Hindustan Zinc: In an exchange filing, the company said that it has executed a long-term renewable Power Delivery Agreement (PDA) up to a capacity of about 200 MW with a special purpose vehicle, Serentica Renewables India 4 Private Limited. The project will be funded on a 70:30 debt-to-equity basis.

ABB India: Shares of the company lost 2.4% after the investment bank Credit Suisse downgraded stock to ‘underperform’ from ‘neutral’. Credit Suisse said that possibility of prolonged slowdown, delay in pick-up of investment activity in India and geopolitical risks were some of the factors for the downgrade.

PTC India: The state-owned company will set up a power trading company in Nepal, which will supply electricity to India and Bangladesh, Livemint reported quoting the firm’s CMD, Rajib K Mishra. The move will boost the Centre’s aim to build a South Asia-focused energy security architecture.

Reliance Power Ltd: Shares of the company jumped 9.9% after the company said it will raise long term funds up to Rs 1,200 crore from Varde Partners. The company added that the stock exchanges will be updated once the terms of the proposed financing are finalised and the definitive documents in relation to the proposed financing are executed.