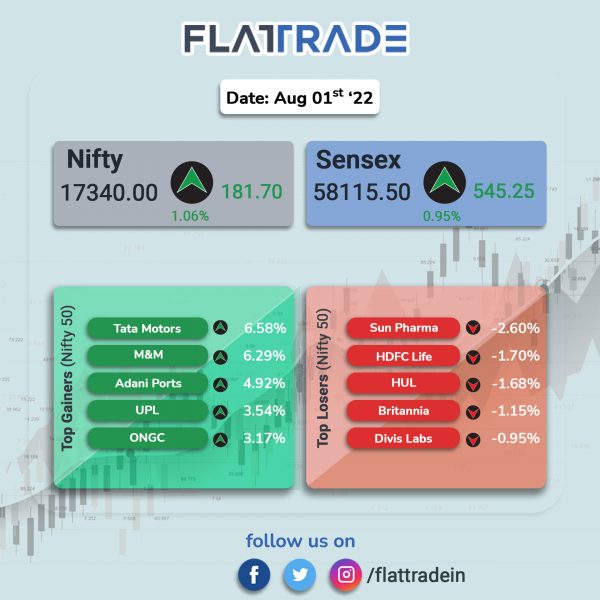

Benchmark indices rallied on broad-based buying by investors and aided by strong gains in auto, energy and metal stocks. The Sensex gained 0.95% and the Nifty surged 1.06%.

Broader markets overperformed headline indices. The Nifty Midcap increased 1.67% and BSE Smallcap advanced 1.47%.

Top Nifty sectoral gainers were Auto [3.27%], Energy [2.8%], Media [2.3%], Oil & Gas [2.12%] and Metal [1.68%]. Nifty Pharma slipped 0.08%, while all other Nifty sectoral indices closed in the positive territory.

The Indian rupee appreciated by 23 paise to 79.02 against the US dollar on Monday.

The S&P Global India Manufacturing Purchasing Managers’ Index rose to 56.4 in July 2022 from 53.9 in June 2022, indicating the strongest improvement in the manufacturing sector in eight months.

The Indian government has collected Rs 1.49 lakh crore as Goods and Services Tax (GST) in July, an increase of 28% compared to the same month last year, according to the finance ministry. The GST collection in July is 3% higher than the tax mop-up in June.

Stock in News Today

UPL: The speciality chemicals company posted a consolidated net profit of Rs 877 crore in Q1FY23 as against Rs 677 crore in the year-ago period. Its revenue rose to Rs 10,821 crore in the reported quarter as against Rs 8,515 crore in the same period a year ago. The company’s EBITDA stood at Rs 2,343 crore in Q1FY23 from Rs 1,863 crore in the same period a year ago.

Varun Beverages: The beverage producer and franchise bottler of PepsiCo reported a two-fold rise in consolidated profit after tax at Rs 802.01 crore in Q1FY23 as against a PAT of Rs 318.80 crore in the same period a year ago. Its revenue from operations in the quarter stood at Rs 5,017.57 crore, up two-fold as compared to Rs 2,483.04 crore in the same quarter last fiscal.

Reliance Jio, Airtel and Vodafone Idea: India’s biggest ever auction of airwaves ended on Monday, with spectrum worth Rs 1,50,173 crore being sold, reported PTI news citing sources. The auction took place for seven days and the final numbers are being tallied, the sources added.

Nazara Tech: The gaming software company said its net profit surged 237% sequentially to Rs 16.5 crore in the quarter ended June 2022. Its revenue increased 27% QoQ to Rs 223.1 crore in Q1FY23 compared to Q4FY22. The company reported an EBITDA of Rs 30.1 crore, up 102%. Shares of the company closed 20% higher.

Maruti Suzuki India: India’s largest car manufacturer said its total sales increased 8.3% YoY to 175,916 units. Domestic sales rose 10.2% to 155,605 units and sales of its mini and compact segment climbed 17% to 105,151 units. Sales of utility vehicles fell 28% YoY to 23,272 units.

Mahindra & Mahindra: Shares of the SUV maker jumped closed over 6% after the company registered over 1 lakh bookings for the all-new Scorpio-N within half an hour of its booking commencement on Saturday. The amount of booking translated to ex-showroom value of Rs 18,000 crore and the commencement of deliveries is scheduled for September 26. Over 20,000 units of Scorpio-N are planned for delivery by December 2022.

Meanwhile, the automaker said its total passenger vehicles sales rise 33% year-on-year to 28,053 units in July and total tractor sales declined 14% YoY to 23,307 units in July.

Eveready Industries: The battery manufacturer registered a consolidated net profit of Rs 21.85 crore in Q1FY23 as against Rs 30.38 crore in the same period a year ago. The company’s revenue at rose to Rs 335.38 crore in Q1FY23 from Rs 282.14 crore in Q1FY22. Its EBITDA came in at Rs 42.11 crore in the first quarter of the current fiscal compared with Rs 59.05 crore in the same period last fiscal.

Ashok Leyland: The truck and bus manufacturer said its domestic commercial vehicle sales rose 56% YoY to 12,715 units from 8129 units in the year-ago period. The company’s exports stood at 910 units as compared to 521 units in July of last fiscal.

Tata Motors: The car manufacturer said its total domestic sales jumped 52% year-on-year to 78,978 units in July. Its domestic passenger vehicle sales increased 57% YoY to 47,505 units and total commercial vehicle sales improved by 43% YoY to 34,154 units

NCC: Shares of the construction company rose over 5% after the company bagged four orders, aggregating to Rs 1,645 crore in July 2022. The orders pertains to building division, water & environment division and electrical division.

Godrej Properties: The real estate firm said it has acquired 0.5 acres of land in Mumbai to develop a luxury housing project with an estimated sales value of Rs 1,200 crore. The land parcel is located near Carmichael Road in Mumbai and was purchased from the Karam Chand Thapar (KCT) group.